Pfizer 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

96

2015 Financial Report

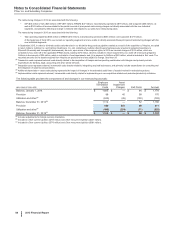

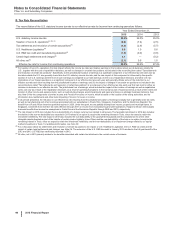

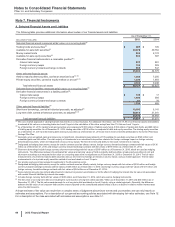

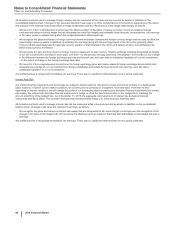

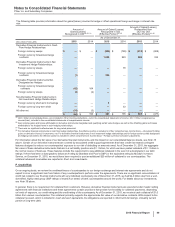

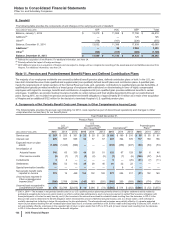

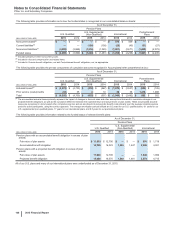

B. Investments in Debt Securities

The following table provides the contractual maturities, or as necessary, the estimated maturities, of the available-for-sale and held-to-

maturity debt securities:

Years

December 31,

2015

(MILLIONS OF DOLLARS) Within 1

Over 1

to 5

Over 5

to 10 Over 10 Total

Available-for-sale debt securities

Western European, Asian and other government debt(a) $9,795 $1,549 $8$—$11,352

Corporate debt(b) 3,153 4,728 1,804 43 9,729

U.S. government debt 920 1,358 156 —2,433

Western European, Scandinavian and other government agency debt(a) 1,861 214 2— 2,078

Supranational debt(a) 947 352 —— 1,299

Federal Home Loan Mortgage Corporation and Federal National

Mortgage Association asset-backed securities 22,143 33 — 2,178

Reverse repurchase agreements(c) 875 ——— 875

Government National Mortgage Association and other U.S. government

guaranteed asset-backed securities 266 478 19 — 763

Other asset-backed debt(d) 490 830 46 51,370

Held-to-maturity debt securities

Western European government debt(a) 113 ——— 113

Time deposits, corporate debt and other(b) 1,270 5—— 1,275

Total debt securities $19,693 $11,655 $2,069 $49$ 33,466

(a) Issued by governments, government agencies or supranational entities, as applicable, all of which are investment-grade.

(b) Issued by a diverse group of corporations, largely consisting of financial institutions, virtually all of which are investment-grade.

(c) Involving U.S. securities.

(d) Includes loan-backed, receivable-backed, and mortgage-backed securities, all of which are investment-grade and in senior positions in the capital structure of

the security. Loan-backed securities are collateralized by senior secured obligations of a diverse pool of companies or student loans, and receivable-backed

securities are collateralized by credit cards receivables. Mortgage-backed securities are collateralized by diversified pools of residential and commercial

mortgages. These securities are valued by third party models that use significant inputs derived from observable market data like prepayment rates, default

rates, and recovery rates.

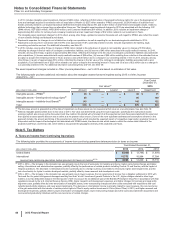

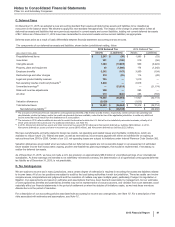

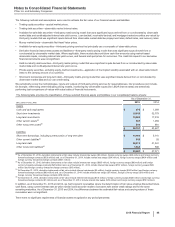

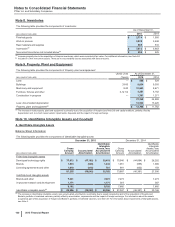

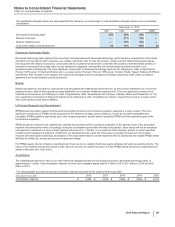

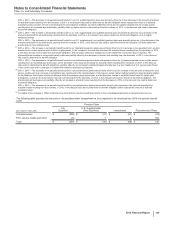

C. Short-Term Borrowings

Short-term borrowings include amounts for commercial paper of $4.9 billion as of December 31, 2015 and $570 million as of December 31,

2014. The weighted-average effective interest rate on short-term borrowings outstanding was 1.9% as of December 31, 2015 and 2.5% as of

December 31, 2014.

As of December 31, 2015, we had access to $8.1 billion of lines of credit, of which $687 million expire within one year. Of these lines of credit,

$7.9 billion are unused, of which our lenders have committed to loan us $7.1 billion at our request. Also, $7.0 billion of our unused lines of

credit, all of which expire in 2020, may be used to support our commercial paper borrowings. Under the terms of a substantial majority of our

lines of credit agreements, upon the merger with Allergan, the lenders under the agreements may elect to require immediate repayment of any

amounts then outstanding and cancel the outstanding lines of credit. We expect to either amend the existing credit agreements or secure new

credit agreements to replace these agreements.

D. Long-Term Debt

On September 3, 2015, the Hospira acquisition date, our long-term debt increased due to the addition of an aggregate principal amount of

$1,750 million of legacy Hospira debt, recorded at acquisition-date fair value of $1,928 million.

On May 15, 2014, we completed a public offering of $4.5 billion aggregate principal amount of senior unsecured notes.