Stein Mart 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

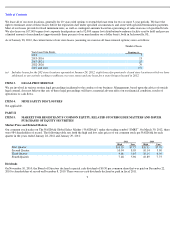

Reconciliations of net income (loss) per diluted share on a GAAP basis to adjusted net income (loss) per diluted share (non-GAAP basis) are

presented in the table below:

We are a national retailer offering the fashion merchandise, service and presentation of a better department or specialty store at prices

comparable to off-price retail chains. Our focused assortment of merchandise features current-season moderate to better fashion apparel for

women and men, as well as accessories, shoes and home fashions.

We report our consolidated financial results in accordance with generally accepted accounting principles (“GAAP”). To supplement these

consolidated financial results, we believe that certain non-GAAP operating results, which exclude the items discussed at Adjusted Results for

Items Impacting Comparability

below, may provide a meaningful measure on which to compare the results of operations between periods.

Wherever used below, the words “as adjusted” or “adjusted” identify financial results excluding these items that impact comparability.

2011 Highlights

Comparable store sales for 2011 decreased 1.1 percent compared to 2010 and total sales decreased 1.8 percent. Net income for 2011 was $19.8

million or $0.44 per diluted share compared to $48.8 million or $1.08 per diluted share for 2010. Net income as adjusted for 2011 was $20.0

million or $0.44 per diluted share compared to $29.6 million or $0.66 per diluted share for 2010.

Cash at year-end 2011 was $94.1 million compared to $80.2 million at year-end 2010. We had no outstanding debt at year-end and had no

borrowings on our credit facility. Inventories were down 5% at the end of 2011 compared to the prior year.

During 2011, we continued to focus on increasing our sales and managing our inventories. We were disappointed with third quarter sales which

were impacted by a shift in our advertising media mix for the largest August promotional event and Hurricane Irene which also disrupted

business during the same event. Coupon usage was reduced by 20 percent during the fourth quarter as part of our long-term strategy to present

our customers with a value proposition more solidly based on our everyday prices. We maintained tight inventory control as we approached the

end of the fiscal year, which left us in a better position entering 2012, but also negatively affected sales at the end of our fourth quarter.

2012 Outlook

We expect the following factors to influence our business in 2012:

13

charges, certain breakage gains, net of a charge associated with changing our physical inventory process and significant tax provision

impacts including the (reversal)/initial recording of a valuation allowance for deferred tax assets, may provide a meaningful measure on

which to compare the results of operations between periods. We believe these non-GAAP results provide useful information to both

management and investors by excluding certain items that impact the comparability of the results.

2011

2010

2009

2008

2007

Net income (loss) per diluted share (GAAP basis)

$

0.44

$

1.08

$

0.54

$

(1.72

)

$

(0.11

)

Adjustments:

Asset impairment and store closing charges, net of tax

0.03

0.06

0.17

0.39

0.07

Correction of reward breakage income related to prior years

(0.03

)

—

—

—

—

Cumulative breakage gain, net of inventory charge

—

(

0.15

)

—

—

—

Valuation allowance for deferred tax assets

–

(

reversal)/initial

—

(

0.13

)

—

0.46

—

Impact of 2011 effective tax rate on 2010*

—

(

0.20

)

—

—

—

Adjustments total

—

(

0.42

)

0.17

0.85

0.07

Adjusted net income (loss) per diluted share (non

-

GAAP basis)

$

0.44

$

0.66

$

0.71

$

(0.87

)

$

(0.04

)

* To make 2011 and 2010 operating results more comparable due to differences in our annual effective tax rate (“ETR”) caused by last year’s

deferred tax valuation allowance, the 2010 tax provision has been adjusted using the 2011 annual ETR of 38 percent.

ITEM 7.

MANAGEMENT

’

S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Overview

•

Current plans are to open seven stores, close three stores and relocate five stores to better locations in their respective markets in 2012.

•

The gross profit rate is expected to be lower than in 2011 as it will be impacted by our new pricing strategy and coupon reduction efforts

(see below) to drive long

-

term sales growth as well as inflationary occupancy cost increases.