Snapple 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

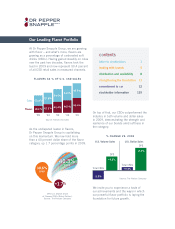

Against a challenging economic backdrop, Dr Pepper Snapple continues to create shareholder value,

as shown in our relative price performance vs. the S&P 500 Index in 2009.

20 09 DPS SH ARE HOL DER RETURN

80%

60%

40%

20%

0%

-20%

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

S&P

DPS

Our accomplishments in 2009 are just a

taste of those to come, and we are energized

by the knowledge that our journey is just

beginning. The actions we have taken this

year will build a foundation for long-term

growth that will sustain our company well

into the future.

The Flavor of Growth

Macroeconomic conditions provided a

challenging backdrop for the beverage

industry in 2009. Sales of liquid refreshment

beverages (LRBs) declined for the second

consecutive year, while consumer spending

remained weak and shoppers continued

to gravitate toward value. Despite these

challenges, Dr Pepper Snapple Group

focused on finding new ways to win, and

the result was strong business performance,

as we were the only major beverage company

to increase our share of LRBs in 2009.

Net sales increased 2 percent on a currency-

neutral basis and excluding the loss of a

licensed brand that we no longer distribute.

Driving the top-line improvement were price

increases and 4 percent sales volume growth,

partially offset by negative mix from higher

sales of CSD concentrates and value juices.

Strong performance across multiple brands

contributed to the volume growth, with

CSDs up 4 percent and our non-carbonated

beverages up 2 percent. Dr Pepper volume

increased 2 percent, largely driven by Diet

Dr Pepper and the launch of Dr Pepper

Cherry. Among our Core 4 brands, Canada

Dry was up mid single digits and 7UP and

A&W grew low single digits, while Sunkist

soda declined high single digits. Crush

volume more than doubled, adding 48

million cases in 2009 through expanded

third-party distribution in the U.S. and the

launch of Crush value offerings in Mexico.

Our leadership in the juice aisle continued

on the strength of Hawaiian Punch and

Mott’s, with volume gains of 14 percent

and 8 percent, respectively. Our premium-

priced products continued to be negatively

impacted as consumers shifted to value

offerings. Snapple volume was down

11 percent for the year, but sales trends

are strengthening and the brand improved

sequentially for the last three quarters

of 2009.

In Mexico, we grew our share of flavored

CSDs. The restage of Peñafiel flavors and

expanded distribution for the brand resulted

in a mid single-digit increase in Peñafiel

volume, while Squirt declined high single

digits. We also grew share of Clamato

and flavored CSDs in Canada, particularly

Dr Pepper, where expanded programming

and trial contributed to double-digit

volume growth for the brand.

Segment operating profit on a comparable

basis increased 17 percent on the strength

of the sales gain and lower packaging,

ingredient and transportation costs.

Excluding certain items, we earned $1.97

per diluted share, an increase of more than

6 percent compared to 2008.

DR PEPPER SNAPPLE GROUP 2009 ANNUAL REPORT

2

letter to stockholders