Stein Mart 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

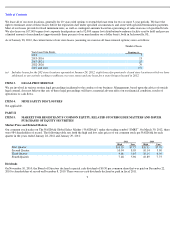

The following selected consolidated financial data has been derived from our audited consolidated financial statements and should be read in

conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial

Statements and notes thereto and the other information contained elsewhere in this Form 10-K.

12

ITEM 6.

SELECTED CONSOLIDATED FINANCIAL DATA

(Dollars in Thousands, Except Per Share and Per Square Foot Data)

2011

2010

2009

2008

2007

Consolidated Statement of Operations Data:

Net sales

$

1,160,367

$

1,181,510

$

1,219,109

$

1,326,469

$

1,457,645

Cost of merchandise sold

863,003

869,202

888,752

1,032,232

1,096,235

Gross profit

297,364

312,308

330,357

294,237

361,410

Selling, general and administrative expenses

289,114

288,208

313,703

394,559

388,329

Other income, net

24,007

29,430

18,405

20,401

21,376

Operating income (loss)

32,257

53,530

35,059

(79,921

)

(5,543

)

Interest expense, net

(286

)

(338

)

(650

)

(1,961

)

(1,037

)

Income (loss) before income taxes

31,971

53,192

34,409

(81,882

)

(6,580

)

Income tax (provision) benefit

(12,143

)

(4,439

)

(10,856

)

10,581

2,050

Net income (loss)

$

19,828

$

48,753

$

23,553

$

(71,301

)

$

(4,530

)

Basic income (loss) per share

$

0.44

$

1.10

$

0.55

$

(1.72

)

$

(0.11

)

Diluted income (loss) per share

$

0.44

$

1.08

$

0.54

$

(1.72

)

$

(0.11

)

Cash dividends paid per share

$

—

$

0.50

$

—

$

—

$

0.25

Adjusted Non

-

GAAP Measures:

Adjusted income (loss) per diluted share

$

0.44

$

0.66

$

0.71

$

(0.87

)

$

(0.04

)

Consolidated Operating Data:

Stores open at end of period

262

264

267

276

280

Sales per store including shoe department

$

4,793

$

4,813

$

4,845

$

5,113

$

5,737

Sales per store excluding shoe department

$

4,427

$

4,469

$

4,515

$

4,778

$

5,363

Sales per square foot including shoe department

$

161

$

161

$

160

$

170

$

190

Sales per square foot excluding shoe department

$

160

$

161

$

161

$

171

$

192

Comparable store net sales decrease

(1.1

)%

(1.8

)%

(5.6

)%

(10.9

)%

(4.0

)%

Consolidated Balance Sheet Data:

Working capital

$

172,872

$

172,302

$

152,781

$

206,104

$

165,469

Total assets

473,216

436,444

404,213

449,890

460,539

Long

-

term debt

—

—

—

100,000

27,133

Capital lease obligations/long

-

term

1,480

—

—

—

—

Total shareholders

’

equity

259,338

247,251

215,689

186,350

256,689

(1) Selling, general and administrative expenses include asset impairment and store closing charges of $2.3 million in 2011, $3.1 million in

2010, $11.1 million in 2009, $25.4 million in 2008 and $5.2 million in 2007.

(2) Earnings per share (“EPS”) data for the years 2007-2008 has been adjusted retrospectively for the February 1, 2009 adoption of new EPS

guidance on participating securities included in the computation of EPS under the two

-

class method.

(3) These sales per store and sales per square foot calculations include shoe department sales, which are not included in our reported net

sales. Sales per store is calculated by dividing (a) total sales including shoe department sales by (b) the number of stores open at the end

of such period, exclusive of stores open for less than 12 months. Sales per square foot includes shoe department sales and selling space

and excludes administrative, receiving and storage areas. Internet sales are excluded from these calculations.

(4) These sales per store and sales per square foot calculations exclude shoe department sales, which are not included in our reported net

sales. Sales per store is calculated by dividing (a) total sales excluding shoe department sales by (b) the number of stores open at the end

of such period, exclusive of stores open for less than 12 months. Sales per square foot excludes shoe department sales and selling space,

administrative, receiving and storage areas. Internet sales are excluded from these calculations.

(5) Comparable store sales information for a period reflects stores open throughout that period and for the same 52-week period in the prior

year and internet sales. Comparable sales does not include Other income.

(6) SEC Regulation S-K 10(e) – We report our consolidated financial results in accordance with generally accepted accounting principles

(“GAAP”). However, to supplement these consolidated financial results, we believe that certain non-GAAP operating results, which

exclude asset impairment and store closing

( 1

)

( 2

)

( 2

)

( 6

)

( 3

)

( 4

)

( 3

)

( 4

)

( 5

)