Pfizer 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

93

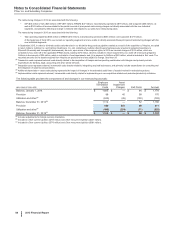

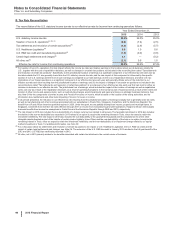

In addition to the open audit years in the U.S., we have open audit years in other major tax jurisdictions, such as Canada (2010-2015), Japan

(2015), Europe (2007-2015, primarily reflecting Ireland, the United Kingdom, France, Italy, Spain and Germany), Latin America (1998-2015,

primarily reflecting Brazil) and Puerto Rico (2010-2015).

Any settlements or statutes of limitations expirations could result in a significant decrease in our uncertain tax positions. We estimate that it is

reasonably possible that within the next twelve months, our gross unrecognized tax benefits, exclusive of interest, could decrease by as much

as $200 million, as a result of settlements with taxing authorities or the expiration of the statutes of limitations. Our assessments are based on

estimates and assumptions that have been deemed reasonable by management, but our estimates of unrecognized tax benefits and potential

tax benefits may not be representative of actual outcomes, and variation from such estimates could materially affect our financial statements in

the period of settlement or when the statutes of limitations expire, as we treat these events as discrete items in the period of resolution.

Finalizing audits with the relevant taxing authorities can include formal administrative and legal proceedings, and, as a result, it is difficult to

estimate the timing and range of possible changes related to our uncertain tax positions, and such changes could be significant.

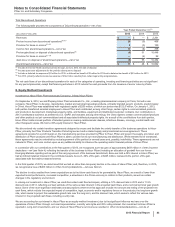

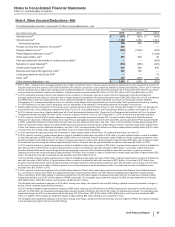

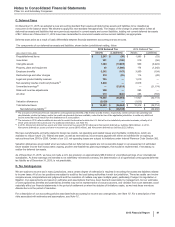

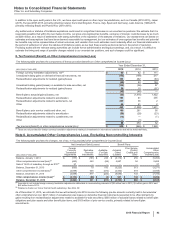

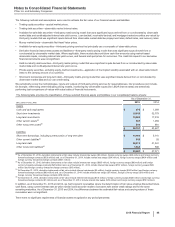

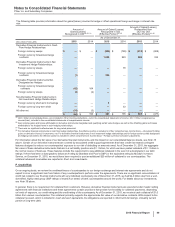

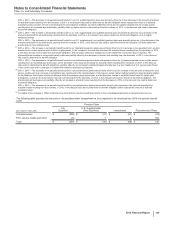

E. Tax Provision/(Benefit) on Other Comprehensive Income/(Loss)

The following table provides the components of the tax provision/(benefit) on Other comprehensive income/(loss):

Year Ended December 31,

(MILLIONS OF DOLLARS) 2015 2014 2013

Foreign currency translation adjustments, net(a) $90$42$

111

Unrealized holding gains on derivative financial instruments, net (173)(199)217

Reclassification adjustments for realized (gains)/losses 104 262 (63)

(69)63 154

Unrealized holding gains/(losses) on available-for-sale securities, net (104)(56)57

Reclassification adjustments for realized (gains)/losses 59 10 (57)

(45)(46)—

Benefit plans: actuarial gains/(losses), net (23)(1,416)1,422

Reclassification adjustments related to amortization 183 61 205

Reclassification adjustments related to settlements, net 237 35 2

Other 66 61 2

462 (1,258)1,631

Benefit plans: prior service credits and other, net 160 281 56

Reclassification adjustments related to amortization (59)(28)(23)

Reclassification adjustments related to curtailments, net (12)—(1)

Other —(1) —

89 253 32

Tax provision/(benefit) on other comprehensive income/(loss) $528 $(946)$ 1,928

(a) Taxes are not provided for foreign currency translation adjustments relating to investments in international subsidiaries that will be held indefinitely.

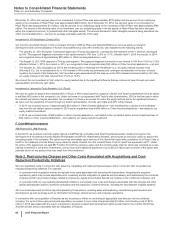

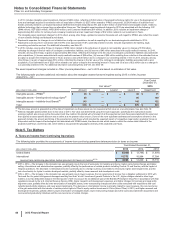

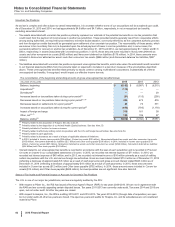

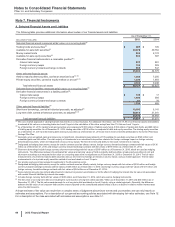

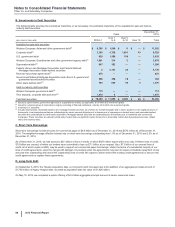

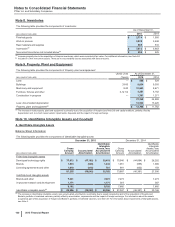

Note 6. Accumulated Other Comprehensive Loss, Excluding Noncontrolling Interests

The following table provides the changes, net of tax, in Accumulated other comprehensive income/(loss):

Net Unrealized Gain/(Losses) Benefit Plans

(MILLIONS OF DOLLARS)

Foreign

Currency

Translation

Adjustments

Derivative

Financial

Instruments

Available-

For-Sale

Securities

Actuarial

Gains/

(Losses)

Prior Service

(Costs)/

Credits and

Other

Accumulated

Other

Comprehensive

Income/(Loss)

Balance, January 1, 2013 $ (177) $ (161) $ 236 $ (6,110) $ 259 $ (5,953)

Other comprehensive income/(loss)(a) (440) 240 (86) 2,887 54 2,655

Sale of 19.8% of subsidiary through an IPO(b) 27 ——— — 27

Balance, December 31, 2013 (590) 79 150 (3,223) 313 (3,271)

Other comprehensive income/(loss)(a) (2,099) 438 (372) (2,432) 419 (4,045)

Balance, December 31, 2014 (2,689) 517 (222) (5,654) 733 (7,316)

Other comprehensive income/(loss)(a) $ (3,174) $ (96) $ (5) $ 921 $ 148 $ (2,206)

Balance, December 31, 2015 $ (5,863) $ 421 $ (227) $ (4,733) $ 880 $ (9,522)

(a) Amounts do not include foreign currency translation adjustments attributable to noncontrolling interests of $26 million loss in 2015, $3 million gain in 2014 and

$62 million loss in 2013.

(b) Relates to Zoetis (our former Animal Health subsidiary). See Note 2D.

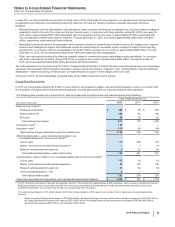

As of December 31, 2015, we estimate that we will reclassify into 2016 income the following pre-tax amounts currently held in Accumulated

other comprehensive loss: $437 million of unrealized pre-tax losses on derivative financial instruments (expected to be offset primarily by

gains resulting from reclassification adjustments related to available-for-sale securities); $555 million of actuarial losses related to benefit plan

obligations and plan assets and other benefit plan items; and $163 million of prior service credits, primarily related to benefit plan

amendments.