Stein Mart 2011 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2011 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

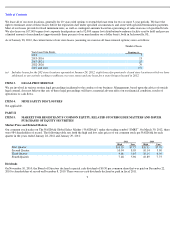

Gross Profit. The following table compares gross profit for fiscal 2010 to fiscal 2009 (dollar amounts in thousands):

The decrease in gross profit reflects a $14.2 million decrease in the comparable store group and a $6.0 million decrease in the closed store

group, offset by a $2.2 million increase in the non-comparable store group. Gross profit as a percent of sales decreased during 2010 primarily

due to a 0.6 percent of sales increase in markdowns and negative leverage on lower sales. Markdowns were higher in 2010 due to the

competitive retail environment.

Selling, General and Administrative Expenses. The following table compares SG&A expenses for fiscal 2010 to fiscal 2009 (dollar amounts

in thousands):

Excluding pre-tax asset impairment and store closing charges in both years and the $1.2 million charge associated with changing our physical

inventory process in 2010, SG&A expenses decreased $18.7 million to $283.9 million or 24.0 percent of sales from $302.6 million or 24.8

percent of sales for 2009. This decrease reflects a $23.7 million decrease in store expenses offset by a $3.2 million increase in advertising

expenses and a $1.8 million increase in corporate expenses. Store expense reductions include a $9.0 million decrease in personnel expenses

resulting from our new supply chain process, a $9.0 million decrease in other store operating and depreciation expenses and a $5.7 million

decrease due to the elimination of operating costs from closed stores. Other store operating expenses were lower as a result of continued cost

savings initiatives. Depreciation expense was lower as a result of asset impairment charges taken at the end of fiscal 2009. Advertising spend

was higher to increase our marketing impact.

Asset impairment charges were $7.3 million higher in 2009 due to more store closings and a greater number of stores with projected cash flows

that did not support the carrying value of their long-lived assets which required a write-down of their assets. Store closing charges were $0.7

million lower this year because there were fewer store closings and this year includes an offsetting $1.2 million gain on a lease buyout by a

landlord for the early termination of a lease.

Other income, net. The following table compares other income, net for fiscal 2010 to fiscal 2009 (dollar amounts in thousands):

The increase in other income, net is primarily due to our second quarter recognition of $9.7 million of other income related to cumulative

breakage on unused gift and merchandise return cards since the inception of these programs. Prior to the second quarter of 2010, we had not

recognized breakage on card balances pending our final determination of the interpretation of the escheat laws applicable to our operations and

historical redemption patterns. The remaining increase in other income was from our magazine subscription program and breakage income

recognized in the second half of 2010.

Income Taxes. The following table compares income tax expense for fiscal 2010 to fiscal 2009 (dollar amounts in thousands):

The income tax expense for 2010 was favorably impacted by the reversal of the remaining $6.0 million deferred tax asset valuation allowance

established in 2008. In the fourth quarter of 2010, we were no longer in a cumulative three-year loss position because the Company’

s income in

the last two years exceeded the loss incurred in 2008. Excluding this favorable tax adjustment, the ETR was 19.6 percent in 2010 compared to

31.6 percent in 2009. The 2010 rate was lower than the federal statutory rate of 35.0 percent due to the impact of favorable changes in book/tax

differences on our valuation allowance prior to the year-end reversal and favorable settlements of state income tax examinations. The 2009

ETR was lower than the federal statutory rate of 35.0 percent due to the effect of certain book/tax differences on the valuation allowance

including a tax accounting method change made in the third quarter of 2009.

17

2010

2009

Decrease

Gross profit

$

312,308

$

330,357

$

(18,049

)

Percentage of net sales

26.4

%

27.1

%

(0.7

)%

2010

2009

Decrease

Selling, general and administrative expenses

$

288,208

$

313,703

$

(25,495

)

Percentage of net sales

24.4

%

25.7

%

(1.3

)%

2010

2009

Increase

Other income, net

$

29,430

$

18,405

$

11,025

Percentage of net sales

2.5

%

1.5

%

1.0

%

2010

2009

Decrease

Income tax expense

$

4,439

$

10,856

$

(6,417

)

Effective tax rate

8.3

%

31.6

%

(23.3

)%