Snapple 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7UP

A&W

AGUAFIEL

BIG RED

CANADA DRY

CLAMATO

COUNTRY TIME

CRUSH

DEJA BLUE

DR PEPPER

HAWAIIAN PUNCH

IBC

MISTIC

MOTT’S

MR AND MRS T

NANTUCKET NECTARS

PEÑAFIEL

RC COLA

REALEMON

REALIME

ROSE’S

SCHWEPPES

SN APPLE

SQUIRT

STEWART’S

SUNDROP

SUNKIST SODA

TAHITIAN TREAT

VENOM ENERGY

VERNORS

WELCH’S

YOO-HOO

DR PEPPER SNAPPLE GROUP 2009 ANNUAL REPORT

growingwithflavor

Table of contents

-

Page 1

...AGUAFIEL BIG RED CANADA DRY CLAMATO COUNTRY TIME CRUS H DEJA BLUE DR PEPPER HAWAIIAN PUNCH IBC MISTIC MOTT'S MR AND MRS T NANTUCKET NECTARS PEÃ'AFIEL RC COLA REALEMON REALIME ROSE'S SCHWEPPES SN APPLE SQUIRT STEWART'S growingwithflavor DR PEPPER SNAPPLE GROUP 2009 ANNUAL REPORT SUNDROP SUNKIST SODA... -

Page 2

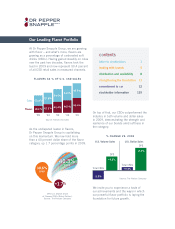

...Portfolio At Dr Pepper Snapple Group, we are growing with flavor - and what's more, flavors are growing as a percentage of carbonated soft drinks (CSDs). Having gained steadily on colas over the past two decades, flavors took the lead in 2009 and now represent 50.4 percent of all CSD retail sales in... -

Page 3

... more than 200 new routes in Mexico • Increased volume and market share of Dr Pepper in Canada "Dr Pepper Snapple was the only major beverage company to increase its share of the liquid refreshment beverages category in 2009." - CHAIRMAN OF THE BOARD WAYNE SANDERS AND PRESIDENT & CEO LARRY YOUNG -

Page 4

..., with CSDs up 4 percent and our non-carbonated beverages up 2 percent. Dr Pepper volume increased 2 percent, largely driven by Diet Dr Pepper and the launch of Dr Pepper Cherry. Among our Core 4 brands, Canada Dry was up mid single digits and 7UP and 2 DR PEPPER SNAPPLE GROUP 2009 ANNUAL REPORT -

Page 5

The Flavor of Our Business In 2009 our solid top- and bottom-line results ...Segment Operating Profit* +17% Volume* +4% Net Sales* +2% *Adjusted volume, net sales and segment operating profit exclude the loss of Hansen product distribution and are on a currency-neutral basis. Adjusted diluted ... -

Page 6

... leaders' level of engagement has improved significantly in the last two years and is now in a league with other highperforming U.S. companies. Wayne R. Sanders CHAIRMAN OF THE BOARD Larry D. Young PRESIDENT & CHIEF EXECUTIVE OFFICER March 2, 2010 4 DR PEPPER SNAPPLE GROUP 2009 ANNUAL REPORT -

Page 7

...re adding value to our iconic brands with our focus on fun, flavor and functionality. In 2009 we increased marketing dollars for Core 4 brands by 75% Building Brand Equity In 2009 we boosted investments for Dr Pepper, Mott's and Snapple and increased marketing spend by more than 75 percent behind... -

Page 8

...graphics, new packaging and a national media campaign, the brand is recapturing its original fun and quirky personality, and consumers are responding. Snapple returned to growth in Q4 2009, with premium volume and share up mid single digits. We also launched a Snapple premium sixpack, a new national... -

Page 9

.... For 125 years, Dr Pepper has been delighting consumers with its legendary 23 flavors, iconic ad campaigns and creative packaging, all of which have become a part of history. Increased media spending, new distribution and strong retail programming drove growth for Mott's apple juice and Mott's for... -

Page 10

... 20 servings per person. That would translate to more than 350 million incremental cases per year. We're already tapping into this potential - in 2009 we saw Dr Pepper consumption increase in 80 percent of the coastal markets in which we made incremental investments. 8 DR PEPPER SNAPPLE GROUP 2009... -

Page 11

... chains. In the dollar channel, we secured new availability for our Core 4 brands, expanded our presence in the juice aisle with increased distribution of Mott's, Hawaiian Punch and Yoo-Hoo, and gained cold-drink availability for Snapple. These wins are just a few examples of how our flavor story... -

Page 12

...the Box®, where Dr Pepper is already on all of its U.S. fountains, Diet Dr Pepper installations began in 2009 and will be completed at most U.S. restaurants this year. Both wins are driving greater awareness for our brands, particularly in coastal markets, aiding our ability to increase per-capita... -

Page 13

...-user IT services in 2009, has also allowed us to crush costs, standardize our processes and improve service delivery. Building a World-Class Supply Chain To create a leaner, more efficient supply chain, we've streamlined our operations over the past four years from 28 U.S. manufacturing plants to... -

Page 14

... demonstrated our commitment to being a good corporate citizen through our second-annual United Way campaign, which included a corporate dollar-for-dollar match. Early on, President and CEO Larry Young challenged DPS employees to increase their contributions by 25 percent and pledged to get a crew... -

