Stein Mart 2011 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2011 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

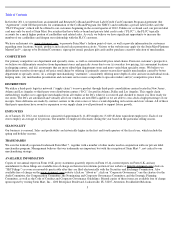

Reconciliations of operating and net income on a GAAP basis to adjusted operating and net income on a non-GAAP basis are presented in the

following table (in thousands):

Asset impairment and store closing charges, including costs to relocate stores, are as follows (dollar amounts in thousands):

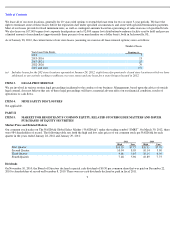

2011 Compared to 2010

Net Sales. The following table provides net sales for fiscal 2011 compared to fiscal 2010 (dollar amounts in thousands):

The decrease in sales reflects a $13.0 million decrease in the comparable store group and a $16.3 million decrease in the closed store group,

offset by an $8.2 million increase in the non-comparable store group due to the inclusion of sales for a total of five stores opened in 2011 and

2010. The closed store group includes five stores closed in 2011 and five stores closed in 2010. The comparable store sales decrease was driven

by decreases in the number of transactions and the average units per transaction, offset by an increase in average unit retail prices.

Gross Profit. The following table compares gross profit for fiscal 2011 to fiscal 2010 (dollar amounts in thousands):

The decrease in gross profit reflects a $13.6 million decrease in the comparable store group and a $3.1 million decrease in the closed store

group, offset by a $1.8 million increase in the non-comparable store group. Gross profit as a percent of sales decreased during 2011 primarily

due to higher occupancy and buying costs and the negative leverage on lower sales.

Selling, General and Administrative Expenses. The following table compares SG&A expenses for fiscal 2011 to fiscal 2010 (dollar amounts

in thousands):

15

2011

2010

2009

Operating

Income

Net

Income

Operating

Income

Net

Income

Operating

Income

Net

Income

Income - (GAAP basis)

$

32,257

$

19,828

$

53,530

$

48,753

$

35,059

$

23,553

Adjustments:

Asset impairment and store closing charges

2,322

1,440

3,093

2,448

11,087

7,589

Correction of reward breakage income related to prior years

(2,023

)

(1,244

)

—

—

—

—

Cumulative gift and return card breakage gain, net of inventory

charge

—

—

(

8,481

)

(6,713

)

—

—

Reversal of deferred tax asset valuation allowance

—

—

—

(

5,973

)

—

—

Impact of 2011 higher 38.0% ETR on 2010

—

—

—

(

8,877

)

—

—

Adjusted income

-

(

non

-

GAAP basis)

$

32,556

$

20,024

$

48,142

$

29,638

$

46,146

$

31,142

2011

2010

2009

Asset impairment charges

$

1,166

$

1,150

$

8,429

Lease termination costs, net

663

1,702

2,089

Severance and other

493

241

569

Total

$

2,322

$

3,093

$

11,087

2011

2010

Decrease

Net sales

$

1,160,367

$

1,181,510

$

(21,143

)

Sales percent decrease:

Total net sales

(1.8

)%

Comparable store sales

(1.1

)%

2011

2010

Decrease

Gross profit

$

297,364

$

312,308

$

(14,944

)

Percentage of net sales

25.6

%

26.4

%

(0.8

)%

2011

2010

Increase

Selling, general and administrative expenses

$

289,114

$

288,208

$

906

Percentage of net sales

24.9

%

24.4

%

0.5

%