Qantas 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

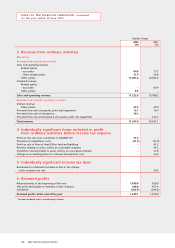

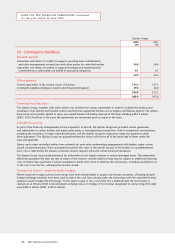

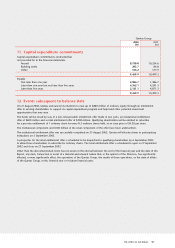

notes to the financial statements continued

for the year ended 30 June 2002

p44 THE SPIRIT OF AUSTRALIA

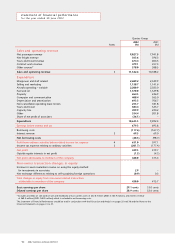

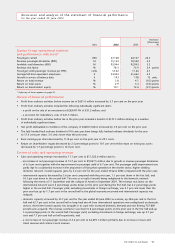

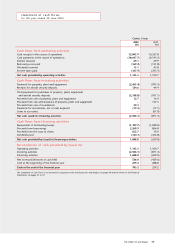

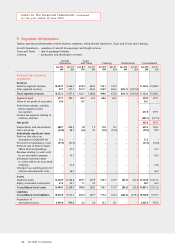

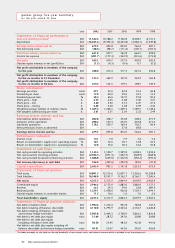

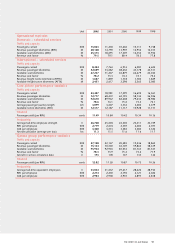

9. Segment information

Qantas operates predominantly in three business segments, being Aircraft Operations, Tours and Travel, and Catering.

Aircraft Operations – operation of aircraft for passenger and freight services.

Tours and Travel – sale of packaged holidays.

Catering – production and distribution of meals.

Aircraft Tours

Operations and Travel Catering Eliminations Consolidated

Jun 02 Jun 01 Jun 02 Jun 01 Jun 02 Jun 01 Jun 02 Jun 01 Jun 02 Jun 01

$M $M $M $M $M $M $M $M $M $M

Analysis by business

segments

Revenue

External segment revenue

10,494.1 9,436.5 674.4 604.3 154.1 147.4 ––11,322.6 10,188.2

Inter-segment revenue

29.1 271.1 451.7 424.3 335.9 306.4 (816.7) (1,001.8) ––

Total segment revenue

10,523.2 9,707.6 1,126.1 1,028.6 490.0 453.8 (816.7) (1,001.8) 11,322.6 10,188.2

Segment result

477.1 490.1 49.2 44.5 68.6 62.5 ––594.9 597.1

Share of net profit of associates

35.4 –0.7 –––––36.1 –

Profit from ordinary activities

before related income

tax expense

631.0 597.1

Income tax expense relating to

ordinary activities

(201.7) (177.4)

Net profit

429.3 419.7

Depreciation and amortisation

680.7 696.5 1.8 1.9 11.0 8.3 ––693.5 706.7

Non-cash items

(45.8) 68.7 (1.6) 0.2 (1.8) (19.0) ––(49.2) 49.9

Individually significant items

Profit on the sale of an

investment in EQUANT NV

31.2 –––––––31.2 –

Provision for redundancy costs

(41.5) (35.0) ––––––(41.5) (35.0)

Profit on sale of Mascot Head

Office land and buildings

–41.2 –––––––41.2

Revenue relating to assets sold

by an associated company

–43.3 –––––––43.3

Dividends received related

to assets sold by an associated

company

–31.8 –––––––31.8

Change in accounting policy for

software development costs

–46.0 –––––––46.0

Assets

Segment assets

14,342.9 12,166.8 307.7 227.9 176.7 131.9 (84.5) (55.4) 14,742.8 12,471.2

Equity accounted investments

57.6 42.1 1.1 0.3 ––––58.7 42.4

Consolidated total assets

14,400.5 12,208.9 308.8 228.2 176.7 131.9 (84.5) (55.4) 14,801.5 12,513.6

Liabilities

Consolidated total liabilities

10,442.0 9,014.7 254.4 207.7 117.2 124.4 (265.6) (149.1) 10,548.0 9,197.7

Acquisition of

non-current assets

2,445.8 984.8 2.3 2.6 15.3 8.1 ––2,463.4 995.5