Page 15

DR PEPPER SNAPPLE GROUP, INC. RECONCILIATION OF GAAP AND NON-GAAP INFORMATION Twelve Months Ended December 31, 2009 and 2008 (Unaudited) The Company reports its financial results in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). However, ... -

Page 16

(Intentionally Left Blank) 14 -

Page 17

...all executive officers and Directors are "affiliates" of the registrant) as of June 30, 2009, the last business day of the registrant's most recently completed second fiscal quarter, was $5,382,637,224 (based on closing sale price of registrant's Common Stock on that date as reported on the New York... -

Page 18

(Intentionally Left Blank) -

Page 19

DR PEPPER SNAPPLE GROUP, INC. FORM 10-K For the Year Ended December 31, 2009 Page Item Item Item Item Item Item 1. 1A. 1B. 2. 3. 4. PART I. Business ...Risk Factors ...Unresolved Staff Comments ...Properties ...Legal Proceedings ...Submission of Matters to a Vote of Security Holders ... 1 13 19 ... -

Page 20

... allied brands; • litigation claims or legal proceedings against us; • increases in the cost of employee benefits; • increases in cost of materials or supplies used in our business; • shortages of materials used in our business; • substantial disruption at our manufacturing or distribution... -

Page 21

... Snapple and other brands, significantly increasing our share of the United States NCB market segment. In 2003, we created Cadbury Schweppes Americas Beverages by integrating the way we managed our four North American businesses (Mott's, Snapple, Dr Pepper/Seven Up and Mexico). During 2006 and 2007... -

Page 22

... Financial Statements for further information. Products and Distribution We are a leading integrated brand owner, manufacturer and distributor of non-alcoholic beverages in the United States, Mexico and Canada and we also distribute our products in the Caribbean. In 2009, 90% of our net sales... -

Page 23

...premium and value teas Brand also includes premium juices and juice drinks Founded in Brooklyn, New York in 1972 #1 apple juice and #1 apple sauce brand in the United States Juice products include apple and other fruit juices, Mott's Plus and Mott's for Tots Apple sauce products include regular... -

Page 24

...share growth in the CSD market in each of the last five years. Our largest brand, Dr Pepper, is the #2 flavored CSD in the United States, according to The Nielsen Company, and our Snapple brand is a leading ready-to-drink tea. Overall, in 2009, approximately 75% of our volume was generated by brands... -

Page 25

... the demand for products with health and wellness benefits. Our portfolio of products is biased toward flavored CSDs, which continue to gain market share versus cola CSDs, but also focuses on emerging categories such as teas, energy drinks and juices. Broad geographic manufacturing and distribution... -

Page 26

... CSD brands. In 2009, our Beverage Concentrates segment had net sales of approximately $1.1 billion. Key brands include Dr Pepper, 7UP, Sunkist soda, A&W, Canada Dry, Crush, Schweppes, Squirt, RC Cola, Diet Rite, Sundrop, Welch's, Vernors and Country Time and the concentrate form of Hawaiian Punch... -

Page 27

... customers, such as fast food restaurants, who mix the syrup with water and carbonation to create a finished beverage at the point of sale to consumers. Dr Pepper represents most of our fountain channel volume. Concentrate prices historically have been reviewed and adjusted at least on an annual... -

Page 28

... party bottlers and distributors. In Mexico, we also participate in a joint venture to manufacture Aguafiel brand water with Acqua Minerale San Benedetto. We provide expertise in the Mexican beverage market and Acqua Minerale San Benedetto provides expertise in water production and new packaging... -

Page 29

... countries where we do not currently have any significant level of business. In addition, in many countries outside the United States, Canada and Mexico, our rights to many of our brands, including our Dr Pepper trademark and formula, were sold by Cadbury beginning over a decade ago to third parties... -

Page 30

... companies for use in connection with food, confectionery and other products. We also license certain brands, such as Dr Pepper and Snapple, to third parties for use in beverages in certain countries where we own the brand but do not otherwise operate our business. Marketing Our marketing strategy... -

Page 31

... the case of glass bottles, resin in the case of PET bottles and caps, corn in the case of sweeteners and pulp in the case of paperboard packaging. Manufacturing costs for our Packaged Beverages segment, where we manufacture and bottle finished beverages, are higher as a percentage of our net sales... -

Page 32

... Scantrack include flavored (non-cola) CSDs, energy drinks, single-serve bottled water, non-alcoholic mixers and NCBs, including ready-to-drink teas, single-serve and multi-serve juice and juice drinks, and sports drinks. The Nielsen Company also provides data on other food items such as apple sauce... -

Page 33

... small business except for Dr Pepper) is not included in The Nielsen Company data, our market share using The Nielsen Company data is generally higher for our CSD portfolio than the Beverage Digest data, which does include the fountain channel. In this Annual Report on Form 10-K, all information... -

Page 34

... bottlers and distributors do not successfully provide appropriate marketing, product, packaging, pricing and service to these retailers, our product availability, sales and margins could suffer. Certain retailers make up a significant percentage of our products' retail volume, including volume sold... -

