Snapple 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160

|

|

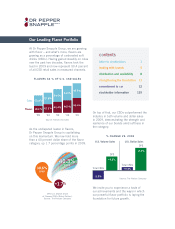

Our Leading Flavor Portfolio

At Dr Pepper Snapple Group, we are growing

with flavor

—

and what’s more, flavors are

growing as a percentage of carbonated soft

drinks (CSDs). Having gained steadily on colas

over the past two decades, flavors took the

lead in 2009 and now represent 50.4 percent

of all CSD retail sales in measured channels.

contents

letter to stockholders 1

leading with brands 5

distribution and availability 8

strengthening the foundation 11

commitment to csr 12

stockholder information 139

On top of that, our CSDs outperformed the

industry in both volume and dollar sales

in 2009, demonstrating the strength and

resilience of our brands amid softness in

the category.

We invite you to experience a taste of

our achievements and the ways in which

our powerful flavor portfolio is laying the

foundation for future growth.

% CHA NGE VS . 20 08

Source: The Nielsen Company

U.S. Volume Sales

Total CSDs

DPS

U.S. Dollar Sales

+4.2%

+0.8%

Total CSDs

-2.5%

DPS

+7.0%

FL AVORS AS % OF U.S. C SD SALES

40.3%

2009

+1.7%

As the undisputed leader in flavors,

Dr Pepper Snapple Group is capitalizing

on this momentum. We now hold more

than a 40 percent dollar share of the flavor

category, up 1.7 percentage points in 2009.

DPS U.S. Market Share

of Flavored CSDs (Retail Dollars).

Source: The Nielsen Company

38.6%

2008

Source: Nielsen estimates

Colas

’89

Flavors

’94 ’99 ’04 ’09

39.2%

60.8%

42.2% 45.4% 46.0% 50.4%

49.6%

57.8%

54.6%

54.0%