Qantas 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

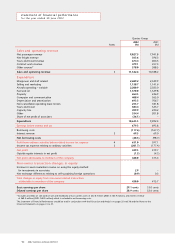

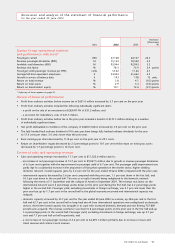

p38 2002 QANTAS ANNUAL REPORT

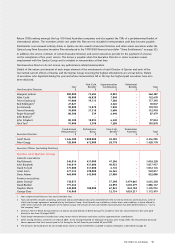

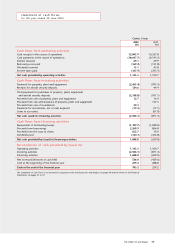

The net assets of the Qantas Group increased by 28.3 per cent to $4,253.5 million during the past financial year. The major

items are discussed below.

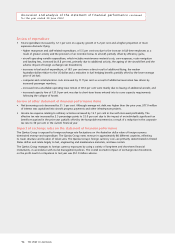

Review of assets

•Current receivables increased by 59.5 per cent due to an increase in aircraft security deposits, short-term money market

securities and term deposits maturing in the next 12 months and a growth in trade debtors in line with increased

operational activity.

•Net receivables/payables under hedge/swap contracts remained consistent with the prior financial year, decreasing

by 1.8 per cent to $1,514.1 million. Net receivables/payables under hedge/swap contracts represent:

– deferred gains/losses on cross-currency swaps used to hedge long-term foreign currency borrowings;

– deferred gains/losses on forward foreign exchange contracts used to hedge capital expenditure; and

– net deferred losses associated with hedges of foreign currency revenue relating to future transportation services

designated to service long-term debt.

•Inventory levels increased by 15.8 per cent due to the growth in the level of inventory required to support the increased

fleet size, reconfiguration of aircraft and maintenance.

•Property, plant and equipment increased by 24.4 per cent due to progress payments under the aircraft fleet plan, the

acquisition of additional aircraft (15 Boeing 737-800s) due to opportunities in the domestic market, and additional

spare parts.

•

Intangible assets increased due to $150.8 million of goodwill recognised on the acquisition of Impulse Airlines on

21 November 2001.

Review of liabilities

•The growth in total payables and total interest-bearing liabilities of 26.8 per cent reflects the increase in operational activity

and the drawdown of the syndicated bank loan facility to finance the new aircraft fleet.

•An increase in total current and deferred tax liabilities of 23.7 per cent is a result of the higher taxable profit and the

timing of tax payments.

Review of equity

•Contributed equity increased by $773.6 million as a result of the issue of 149.5 million shares as part of the Institutional

Equity Placement, 68.2 million shares as part of the Shareholder Equity Placement, 34.1 million shares as part of the

Qantas Dividend Reinvestment Plan and 3.5 million shares under the Qantas Profitshare Scheme.

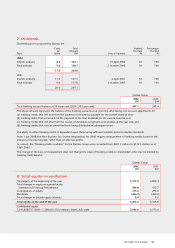

Gearing

Qantas Group gearing (including the notional capitalisation of non-cancellable operating leases) on a hedged basis at 30 June

2002 was 49:51 compared to 48:52 at 31 December 2001 and 53:47 at 30 June 2001. The decrease in gearing is principally

a result of the increase in contributed equity during the past financial year.

Gearing is determined by dividing the book value of the Qantas Group’s net debt (short and long term plus the present value

of non-cancellable operating leases less related hedge receivables and cash and cash equivalents) by the same amount plus the

book value of total equity.

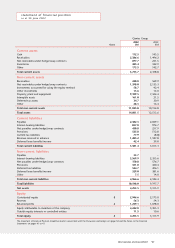

discussion and analysis of the statement of financial position

for the year ended 30 June 2002