Page 35

...or capital expenditures. For example, changes in recycling and bottle deposit laws or special taxes on soft drinks or ingredients could increase our costs. Regulatory focus on the health, safety and marketing of food products is increasing. Certain state warning and labeling laws, such as California... -

Page 36

... materials we use in our business are aluminum cans and ends, glass bottles, PET bottles and caps, paperboard packaging, sweeteners, juice, fruit, water and other ingredients. Additionally, conversion of raw materials into our products for sale also uses electricity and natural gas. The cost of the... -

Page 37

... risks may be more acute where the supplier or its plant is located in riskier or less-developed countries or regions. Any significant interruption to supply or cost increase could substantially harm our business and financial performance. Substantial disruption to production at our manufacturing... -

Page 38

... rights, our brands, products and business could be harmed. We also license various trademarks from third parties and license our trademarks to third parties. In some countries, other companies own a particular trademark which we own in the United States, Canada or Mexico. For example, the Dr Pepper... -

Page 39

... footprint serving consumers in California and parts of the desert Southwest. When open in 2010, the facility will produce a wide range of soft drinks, juices, juice drinks, bottled water, ready-to-drink teas, energy drinks and other premium beverages at the Victorville plant. The plant will... -

Page 40

... our common stock, whose shares are held of record by banks, brokers, and other financial institutions. The information under the principal heading "Equity Compensation Plan Information" in our definitive Proxy Statement for the Annual Meeting of Stockholders to be held on May 20, 2010, to be filed... -

Page 41

...The Peer Group Index consists of the following companies: The Coca-Cola Company, Coca-Cola Enterprises, Inc, Pepsi Bottling Group, Inc, PepsiAmericas, Inc, PepsiCo, Inc, Hansen Natural Corporation, The Cott Corporation and National Beverage Corporation. We believe that these companies help to convey... -

Page 42

... was traded prior to May 7, 2008 and no DPS equity awards were outstanding for the prior periods. Subsequent to May 7, 2008, the number of basic shares includes approximately 500,000 shares related to former Cadbury Schweppes benefit plans converted to DPS shares on a daily volume weighted average... -

Page 43

..."), including ready-to-drink teas, juices, juice drinks and mixers. Our brand portfolio includes popular CSD brands such as Dr Pepper, Sunkist soda, 7UP, A&W, Canada Dry, Crush, Squirt, Peñafiel, Schweppes and Venom Energy, and NCB brands such as Snapple, Mott's, Hawaiian Punch, Clamato, Rose's and... -

Page 44

... fixed cost nature of the manufacturing and distribution businesses, increases in costs, for example raw materials tied to commodity prices, could have a significant negative impact on the margins of our businesses. Approximately 87% of our 2009 Packaged Beverages net sales of branded products come... -

Page 45

... customers, such as fast food restaurants, who mix the syrup with water and carbonation to create a finished beverage at the point of sale to consumers. Dr Pepper represents most of our fountain channel volume. Concentrate prices historically have been reviewed and adjusted at least on an annual... -

Page 46

...by third party distributors. The raw materials used to manufacture our products include aluminum cans and ends, glass bottles, PET bottles and caps, paper products, sweeteners, juices, water and other ingredients. We sell our Packaged Beverages' products both through our Direct Store Delivery system... -

Page 47

... into retail channels. Packaged Beverages Sales Volume In our Packaged Beverages segment, we measure volume as case sales to customers. A case sale represents a unit of measurement equal to 288 fluid ounces of packaged beverage sold by us. Case sales include both our ownedbrands and certain brands... -

Page 48

... consolidated financial statements using historical results of operations, assets and liabilities attributable to Cadbury's Americas Beverages business and including allocations of expenses from Cadbury. The historical Cadbury's Americas Beverages information is our predecessor financial information... -

Page 49

...States and Mexico negatively impacted both total volumes and CSD volumes by 1% for the year ended December 31, 2009. In CSDs, Dr Pepper increased 2% led by the launch of the Cherry line extensions and strength in Diet Dr Pepper. 7UP, Sunkist soda, A&W and Canada Dry (collectively, our "Core 4 brands... -

Page 50

... of employees in the Company's corporate, sales and supply chain functions and the continued integration of DSD into our Packaged Beverages segment. Selling, general and administrative ("SG&A") expenses increased for 2009 primarily due to an increase in compensation-related costs and an increase in... -

Page 51

... We report our business in three segments: Beverage Concentrates, Packaged Beverages and Latin America Beverages. The key financial measures management uses to assess the performance of our segments are net sales and SOP. The following tables set forth net sales and SOP for our segments for 2009 and... -

Page 52

... 44 million cases in 2009. Dr Pepper increased 2% led by the launch of the Cherry line extensions and strength in Diet Dr Pepper. The volume of our Core 4 brands declined 1%. Packaged Beverages The following table details our Packaged Beverages segment's net sales and SOP for 2009 and 2008... -

Page 53

..., 2008. The increase in volumes was driven by additional distribution routes, gains in Crush with the introduction of new flavors in a 2.3 liter value offering which added an incremental 4 million cases in 2009, and gains in Peñafiel, which benefited from a new marketing campaign, partially offset... -

Page 54

... from Cadbury were included in the Consolidated Statements of Operations for the year ended December 31, 2009 and 2008 (in millions): 2009 2008 Transaction costs and other one time separation costs(1) ...Costs associated with the bridge loan facility(2) ...Incremental tax (benefit) expense related... -

