Qantas 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE SPIRIT OF AUSTRALIA p27

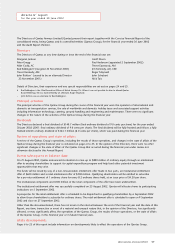

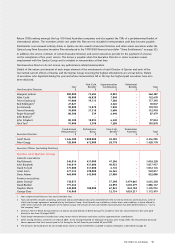

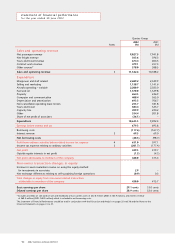

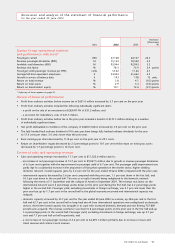

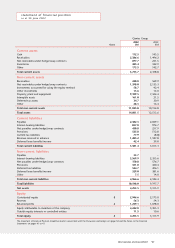

Qantas Group

Increase/

2002 2001 (Decrease)

$M $M %

Financial results

Sales and operating revenue

Net passenger revenue 9,027.5 7,941.8 13.7

Net freight revenue 563.6 596.3 (5.5)

Tours and travel revenue 674.4 604.3 11.6

Contract work revenue 479.1 457.3 4.8

Other sources* 578.0 588.5 (1.8)

Sales and operating revenue 11,322.6 10,188.2 11.1

Expenditure

Manpower and staff related 2,689.2 2,549.9 5.5

Selling and marketing 1,158.7 1,141.6 1.5

Aircraft operating – variable 2,200.9 2,023.0 8.8

Fuel and oil 1,570.0 1,329.8 18.1

Property 264.3 246.9 7.0

Computer and communication 408.4 365.0 11.9

Depreciation and amortisation 693.5 706.7 (1.9)

Non-cancellable operating lease rentals 255.7 181.8 40.6

Tours and travel 584.4 525.7 11.2

Capacity hire 499.9 220.2 127.0

Other 354.4 201.8 75.6

Share of net profit of associates (36.1) – n/a

Expenditure 10,643.3 9,492.4 12.1

Earnings before interest and tax 679.3 695.8 (2.4)

Net borrowing costs (48.3) (98.7) (51.1)

Profit from ordinary activities

before related income tax expense 631.0 597.1 5.7

Income tax expense relating to ordinary activities (201.7) (177.4) 13.7

Net profit 429.3 419.7 2.3

Outside equity interests in net profit (1.3) (4.3) (69.8)

Net profit attributable to members of the company 428.0 415.4 3.0

Financial position

Total assets 14,801.5 12,513.6 18.3

Total liabilities 10,548.0 9,197.7 14.7

Total equity 4,253.5 3,315.9 28.3

Cash flows

Net cash provided by operating activities 1,143.3 1,100.7 3.9

Net cash used in investing activities (2,306.1) (871.3) 164.7

Net cash provided by/(used in) financing activities 1,688.8 (659.0) 356.3

Net increase/(decrease) in cash held 526.0 (429.6) 222.4

Performance ratios

Net debt to net debt plus equity (ratio) 31:69 28:72 n/a

Net debt to net debt plus equity including off balance sheet debt (ratio) 50:50 55:45 n/a

Net debt to net debt plus equity including off balance sheet debt

and revenue hedge receivables (ratio) 49:51 53:47 n/a

Earnings per share (cents per share) 29.1 33.0 (11.8)

Return on shareholders’ equity (percentage) 10.1 12.6 (2.5) points

Return on shareholders’ equity including the notional capitalisation

of non-cancellable operating leases on a hedged basis (percentage) 12.0 10.6 1.4 points

Profit from ordinary activities before income tax expense as a percentage

of sales and operating revenue (percentage) 5.6 5.9 (0.3) points

Earnings before interest and tax as a percentage of sales

and operating revenue (percentage) 6.0 6.8 (0.8) points

* Excludes proceeds on sale (and on sale and leaseback) of non-current assets of $52.0 million (2001: $163.9 million), and interest revenue

of $69.3 million (2001: $69.0 million) which is included in net borrowing costs.

performance summary

for the year ended 30 June 2002