Snapple 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

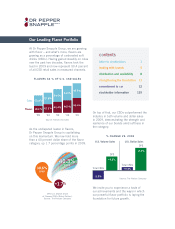

PL ANN ED NET IN CRE ASE IN

CO LD- DRI NK EQU IPM ENT

Opportunity

to generate

more serving

occasions over

5 years

81K

Winning in Single Serve is our strategy to sustain and grow

our high-margin immediate consumption business with the

addition of 35,000 incremental coolers and venders per year.

116K

186K

’08 ’09 ’10 ’11 ’12 ’13

10K

46K

151K

36K 35K 35K 35K 35K

Winning in Single Serve

Our strategy to sustain and grow our

high-margin immediate consumption

business reaped great benefits in 2009

with the placement of nearly 36,000

incremental coolers and venders at local

and national accounts. That’s more than

three-and-a-half times the number we

placed in 2008. Now more than a year

into our Winning in Single Serve initiative,

we’re on target with our five-year cold-drink

equipment placement objectives.

Brands That Matter Across

Retail Channels

In 2009 we saw volume growth in every

measured CSD channel, and we were the

only national beverage company to grow

both volume and share in the convenience,

drug and grocery channels. Our customer-

centric focus with our retail partners earned

DPS Progressive Grocer’s Best in Class

Category Captain award for soft drinks for

the fourth time in five years. We also took

home the 7-Eleven Franchisee Vendor of the

Year award. Other convenience wins in 2009

included new distribution for single-serve

and take-home packages at leading

convenience chains.

In the dollar channel, we secured new

availability for our Core 4 brands, expanded

our presence in the juice aisle with increased

distribution of Mott’s, Hawaiian Punch and

Yoo-Hoo, and gained cold-drink availability

for Snapple. These wins are just a few

examples of how our flavor story has helped

alter the traditionally exclusive beverage

agreements by which many value outlets

operate and has opened the door for further

penetration in this growth area.

Going forward, we’ll target new availability

and build consumer preference for our

flavors with the help of accelerated marketing

efforts and increased investments in key

Hispanic markets.

9

distributionandavailability

distribution and availability