Page 55

...a 7% decline in 7UP as the brand cycled the final stages of launch support for 7UP with 100% Natural Flavors and the re-launch of Diet 7UP, partially offset by a 3% increase in Canada Dry due to the launch of Canada Dry Green Tea Ginger Ale. In NCBs, 9% growth in Hawaiian Punch, 6% growth in Clamato... -

Page 56

... announced in October 2007 intended to create a more efficient organization that resulted in the reduction of employees in the Company's corporate, sales and supply chain functions and the continued integration of DSD into other operations of the Company. Restructuring costs for 2007 were higher due... -

Page 57

... of Operations by Segment We report our business in three segments: Beverage Concentrates, Packaged Beverages and Latin America Beverages. The key financial measures management uses to assess the performance of our segments are net sales and SOP. The following tables set forth net sales and SOP for... -

Page 58

... 2009 compared with price increases which were effective in February 2008. SOP increased $14 million for 2008 as compared with 2007 driven by lower personnel costs, primarily due to savings generated from restructuring initiatives, and lower marketing costs. Volume (BCS) was flat in 2008. Dr Pepper... -

Page 59

... launched products, including Venom Energy and A&W and Sunkist Ready-to-Drink Floats, and 2% volume increases in both Clamato and Mott's. Net sales increased $10 million for 2008 compared with 2007 reflecting sales volume declines offset by price increases primarily driven by the Mott's brand. The... -

Page 60

... Energy in Mexico effective January 26, 2009. During 2008, our Latin America Beverages segment generated approximately $19 million and $6 million in net sales and operating profits, respectively, from sales of Hansen brands to third parties in Mexico. Accounting for the Separation from Cadbury... -

Page 61

... Customer and consumer demand for the Company's products may be impacted by recession or other economic downturn in the United States, Canada, Mexico or the Caribbean, which could result in a reduction in our sales volume. Similarly, disruptions in financial and credit markets may impact the Company... -

Page 62

... costs of $30 million were expensed when the Term Loan A was terminated upon repayment in December 2009. The Company utilizes interest rate swaps to convert variable interest rates to fixed rates. See Note 10 of the Notes to our Audited Consolidated Financial Statements for further information... -

Page 63

... of deferred financing costs of less than $1 million. The Company utilizes interest rate swaps, effective December 21, 2009, to convert fixed interest rates to variable rates. See Note 10 of the Notes to our Audited Consolidated Financial Statements for further information regarding derivatives. The... -

Page 64

... drink equipment and IT investments for new systems. The increase in expenditures for 2009 compared with 2008 was primarily related to costs of a new manufacturing and distribution center in Victorville, California. The increase in 2008 compared with 2007 was primarily related to early stage costs... -

Page 65

...for customer promotion and employee compensation, increased inventory purchases and improved cash management by paying vendors in accordance with invoice terms. Other non-current liabilities decreased primarily due to payments associated with the Company's pension and postretirement employee benefit... -

Page 66

... compared with cash provided by net repayments of related party notes receivable of $1,375 million for 2008. We increased capital expenditures by $74 million in the current year, primarily due to early stage costs of a new manufacturing and distribution center in Victorville, California. Capital... -

Page 67

...on related party debt ...Net change in related party debt ...$ - - - $ 1,615 (4,664) $ (3,049) The increase of $2,140 million in cash used in financing activities for the year ended December 31, 2008, compared with the year ended December 31, 2007, was driven by the change in Cadbury's investment... -

Page 68

...2009 (in millions). Based on our current...available under our Revolver. Refer to Notes 9 and 15 of the Notes to our Audited Consolidated Financial Statements for additional information regarding the items described in this table. Payments Due in Year Total 2010 2011...goods or services... 2009, the Company ... -

Page 69

... the new licensing agreements, PepsiCo will distribute Dr Pepper, Crush and Schweppes in the U.S. territories where these brands are currently distributed by PBG and PAS. The same will apply for Dr Pepper, Crush, Schweppes, Vernors and Sussex in Canada; and Squirt and Canada Dry in Mexico. Under... -

Page 70

... list price structure across locations. The impact of the change increased gross sales and related discounts by equal amounts on customer invoices. Net sales were not affected. The amounts of trade spend are larger in our Packaged Beverages segment than those related to other parts of our business... -

Page 71

... the rights to manufacture, distribute and sell products of the licensor within specified territories. (3) Includes all goodwill recorded in the DSD reporting unit which related to our bottler acquisitions in 2006 and 2007. The following table summarizes the critical assumptions that were used in... -

Page 72

...Snapple brand and the DSD reporting unit's distribution rights recorded in the fourth quarter. Indicative of the economic and market conditions, our average stock price declined 19% in the fourth quarter as compared to the average stock price from May 7, 2008, the date of our separation from Cadbury... -

Page 73

...accrue the cost of these benefits during the years that employees render service to us in accordance with U.S. GAAP. The calculation of pension and postretirement plan obligations and related expenses is dependent on several assumptions used to estimate the present value of the benefits earned while... -

Page 74

...in Item 8, "Financial Statements and Supplementary Data" of this Annual Report on Form 10-K for a discussion of recent accounting standards and pronouncements. ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK We are exposed to market risks arising from changes in market rates and... -

