Snapple 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

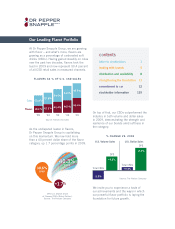

expandingdistributionandavailability

One of the greatest opportunities for DPS

rests with our ability to close distribution

gaps and increase the availability of our

brands, particularly the Dr Pepper, Core 4

and Snapple trademarks. Even in areas

where distribution is plentiful, we are working

to expand availability of line extensions and

packaging options. Our balanced route to

market and strong alignment with our

bottling and distributing partners are

key to our success.

Building Per-Capita Consumption

for Priority Brands

As one of the most recognized brands in our

portfolio, Dr Pepper is consistently well-

known and consumer-preferred, but its per-

capita consumption rates vary widely across

the U.S., from a low of eight 8-oz. servings

per person per year in Massachusetts to a

high of 238 servings in Oklahoma. Stepped-

up distribution and availability have the

potential to grow Dr Pepper from a national

average of 62 servings to 100, equating

to a potential 300 million-plus cases of

incremental volume. Likewise, our Core 4

brands and Crush average 11 servings per

person per year, but we believe the per-

capita opportunity, with the right investment

over time, is 20 servings per person. That

would translate to more than 350 million

incremental cases per year. We’re already

tapping into this potential

—

in 2009

we saw Dr Pepper consumption increase

in 80 percent of the coastal markets in

which we made incremental investments.

Capitalizing on the West Coast

Growth Opportunity

Brands that go through our warehouse-

direct system have tremendous upside

in the western United States, and we’re

actively building our business there. Our

new production and distribution facility

in Victorville, Calif., has opened, and we

anticipate that it will be certified as a

Leadership in Energy and Environmental

Design (LEED) facility by the U.S. Green

Building Council. With our Victorville plant,

we’ll dramatically increase our production

capability in the West and complete our

hub-and-spoke model for all five major

regions of the United States. This 850,000

square-foot facility gives us a platform for

growth and will help us boost West Coast

market share for brands like Mott’s

through better customer service and

increased efficiencies in production

and delivery logistics.

In preparation for this expanded capability,

we’ve been ramping up our sales efforts

for our packaged beverages in the region,

achieving impressive results. Our national

account teams have secured more than 1,400

new points of distribution for Mott’s apple

sauce and juice and more than 3,000 new

Hawaiian Punch placements at key retail

accounts and grocery distributors. In 2010

we’ll enhance support for our western growth

plans through an expanded selling team

and a coordinated mix of national account

sales and local retail execution.

DR PEPPER SNAPPLE GROUP 2009 ANNUAL REPORT

8

distribution and availability

No.1 or

No.2 brands

generate

approximately

75%

of our

volume