Pfizer 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

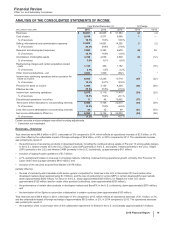

Financial Review

Pfizer Inc. and Subsidiary Companies

10

2015 Financial Report

quarterly dividend paid during 2015. For additional information, see the “Analysis of Financial Condition, Liquidity and Capital Resources”

section of this Financial Review and Notes to Consolidated Financial Statements––Note 12. Equity.

We remain focused on achieving an appropriate cost structure for the Company. For additional information about our cost-reduction and

productivity initiatives, see the “Costs and Expenses––Restructuring Charges and Other Costs Associated with Acquisitions and Cost-

Reduction/Productivity Initiatives” section of this Financial Review and Notes to Consolidated Financial Statements––Note 3. Restructuring

Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives.

Our Business Development Initiatives

We are committed to capitalizing on growth opportunities by advancing our own pipeline and maximizing the value of our in-line products, as

well as through various forms of business development, which can include alliances, licenses, joint ventures, collaborations, equity- or debt-

based investments, dispositions, mergers and acquisitions. We view our business development activity as an enabler of our strategies, and we

seek to generate earnings growth and enhance shareholder value by pursuing a disciplined, strategic and financial approach to evaluating

business development opportunities. We are especially interested in opportunities in our high-priority therapeutic areas—immunology and

inflammation; cardiovascular and metabolic diseases; oncology; vaccines; neuroscience and pain; and rare diseases––and in emerging

markets and established products, including biosimilars. We continue to evaluate business development transactions that have the potential to

strengthen one or both of our businesses and their capabilities, such as our recent acquisition of Hospira and our pending combination with

Allergan, as well as collaborations, and alliance and license agreements with other companies, including our collaborations with Cellectis SA,

OPKO Health, Inc. and Merck KGaA. We assess our businesses, assets and scientific capabilities/portfolio as part of our regular, ongoing

portfolio review process and also continue to consider business development activities that will advance our businesses. We are continuing to

consider whether a further separation of our Innovative Products and Established Products businesses would be in the best interests of our

shareholders. However, no decision has been made regarding any such potential separation; we anticipate making a decision regarding any

such potential separation by no later than the end of 2018. For additional information on our business development activities, see Notes to

Consolidated Financial Statements––Note 2. Acquisitions, Licensing Agreements, Collaborative Arrangements, Divestitures, Equity-Method

Investments and Cost-Method Investment, Notes to Consolidated Financial Statements––Note 19. Pending Combination with Allergan and the

“Significant Accounting Policies and Application of Critical Accounting Estimates––Acquisition of Hospira” section of this Financial Review.

The more significant recent transactions and events are described below:

• Agreement to Combine with Allergan plc (Allergan)––On November 23, 2015, we announced that we have entered into a definitive merger

agreement with Allergan, a global pharmaceutical company incorporated in Ireland.

• Acquisition of Hospira––On September 3, 2015 (the acquisition date), we acquired Hospira, a leading provider of sterile injectable drugs

and infusion technologies as well as a provider of biosimilars, for approximately $16.1 billion in cash ($15.7 billion, net of cash acquired).

• Acquisition of a Minority Interest in AM-Pharma B.V. (AM-Pharma)––In April 2015, we acquired a minority equity interest in AM-Pharma, a

privately-held Dutch biopharmaceutical company focused on the development of recombinant human Alkaline Phosphatase (recAP) for

inflammatory diseases, and secured an exclusive option to acquire the remaining equity in the company. The option becomes exercisable

upon delivery of the clinical trial report after completion of a Phase II trial of recAP in the treatment of Acute Kidney Injury related to sepsis.

Results from the current Phase II trial for recAP are expected in 2017. Under the terms of the agreement, we paid $87.5 million for both

the exclusive option and the minority equity interest, which was recorded as a cost-method investment in Long-term investments, and we

may make additional payments of up to $512.5 million upon exercise of the option and potential launch of any product that may result from

this investment.

• Collaboration with OPKO Health, Inc. (OPKO)––In December 2014, we entered into a collaborative agreement with OPKO to develop and

commercialize OPKO’s long-acting human growth hormone (hGH-CTP) for the treatment of growth hormone deficiency (GHD) in adults

and children, as well as for the treatment of growth failure in children born small for gestational age (SGA) who fail to show catch-up

growth by two years of age. hGH-CTP has the potential to reduce the required dosing frequency of human growth hormone to a single

weekly injection from the current standard of one injection per day. We have received the exclusive license to commercialize hGH-CTP

worldwide. OPKO will lead the clinical activities and will be responsible for funding the development programs for the key indications,

which include Adult and Pediatric GHD and Pediatric SGA. We will be responsible for all development costs for additional indications, all

postmarketing studies, manufacturing and commercialization activities for all indications, and we will lead the manufacturing activities

related to product development. The transaction closed on January 28, 2015, upon termination of the waiting period under the Hart-Scott-

Rodino Antitrust Improvements Act. In February 2015, we made an upfront payment of $295 million to OPKO, which was recorded in

Research and development expenses, and OPKO is eligible to receive up to an additional $275 million upon the achievement of certain

regulatory milestones. OPKO is also eligible to receive royalty payments associated with the commercialization of hGH-CTP for Adult

GHD, which is subject to regulatory approval. Upon the launch of hGH-CTP for Pediatric GHD, which is subject to regulatory approval, the

royalties will transition to tiered gross profit sharing for both hGH-CTP and our product, Genotropin.

• Acquisition of Marketed Vaccines Business of Baxter International Inc. (Baxter)––On December 1, 2014 (which falls in the first fiscal

quarter of 2015 for our international operations), we acquired Baxter’s portfolio of marketed vaccines for a final purchase price of $648

million. The portfolio that was acquired consists of NeisVac-C and FSME-IMMUN/TicoVac. NeisVac-C is a vaccine that helps protect

against meningitis caused by group C meningococcal meningitis and FSME-IMMUN/TicoVac is a vaccine that helps protect against tick-

borne encephalitis.

• Collaboration with Merck KGaA––In November 2014, we entered into a collaborative agreement with Merck KGaA, to jointly develop and

commercialize avelumab, the proposed international non-proprietary name for the investigational anti-PD-L1 antibody (MSB0010718C),

currently in development as a potential treatment for multiple types of cancer. We and Merck KGaA are exploring the therapeutic potential

of this novel anti-PD-L1 antibody as a single agent as well as in various combinations with our and Merck KGaA’s broad portfolio of

approved and investigational oncology therapies. The collaboration with Merck KGaA has initiated 28 programs, monotherapy and

combination trials, including seven pivotal trials in Phase IB/2 or Phase 3 (two in lung cancer, two in gastric cancer, and one in each of

bladder cancer, Merkel cell carcinoma and ovarian cancer) and received FDA breakthrough therapy designation for avelumab in metastatic

Merkel cell carcinoma. We and Merck KGaA are also combining resources and expertise to advance Pfizer’s anti-PD-1 antibody into