Page 75

... our ability to recover increased costs through higher pricing may be limited by the competitive environment in which we operate. Our principal commodities risks relate to our purchases of aluminum, corn (for high fructose corn syrup), natural gas (for use in processing and packaging), PET and fuel... -

Page 76

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Audited Financial Statements: Reports of Independent Registered Public Accounting Firm ...Consolidated Statements of Operations for the years ended December 31, 2009, 2008 and 2007 ...Consolidated Balance Sheets as of December 31, 2009 and 2008 ... -

Page 77

... consolidated balance sheets of Dr Pepper Snapple Group, Inc. and subsidiaries (the "Company") as of December 31, 2009 and 2008, and the related consolidated statements of operations, stockholders' equity and other comprehensive income (loss), and cash flows for each of the three years in the... -

Page 78

... the year ended December 31, 2009 of the Company and our report dated February 26, 2010 expressed an unqualified opinion on those financial statements and included explanatory paragraphs regarding the allocation of certain general corporate overhead costs through May 7, 2008, from Cadbury Schweppes... -

Page 79

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED STATEMENTS OF OPERATIONS For the Years Ended December 31, 2009, 2008 and 2007 For the Year Ended December 31, 2009 2008 2007 (In millions, except per share data) Net sales ...Cost of sales ...Gross profit ...Selling, general and administrative expenses ...... -

Page 80

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED BALANCE SHEETS As of December 31, 2009 and 2008 December 31, December 31, 2009 2008 (In millions except share and per share data) ASSETS Current assets: Cash and cash equivalents ...Accounts receivable: Trade, net ...Other ...Inventories ...Deferred tax ... -

Page 81

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS For the Years Ended December 31, 2009, 2008 and 2007 For the Year Ended December 31, 2009 2008 2007 (In millions) Operating activities: Net income (loss) ...Adjustments to reconcile net income (loss) to net cash provided by ... -

Page 82

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY AND OTHER COMPREHENSIVE INCOME (LOSS) For the Years Ended December 31, 2009, 2008 and 2007 Common Stock Issued Shares Amount Additional Paid-In Capital Accumulated Other Retained Comprehensive Earnings Cadbury's... -

Page 83

...-carbonated beverages ("NCBs"), including ready-to-drink teas, juices, juice drinks and mixers. The Company's brand portfolio includes popular CSD brands such as Dr Pepper, Sunkist soda, 7UP, A&W, Canada Dry, Crush, Squirt, Peñafiel, Schweppes, and Venom Energy, and NCB brands such as Snapple, Mott... -

Page 84

... regulatory, human resources and benefit management, treasury, investor relations, corporate controller, internal audit, Sarbanes Oxley compliance, information technology, corporate and legal compliance and community affairs. The costs of such services were allocated to the Company based on the most... -

Page 85

... and do not bear interest. The Company determines the required allowance for doubtful collections using information such as its customer credit history and financial condition, industry and market segment information, economic trends and conditions and credit reports. Allowances can be affected by... -

Page 86

... programs and initiatives to increase net sales, including contributions to customers or vendors for cold drink equipment used to market and sell the Company's products. These programs and initiatives generally directly benefit the Company over a period of time. Accordingly, costs of these programs... -

Page 87

... accrues the cost of these benefits during the years that employees render service. Refer to Note 15 for additional information. Risk Management Programs The Company retains selected levels of property, casualty, workers' compensation, health and other business risks. Many of these risks are covered... -

Page 88

..., DPS harmonized its gross list price structure across locations. The impact of the change increased gross sales and related discounts by equal amounts on customer invoices. Net sales to the customers were not affected. The amounts of trade spend are larger in the Packaged Beverages segment 68 -

Page 89

... Statements of Operations related to the fair value of employee share-based awards. The Company recognizes the cost of all unvested employee stock options on a straight-line attribution basis over their respective vesting periods, net of estimated forfeitures. Prior to the separation from Cadbury... -

Page 90

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table sets forth exchange rate information for the periods and currencies indicated: Mexican Peso to U.S. Dollar Exchange Rate End of Year Rates Annual Average Rates 2009 ...2008 ...2007 ...... -

Page 91

... May 7, 2008, the Company's consolidated financial information has been prepared on a "carve-out" basis from Cadbury's consolidated financial statements using the historical results of operations, assets and liabilities, attributable to Cadbury's Americas Beverages business and including allocations... -

Page 92

... Agreement, Transition Services Agreement, Tax Sharing and Indemnification Agreement ("Tax Indemnity Agreement") and Employee Matters Agreement with Cadbury, each dated as of May 1, 2008. Settlement of Related Party Balances Upon the Company's separation from Cadbury, the Company settled debt and... -

Page 93

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) the Company's Consolidated Statement of Operations at the time of the estimate change. In addition, pursuant to the terms of the Tax Indemnity Agreement, if DPS breaches certain covenants ... -

Page 94

... fair value as the joint venture is not publicly traded. The Company's proportionate share of the net income resulting from its investment in the joint venture is reported under the line item captioned equity in earnings of unconsolidated subsidiaries, net of tax, in the Consolidated Statements of... -

