Snapple 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

leadingwithbrands

robust marketing plans that include activation

behind our “Better Diet Stuff,” we expect

ongoing improvement for the brand in 2010.

Growth for Juice and Juice Drinks

Our juice and juice drinks portfolio continued

its leading position in the juice aisle in

2009, bolstered by Hawaiian Punch and the

health and wellness messages around Mott’s.

Increased media spending, new distribution

and strong retail programming drove growth

for Mott’s apple juice and Mott’s for Tots, a

lower-sugar juice that maintains the nutrient

content of the regular offering. In 2010

we’ll provide more convenient nutrition for

moms with Mott’s Medleys, a breakthrough

innovation that combines the great taste

of Mott’s juice with two fruit and vegetable

servings per 8-oz. serving.

A favorite of shoppers seeking value,

Hawaiian Punch surpassed volume

expectations with double-digit growth and

delighted consumers with two new flavors,

Polar Blast and Berry Bonkers. We’ll

premiere Hawaiian Punch Lemon Lime

Splash in spring 2010.

Solidifying Our Hispanic Strategy

In 2009 we boosted investments behind

Hispanic programming across our portfolio,

including a traveling Dr Pepper club

experience called Vida23. As a result of

these efforts and expanded distribution,

Dr Pepper has increased volume share in

nine of the top 10 Hispanic markets. In

fact, volume for Dr Pepper is up 5 percent

in the U.S. Hispanic market compared to

a 1 percent decline for total CSDs. 7UP

also headlined a Sevenisima campaign that

connected with the natural energy, fun

and spirit of Hispanic consumers.

We’ll invest further in local and national

programs that connect with Hispanic

consumers, including a greater focus on our

juice category, particularly Mott’s and Clamato.

In 2010 7UP will sponsor the Latin Grammy

Awards and Dr Pepper will sponsor Premios

Juventud (Hispanic youth awards).

Building Venom Energy from

the Ground Up

Our new Venom Energy brand rounds out

our portfolio. In its first full year, Venom

Energy has captured a 1.5 percent share

of the $6 billion energy drink market and

has significant distribution upside in 2010.

Venom Energy’s sponsorship of Andretti

Autosport and the #26 car driven by

Marco Andretti will augment our localized,

grassroots efforts to build this brand from

the ground up.

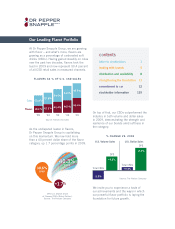

125 YEARS IN 2010 AND ST ILL GR OWI NG

In 1885, pharmacist Charles Alderton mixed up a blend

of fruit flavors at the Old Corner Drug Store in Waco, Texas,

and a beverage industry icon was born. For 125 years,

Dr Pepper has been delighting consumers with its legendary

23 flavors, iconic ad campaigns and creative packaging,

all of which have become a part of history.

Source: Company-

reported 288-oz.

bottler case sales

(in millions of cases)

’89

250

’09

530

4% CAGR Over 20 Years

leading with brands