Qantas 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2002 QANTAS ANNUAL REPORT p29

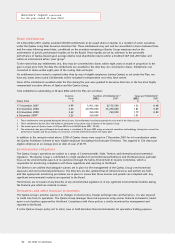

The Directors of Qantas Airways Limited (Qantas) present their report together with the Concise Financial Report of the

consolidated entity, being Qantas and its controlled entities (Qantas Group), for the financial year ended 30 June 2002

and the Audit Report thereon.

Directors

The Directors of Qantas at any time during or since the end of the financial year are:

Margaret Jackson Geoff Dixon

Peter Gregg Paul Anderson (appointed 2 September 2002)

Mike Codd, AC Trevor Eastwood, AM

Rod Eddington#(resigned 23 November 2001) Jim Kennedy, AO, CBE

Trevor Kennedy, AM Roger Maynard

John Rishton~(ceased to be an alternate Director John Schubert

23 November 2001) Nick Tait.

Details of Directors, their experience and any special responsibilities are set out on pages 24 and 25.

#Rod Eddington is the Chief Executive Officer of British Airways Plc. When it was not possible for him to attend Qantas

Board Meetings, he was represented by an alternate, Roger Maynard.

~John Rishton was an alternate for Rod Eddington.

Principal activities

The principal activities of the Qantas Group during the course of the financial year were the operation of international and

domestic air transportation services, the sale of worldwide and domestic holiday tours and associated support activities

including information technology, catering, ground handling and engineering and maintenance. There were no significant

changes in the nature of the activities of the Qantas Group during the financial year.

Dividends

The Directors declared a final dividend of $140.7 million (final ordinary dividend of 9.0 cents per share) for the year ended

30 June 2002 (2001: final ordinary dividend of 9.0 cents per share). The final dividend will be fully franked and follows a fully

franked interim ordinary dividend of $124.1 million (8.0 cents per share), which was paid during the financial year.

Review of operations and state of affairs

A review of the Qantas Group’s operations, including the results of those operations, and changes in the state of affairs of the

Qantas Group during the financial year is contained on pages 6 to 23. In the opinion of the Directors, there were no other

significant changes in the state of affairs of the Qantas Group that occurred during the financial year under review not

otherwise disclosed in this Annual Report.

Events subsequent to balance date

On 21 August 2002, Qantas announced its intention to raise up to $800 million of ordinary equity through an entitlement

offer to existing shareholders to support its capital expenditure program and help fund other potential investment

opportunities that may arise.

The funds will be raised by way of a non-renounceable entitlement offer made in two parts, an institutional entitlement

offer of $600 million and a retail entitlement offer of $200 million. Qualifying shareholders will be entitled to subscribe

for a pro-rata entitlement of 1 ordinary share for every 8.2 ordinary shares held, at an issue price of $4.20 per share.

The institutional component and $100 million of the retail component of the offer have been underwritten.

The institutional entitlement offer was successfully completed on 23 August 2002. Qantas will allocate shares to participating

institutions on 5 September 2002.

A prospectus for the retail entitlement offer is scheduled to be dispatched to qualifying shareholders by 6 September 2002

to allow those

shareholders to subscribe for ordinary shares. The retail entitlement offer is scheduled to open on 9 September

2002 and close on 27 September 2002.

Other than the abovementioned, there has not arisen in the interval between the end of the financial year and the date of this

Report, any item, transaction or event of a material and unusual nature that, in the opinion of the Directors, has significantly

affected, or may significantly affect, the operations of the Qantas Group, the results of those operations, or the state of affairs

of the Qantas Group, in this financial year or in future financial years.

Likely developments

Pages 6 to 23 of this report include information on developments likely to affect the operations of the Qantas Group.

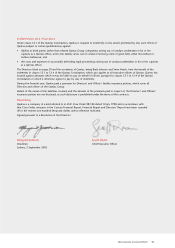

directors’ report

for the year ended 30 June 2002