Page 95

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 7. Goodwill and Other Intangible Assets Changes in the carrying amount of goodwill for the years ended December 31, 2009 and 2008, by reporting unit, are as follows (in millions): Beverage Concentrates WD... -

Page 96

...acquired indefinite lived distribution rights as well as terminated a finite-lived agreement to distribute a third party's branded beverages. The Company recorded one-time gains of $62 million in 2009 as a component of other operating income in the audited Consolidated Statement of Operations. As of... -

Page 97

...value. Management's estimates, which fall under Level 3, are based on historical and projected operating performance, recent market transactions and current industry trading multiples. Discount rates were based on a weighted average cost of equity and cost of debt and were adjusted with various risk... -

Page 98

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes the critical assumptions that were used in estimating fair value for DPS' annual impairment tests of goodwill and intangible assets performed as of December 31, 2008: ... -

Page 99

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 9. Long-term Obligations The following table summarizes the Company's long-term debt obligations as of December 31, 2009 and 2008 (in millions): December 31, 2009 December 31, 2008 Senior unsecured notes... -

Page 100

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) During 2008, the Company... summaries of...costs associated with the Revolver for the years ended December 31, 2009 and 2008, respectively. The Company was required to pay annual amortization in equal quarterly... -

Page 101

... on the 2011 and 2012 Notes is payable semi-annually on June 21 and December 21. Interest expense was $1 million for the year ended December 31, 2009, including amortization of deferred financing costs of less than $1 million. The Company utilizes interest rate swaps designated as fair value hedges... -

Page 102

...): 2010 ...2011 ...2012 ...2013 ...2014 ...Thereafter ...10. Derivatives DPS is exposed to market risks arising from adverse changes in: • interest rates; • foreign exchange rates; and • commodity prices, affecting the cost of raw materials. The Company manages these risks through a variety of... -

Page 103

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The Company formally designates and accounts for certain interest rate swaps and foreign exchange forward contracts that meet established accounting criteria under U.S. GAAP as either fair value or cash ... -

Page 104

...in interest rates and manages these risks through the use of receive-fixed, pay-variable interest rate swaps. In December 2009, the Company entered into two interest rate swaps having an aggregate notional amount of $850 million and durations ranging from two to three years in order to convert fixed... -

Page 105

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes the location of the fair value of the Company's derivative instruments within the Consolidated Balance Sheets as of December 31, 2009 and 2008 (in millions): Balance Sheet ... -

Page 106

... Cost of sales The total hedge ineffectiveness recognized in net income was $1 million for the year ended December 31, 2009. During the next 12 months, the Company expects to reclassify net losses of $3 million from AOCL into net income. The interest rate swap agreements designated as fair value... -

Page 107

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 11. Other Non-Current Assets and Other Non-Current Liabilities Other non-current assets consisted of the following as of December 31, 2009 and 2008 (in millions): December 31, 2009 December 31, 2008 Long-... -

Page 108

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The provision for income taxes attributable to continuing operations has the following components (in millions): For the Year Ended December 31, 2009 2008 2007 Current: Federal...$ 194 State ...22 Non... -

Page 109

... and Mexican income tax returns are open for tax years 2000 and forward. Under the Tax Indemnity Agreement, Cadbury agreed to indemnify DPS for net unrecognized tax benefits and other tax related items of $402 million. This balance increased by $16 million during 2009 and was offset by indemnity... -

Page 110

...Statements of Operations for uncertain tax positions was $19 million and $18 million and $(2) million for 2009, 2008 and 2007, respectively. The Company had a total of $51 million and $33 million accrued for interest and penalties for its uncertain tax positions reported as part of other non-current... -

Page 111

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 13. Restructuring Costs The Company implements restructuring programs from time to time and incurs costs that are designed to improve operating effectiveness and lower costs. When the Company implements ... -

Page 112

...to date by operating segment (in millions). The Company does not expect to incur additional restructuring charges related to the integration of the bottling group. Costs For the Year Ended December 31, 2008 2007 Cumulative Costs to Date Packaged Beverages...$ 8 Beverage Concentrates ...2 Corporate... -

Page 113

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Process Outsourcing In 2007, the Company incurred $6 million in costs related to restructuring actions to outsource the activities of Latin America Beverages' warehousing and distribution processes. The ... -

Page 114

... 31, 2009 and 2008 was estimated based on quoted market prices for publicly traded securities. The difference between the fair value and the carrying value represents the theoretical net premium or discount that would be paid or received to retire all debt at such date. 15. Employee Benefit Plans... -

Page 115

...plan assets and postretirement benefit plan assets reflected were valued using NAV as of December 31, 2009. On January 1, 2008, the Company adopted the measurement date provisions under U.S. GAAP, which requires that assumptions used to measure the Company's annual pension and postretirement medical... -

Page 116

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The total pension and postretirement defined benefit costs recorded in the Company's Consolidated Statements of Operations for the years ended December 31, 2009, 2008 and 2007 were as follows (in millions... -

Page 117

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following tables set forth amounts recognized in the Company's financial statements and the plans' funded status for the years ended December 31, 2009 and 2008 (in millions): Pension Plans 2009 2008 ... -

