Qantas 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

p40 THE SPIRIT OF AUSTRALIA

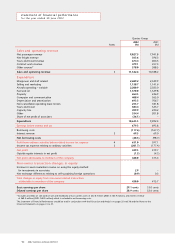

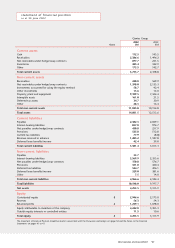

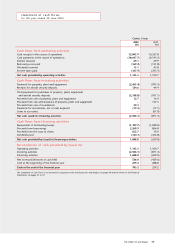

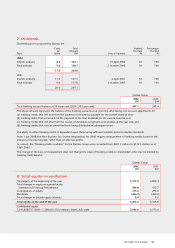

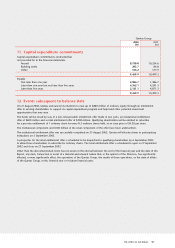

For the purposes of the Statement of Cash Flows, cash includes cash at bank and on hand, bank overdrafts, cash at call,

short-term money market securities and term deposits.

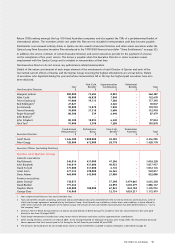

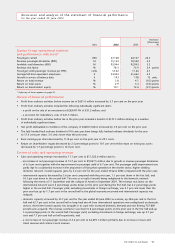

Review of cash flows from operating activities

•Cash flows from operations increased by 3.9 per cent to $1,143.3 million due to higher profitability.

•Income taxes paid were lower due to the change in corporate tax rates and timing of cash payments.

•Borrowing costs paid increased by 11.5 per cent due to higher average net debt.

Review of cash flows from investing activities

•Cash flows used in investing activities increased by $1,434.8 million to $2,306.1 million. The prior year included the

sale and leaseback of the Mascot Head Office land and buildings, which generated proceeds of $147.5 million.

•Total capital expenditure of $2,463.4 million for the year predominantly related to aircraft progress payments for

new aircraft, engines and spare parts made under the new aircraft fleet plan as well as the acquisition of additional aircraft

(15 Boeing 737-800s) as a result of opportunities in the domestic market following the collapse of Ansett.

•Payments for investments made during the year for $19.3 million comprised investments in Impulse Airlines, Airport

Infrastructure Finance, Travel Exchange Asia and Air Pacific.

•Proceeds on the sale of investments of $39.3 million represented the proceeds on the sale of the Qantas Group’s

investment in EQUANT NV.

Review of cash flows from financing activities

•Cash flows from financing activities increased by $2,347.8 million from cash outflows of $659.0 million in the prior

financial year to cash inflows of $1,688.8 million in the current year.

•Repayments of borrowings/swaps of $1,109.7 million comprises repayments of short-term borrowings, swaps, loans

and leases.

•Proceeds from borrowings of $2,269.9 million include the drawdown of a syndicated bank loan facility, secured funding,

the issue of a medium-term note and the issue of other short-term commercial paper.

•Proceeds from the issue of shares of $652.7 million reflects the proceeds received from the Institutional and Shareholder

Equity Placements. The prior year reflects proceeds received from the underwriters as part of the Dividend Reinvestment Plan.

•Dividend payments represent total dividends paid, net of $120.9 million which was converted directly to shares via the

Dividend Reinvestment Plan.

discussion and analysis of the statement of cash flows

for the year ended 30 June 2002