Pfizer 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

84

2015 Financial Report

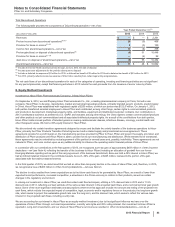

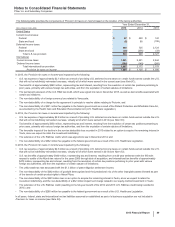

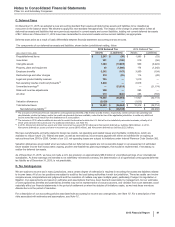

December 31, 2015, the carrying value of our investment in Hisun Pfizer was approximately $775 million and the amount of our underlying

equity in the net assets of Hisun Pfizer was approximately $668 million. As of December 31, 2014, the carrying value of our investment in

Hisun Pfizer was approximately $1.4 billion, and the amount of our underlying equity in the net assets of Hisun Pfizer was approximately $780

million. The excess of the carrying value of our investment over our underlying equity in the net assets of Hisun Pfizer has been allocated,

within the investment account, to goodwill and other intangible assets. The amount allocated to other intangible assets is being amortized into

Other (income)/deductions––net over an average estimated useful life of 25 years.

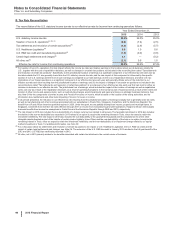

Investment in ViiV Healthcare Limited (ViiV)

Our minority ownership interest in ViiV, a company formed in 2009 by Pfizer and GlaxoSmithKline plc to focus solely on research,

development and commercialization of human immunodeficiency virus (HIV) medicines, was impacted by the following events:

• The January 21, 2014 European Commission approval of Tivicay (dolutegravir), a product for the treatment of HIV-1 infection, developed

by ViiV. This approval triggered a reduction in our equity interest in ViiV from 12.6% to 11.7%, effective April 1, 2014. As a result, in 2014,

we recognized a loss of approximately $30 million in Other (income)/deductions––net;

• The August 12, 2013 FDA approval of Tivicay (dolutegravir). This approval triggered a reduction in our interest in ViiV from 13.5% to 12.6%

effective October 1, 2013. As a result, in 2013, we recognized a loss of approximately $32 million in Other (income)/ deductions––net; and

• The October 31, 2012 acquisition by ViiV of the remaining 50% of Shionogi-ViiV Healthcare LLC, its equity-method investee, from

Shionogi & Co., Ltd. in consideration for a 10% interest in ViiV (newly issued shares) and contingent consideration in the form of future

royalties. As a result of this transaction, ViiV recorded a gain associated with the step-up on the 50% interest previously held by ViiV. Also,

our equity interest in ViiV was reduced from 15.0% to 13.5%.

We account for our investment in ViiV under the equity method due to the significant influence that we continue to have through our board

representation and minority veto rights.

Investment in Laboratório Teuto Brasileiro S.A. (Teuto)

We have an option to acquire the remaining 60% of Teuto, a 40%-owned generics company in Brazil, and Teuto’s shareholders have an option

to sell their 60% stake in the company to us. Under the terms of our agreement with Teuto’s other shareholders, 2016 is the final year in which

the call and put options may be exercised. Our investment in Teuto is accounted for under the equity method due to the significant influence

we have over the operations of Teuto through our board representation, minority veto rights and 40% voting interest.

• In 2014, we recorded income of approximately $55 million in Other (income)/deductions––net, resulting from a decline in the estimated

loss from the net call/put option recorded in 2013 and an impairment loss of $56 million in Other (income)/deductions––net related to our

equity method investment.

• In 2013, we recorded a loss of $223 million in Other (income)/deductions––net related to the net call/put option and an impairment loss of

$32 million in Other (income)/deductions––net related to our equity-method investment.

F. Cost-Method Investment

AM-Pharma B.V. (AM-Pharma)

In April 2015, we acquired a minority equity interest in AM-Pharma, a privately-held Dutch biopharmaceutical company focused on the

development of recombinant human Alkaline Phosphatase (recAP) for inflammatory diseases, and secured an exclusive option to acquire the

remaining equity in the company. The option becomes exercisable upon delivery of the clinical trial report after completion of a Phase II trial of

recAP in the treatment of Acute Kidney Injury related to sepsis. Results from the current Phase II trial for recAP are expected in 2017. Under

the terms of the agreement, we paid $87.5 million for both the exclusive option and the minority equity interest, which was recorded as a cost-

method investment in Long-term investments, and we may make additional payments of up to $512.5 million upon exercise of the option and

potential launch of any product that may result from this investment.

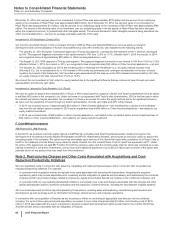

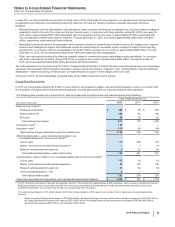

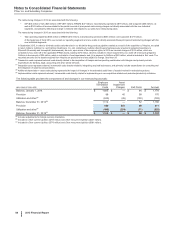

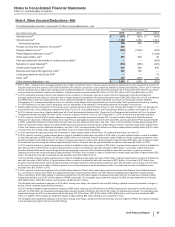

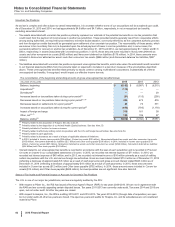

Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-

Reduction/Productivity Initiatives

We incur significant costs in connection with acquiring, integrating and restructuring businesses and in connection with our global cost-

reduction/productivity initiatives. For example:

• In connection with acquisition activity, we typically incur costs associated with executing the transactions, integrating the acquired

operations (which may include expenditures for consulting and the integration of systems and processes), and restructuring the combined

company (which may include charges related to employees, assets and activities that will not continue in the combined company); and

• In connection with our cost-reduction/productivity initiatives, we typically incur costs and charges associated with site closings and other

facility rationalization actions, workforce reductions and the expansion of shared services, including the development of global systems.

All of our businesses and functions may be impacted by these actions, including sales and marketing, manufacturing and research and

development, as well as groups such as information technology, shared services and corporate operations.

In connection with our acquisition of Hospira, we are focusing our efforts on achieving an appropriate cost structure for the combined

company. For up to a three-year period post-acquisition, we expect to incur costs of approximately $1 billion (not including costs of $215

million in 2015 associated with the return of acquired in-process research and development rights as described in the Current-Period Key

Activities section below) associated with the integration of Hospira.