Page 118

... and foreign plans for the years ended December 31, 2009, 2008 and 2007 (in millions): Benefit Plans Pension Plans Postretirement For the Year Ended December 31, 2009 2008 2007 2009 2008 2007 Net Periodic Benefit Costs(1) Service cost ...Interest cost ...Expected return on assets ...Amortization of... -

Page 119

... 8 The Company's 2009 pension expense for U.S. plans was calculated based upon a number of actuarial assumptions including discount rate, retirement age, compensation rate increases, expected long-term rate of return on plan assets for pension benefits and the healthcare cost trend rate related to... -

Page 120

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes the weighted-average assumptions used to determine benefit obligations at the plan measurement dates for U.S. plans: Pension Plans 2009 2008 Postretirement Benefit Plans 2009... -

Page 121

... of market conditions, tolerance for risk and cash requirements for benefit payments. The investment policy contains allowable ranges in asset mix as outlined in the table below: Asset Category Target Range Equity securities: U.S. Large Cap equities ...U.S. Small-Mid Cap equities ...International... -

Page 122

...Total ...$ 223 $ 125 $ - (1) Equity securities are comprised of common stock and actively managed U.S. index funds and Europe, Australia, Far East (EAFE) index funds. Investments in common stocks are valued using quoted market prices multiplied by the number of shares held. (2) Fixed income... -

Page 123

... per share multiplied by the number of units held as of the measurement date and are classified as Level 2 assets. Multi-employer Plans Cadbury Prior to the separation from Cadbury, certain employees of the Company participated in defined benefit plans and postretirement health care plans sponsored... -

Page 124

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The contributions paid into the U.S. and foreign multi-employer plans on the Company's behalf by Cadbury were $30 million for 2007. Other Plans The Company participates in a number of trustee-managed multi... -

Page 125

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The components of stock-based compensation expense for the years ended December 31, 2009, 2008 and 2007, are presented below (in millions): For the Year Ended December 31, 2009 2008 2007 Plans sponsored ... -

Page 126

...PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The fair value of each stock option is estimated on the date of grant using the Black-Scholes option-pricing model with the weighted average assumptions as detailed below: For the Year Ended December 31, 2009... -

Page 127

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) A summary of the status of the Company's nonvested options as of December 31, 2009 and changes during the year ended December 31, 2009 is presented below: Stock Options Weighted-Average Grant-Date Fair ... -

Page 128

... plans and, accordingly, the Company's consolidated financial statements will not be impacted by the Cadbury sponsored plans in future periods. The Company recognized the cost of all unvested employee stock-based compensation plans sponsored by Cadbury on a straight-line attribution basis over the... -

Page 129

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) intrinsic value of options exercised during the year was $24 million for 2007. An expense was recognized for the fair value at the date of grant of the estimated number of shares to be awarded to settle ... -

Page 130

.... Subsequent to May 7, 2008, the number of basic shares includes approximately 500,000 shares related to former Cadbury benefit plans converted to DPS shares on a daily volume weighted average. See Note 16 for further information regarding the Company's stock-based compensation plans. (2) Anti... -

Page 131

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 18. Accumulated Other Comprehensive (Loss) Income The Company's accumulated balances, shown net of tax for each classification of AOCL as of December 31, 2009, 2008 and 2007, are as follows (in millions): ... -

Page 132

...2009 2008 2007 Supplemental cash flow disclosures of non-cash investing and financing activities: Settlement related to separation from Cadbury(1) ...Purchase accounting adjustment related to prior year acquisitions ...Capital expenditures included in accounts payable ...Transfer of property, plant... -

Page 133

... or collectively, will have a material adverse effect on the business or financial condition of the Company although such matters may have a material adverse effect on the Company's results of operations or cash flows in a particular period. Snapple Litigation - Labeling Claims Snapple Beverage Corp... -

Page 134

...the Company as a whole. Prior to DPS' separation from Cadbury, it maintained its books and records, managed its business and reported its results based on International Financial Reporting Standards ("IFRS"). DPS' segment information has been prepared and presented on the basis which management uses... -

Page 135

... States and Canada from the manufacture and distribution of finished beverages and other products, including sales of the Company's own brands and third party brands, through both DSD and WD systems. • The Latin America Beverages segment reflects sales in the Mexico and Caribbean markets from the... -

Page 136

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) For the Year Ended December 31, 2009 2008 2007 Segment Results - SOP Beverage Concentrates ...Packaged Beverages ...Latin America Beverages ...Total SOP ...Unallocated corporate costs ...Impairment of ... -

Page 137

... FINANCIAL STATEMENTS - (Continued) For the Year Ended December 31, 2009 2008 Total assets Beverage Concentrates ...Packaged Beverages ...Latin America Beverages...Segment total...Corporate and other...Adjustments and eliminations ...Property, plant and equipment, net as reported ...Current... -

Page 138

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 22. Related Party Transactions Separation from Cadbury Upon the Company's separation from Cadbury, the Company settled outstanding receivable, debt and payable balances with Cadbury except for amounts due ... -

Page 139

... 31, 2009 and 2008. The consolidating schedules are provided in accordance with the reporting requirements for guarantor subsidiaries. On May 7, 2008, Cadbury plc transferred its Americas Beverages business to Dr Pepper Snapple Group, Inc., which became an independent publicly-traded company. Prior... -

