Stein Mart 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Impact of Inflation

We have experienced merchandise price increases in the single-digit percentage range in 2011. Categories that are fashion-oriented and feature

brand name and designer labels are showing little price sensitivity, while some basic categories are more negatively impacted. We expect that

prices will continue to increase for the spring, but at a lower rate of increase than in 2011. To that end, we are reviewing all pricing decisions

carefully for customer response and continue to work with our vendors who are optimizing design and fabrications to maintain key price

points.

Contractual Obligations

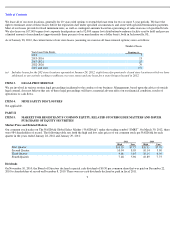

The following table sets forth our contractual obligations at January 28, 2012 (in thousands):

The above table does not include long-term debt as we did not have any direct borrowings under our senior revolving credit facility at

January 28, 2012. Other long-term liabilities on the balance sheet include the liability for unrecognized tax benefits, deferred compensation,

deferred rent liability, postretirement benefit liability and other long-term liabilities that do not have specific due dates, so are excluded from

the preceding table. Other long-term liabilities also include long-term store closing reserves, a component of which is future minimum

payments under non-

cancelable leases for closed stores. These future minimum lease payments for these closed stores total $3.3 million and are

included in the above table.

Off-Balance Sheet Arrangements

We have outstanding standby letters of credit totaling $8.6 million securing certain insurance programs at January 28, 2012. If certain

conditions were to occur under these arrangements, we would be required to satisfy the obligations in cash. Due to the nature of these

arrangements and based on historical experience, we do not expect to make any payments; therefore, the letters of credit are excluded from the

preceding table. There are no other off-balance sheet arrangements that could affect our financial condition.

Critical Accounting Policies and Estimates

The preparation of our consolidated financial statements requires management to make estimates and assumptions that affect the reported

amounts of assets, liabilities, expenses and related disclosure of contingent assets and liabilities. Management bases its estimates and judgments

on historical experience and other relevant factors, the results of which form the basis for making judgments about the carrying values of assets

and liabilities that are not readily apparent from other sources. While we believe that the historical experience and other factors considered

provide a meaningful basis for the accounting policies applied in the preparation of the financial statements, we cannot guarantee that our

estimates and assumptions will be accurate, which could require adjustments of these estimates in future periods. A summary of the more

significant accounting policies follows.

Retail Inventory Method and Inventory Valuation.

Merchandise inventories are valued at the lower of average cost or market, on a first-in

first-out basis, using the retail inventory method (“RIM”). RIM is an averaging method that is widely used in the retail industry. The use of

RIM results in inventories being valued at the lower of cost or market as markdowns are taken as a reduction of the retail values of inventories.

Based on a review of historical markdowns, current business trends and seasonal inventory categories, additional inventory reserves may be

recorded to reflect estimated markdowns which may be required to liquidate certain inventories and reduce inventories to the lower of cost or

market. Management believes its inventory valuation methods approximate the net realizable value of clearance inventory and result in valuing

inventory at the lower of cost or market.

We perform physical inventory counts at all stores annually. Included in the carrying value of merchandise inventories is a reserve for

shrinkage. Shrinkage is estimated based on historical physical inventory results as a percentage of sales for the year. The difference between

actual and estimated amounts in any year may cause fluctuations in quarterly results, but is not a factor in full year results.

Vendor Allowances. We receive allowances from some of our vendors primarily related to markdown reimbursement, damaged/defective

merchandise and vendor compliance issues. Vendor allowances are recorded when earned. Allowances received from vendors related to

profitability of inventory recently sold are reflected as reductions to cost of merchandise sold in the later of the period that the merchandise

markdown is incurred or the allowance is negotiated. Allowances received from vendors

19

Total

Less than

1 Year

1 – 2

Years

3 – 5

Years

After 5

Years

Operating leases

$

337,536

$

73,956

$

66,117

$

136,562

$

60,901

Capital leases

6,351

4,871

1,480

—

—

Purchase obligations (a)

90,425

90,425

—

—

—

Total

$

434,312

$

169,252

$

67,597

$

136,562

$

60,901

(a)

Represent open purchase orders with vendors for merchandise not yet received and recorded on our Consolidated Balance Sheet.