Page 140

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Condensed Consolidating Statement of Operations For the Year Ended December 31, 2008 Guarantors Non-Guarantors Eliminations (In millions) Parent Total Net sales ...Cost of sales ...Gross profit ...... -

Page 141

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Condensed Consolidating Statement of Operations For the Year Ended December 31, 2007 Guarantors Non-Guarantors Eliminations (In millions) Parent Total Net sales ...Cost of sales ...Gross profit ...... -

Page 142

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Condensed Consolidating Balance Sheet As of December 31, 2009 Guarantors Non-Guarantors Eliminations (In millions) Parent Total Current assets: Cash and cash equivalents ...$ Accounts receivable: Trade ... -

Page 143

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Condensed Consolidating Balance Sheet As of December 31, 2008 Guarantors Non-Guarantors Eliminations (In millions) Parent Total Current assets: Cash and cash equivalents ...$ Accounts receivable: Trade ... -

Page 144

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Condensed Consolidating Statement of Cash Flows For the Year Ended December 31, 2009 Guarantors Non-Guarantors Eliminations (In millions) Parent Total Operating activities: Net cash provided by ... -

Page 145

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Condensed Consolidating Statement of Cash Flows For the Year Ended December 31, 2008 Guarantors Non-Guarantors Eliminations (In millions) Parent Total Operating activities: Net cash provided by ... -

Page 146

...Under the new licensing agreements, PepsiCo will distribute Dr Pepper, Crush and Schweppes in the U.S. territories where these brands are currently distributed by PBG and PAS. The same will apply for Dr Pepper, Crush, Schweppes, Vernors and Sussex in Canada; and Squirt and Canada Dry in Mexico. 126 -

Page 147

...year life of the customer relationship. Additionally, in U.S. territories where it has a distribution footprint, DPS will begin selling certain owned and licensed brands, including Sunkist soda, Squirt, Vernors and Hawaiian Punch, that were previously distributed by PBG and PAS. On February 26, 2010... -

Page 148

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 25. Selected Quarterly Financial Data (unaudited) The following table summarizes the Company's information on net sales, gross profit, net income and earnings per share by quarter for the years ended ... -

Page 149

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 26. SUBSEQUENT EVENTS On February 3, 2010, the Company's Board declared a dividend of $0.15 per share on the common stock of the Company, payable on April 9, 2010 to the stockholders of record at the close... -

Page 150

... Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting. In making its assessment of internal control over financial reporting, management used criteria issued by the Committee of Sponsoring Organizations... -

Page 151

... the U.S. territories where these brands were formerly distributed by PBG and PAS. The same will apply for Dr Pepper, Crush, Schweppes, Vernors and Sussex in Canada, and Squirt and Canada Dry in Mexico. The new agreements will have an initial term of 20 years, with 20-year renewal periods, and will... -

Page 152

...2012 (in global form) (filed as Exhibit 4.4 to the Company's Current Report on Form 8-K (filed on December 23, 2009) and incorporated herein by reference). Transition Services Agreement between Cadbury Schweppes plc and Dr Pepper Snapple Group, Inc., dated as of May 1, 2008 (filed as Exhibit 10.1 to... -

Page 153

...Exhibit 10.2 to the Company's Current Report on Form 8-K (filed on May 5, 2008) and incorporated herein by reference). Employee Matters Agreement between Cadbury Schweppes plc and Dr Pepper Snapple Group, Inc. and, solely for certain provisions set forth therein, Cadbury plc, dated as of May 1, 2008... -

Page 154

... 2010, between Dr Pepper Snapple Group, Inc. and Martin M. Ellen. Dr Pepper Snapple Group, Inc. Omnibus Stock Incentive Plan of 2008 (filed as Exhibit 10.2 to the Company's Current Report on Form 8-K (filed on May 12, 2008) and incorporated herein by reference). Dr Pepper Snapple Group, Inc. Annual... -

Page 155

...). First Amendment to the Dr Pepper Snapple Group, Inc. Change in Control Severance Plan, effective as of February 24, 2010. Letter Agreement, dated December 7, 2009, between Dr Pepper Snapple Group, Inc. and PepsiCo, Inc. (filed as Exhibit 10.1 to the Company's Current Report on Form 8-K (filed on... -

Page 156

.... Dr Pepper Snapple Group, Inc. By: Date: February 26, 2010 /s/ John O. Stewart Name: John O. Stewart Title: Executive Vice President and Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on... -

Page 157

... Name: Ronald G. Rogers Title: Director By: Date: February 26, 2010 /s/ Jack L. Stahl Name: Jack L. Stahl Title: Director By: Date: February 26, 2010 /s/ M. Anne Szostak Name: M. Anne Szostak Title: Director By: Date: February 26, 2010 /s/ Mike Weinstein Name: Mike Weinstein Title: Director... -

Page 158

(Intentionally Left Blank) 138 -

Page 159

...available at www.drpeppersnapple.com. Investors wanting further information about DPS should contact the investor relations department at corporate headquarters at (972) 673-7000 or http://investor. drpeppersnapple.com/contactus.cfm. Form 10-K Copies of Dr Pepper Snapple Group, Inc.'s Annual Report... -

Page 160

DR PEPPER SNAPPLE GROUP 5301 LEGACY DRIVE PLANO, TX 75024 drpeppersnapple • com