Pfizer 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

79

example, because we plan to repatriate certain overseas funds, we provided deferred taxes on Hospira’s unremitted earnings for which no

taxes have been previously provided by Hospira as it was Hospira’s intention to indefinitely reinvest those earnings.

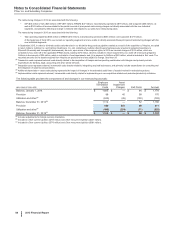

Goodwill is calculated as the excess of the consideration transferred over the net assets recognized and represents the future economic

benefits arising from other assets acquired that could not be individually identified and separately recognized. Specifically, the goodwill

recorded as part of the acquisition of Hospira includes the following:

• the expected specific synergies and other benefits that we believe will result from combining the operations of Hospira with the operations of

Pfizer;

• any intangible assets that do not qualify for separate recognition, as well as future, as yet unidentified projects and products; and

• the value of the going-concern element of Hospira’s existing businesses (the higher rate of return on the assembled collection of net assets

versus if Pfizer had acquired all of the net assets separately).

Goodwill is not amortized and is not deductible for tax purposes. All of the goodwill related to the acquisition of Hospira is related to our GEP

segment (see Note 10 for additional information).

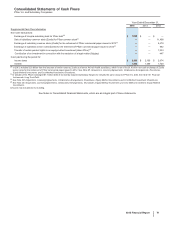

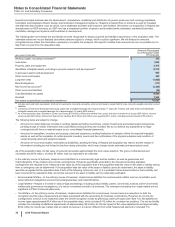

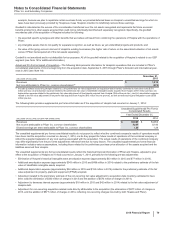

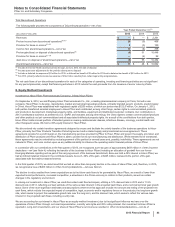

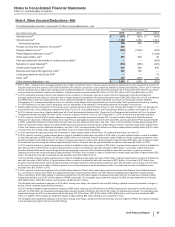

Actual and Pro Forma Impact of Acquisition—The following table presents information for Hospira’s operations that are included in Pfizer’s

consolidated statements of income beginning from the acquisition date, September 3, 2015 through Pfizer’s domestic and international year-

ends in 2015 (see Note 1A):

(MILLIONS OF DOLLARS)

December 31,

2015

Revenues $1,513

Net loss attributable to Pfizer Inc. common shareholders(a) (575)

(a) Includes purchase accounting charges related to (i) the preliminary fair value adjustment for acquisition-date inventory estimated to have been sold ($378

million pre-tax); (ii) amortization expense related to the preliminary fair value of identifiable intangible assets acquired from Hospira ($161 million pre-tax); (iii)

depreciation expense related to the preliminary fair value adjustment of fixed assets acquired from Hospira ($34 million pre-tax ); and (iv) amortization expense

related to the fair value adjustment of long-term debt acquired from Hospira ($13 million income pre-tax), as well as restructuring and integration costs ($556

million pre-tax).

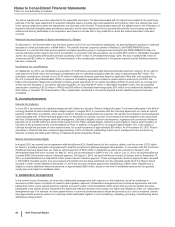

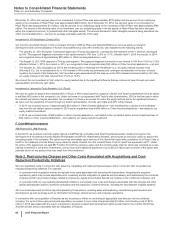

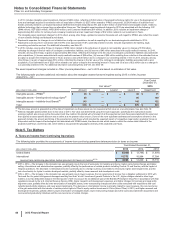

The following table provides supplemental pro forma information as if the acquisition of Hospira had occurred on January 1, 2014:

Unaudited Supplemental Pro Forma

Consolidated Results

Year Ended December 31,

(MILLIONS OF DOLLARS, EXCEPT PER SHARE DATA) 2015 2014

Revenues $ 52,082 $ 54,069

Net income attributable to Pfizer Inc. common shareholders 7,647 8,194

Diluted earnings per share attributable to Pfizer Inc. common shareholders 1.22 1.28

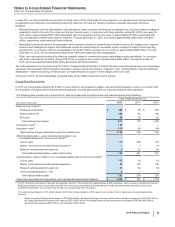

The unaudited supplemental pro forma consolidated results do not purport to reflect what the combined company’s results of operations would

have been had the acquisition occurred on January 1, 2014, nor do they project the future results of operations of the combined company or

reflect the expected realization of any cost savings associated with the acquisition. The actual results of operations of the combined company

may differ significantly from the pro forma adjustments reflected here due to many factors. The unaudited supplemental pro forma financial

information includes various assumptions, including those related to the preliminary purchase price allocation of the assets acquired and the

liabilities assumed from Hospira.

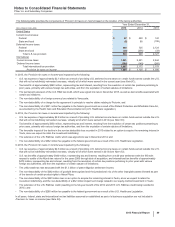

The unaudited supplemental pro forma consolidated results reflect the historical financial information of Pfizer and Hospira, adjusted to give

effect to the acquisition of Hospira as if it had occurred on January 1, 2014, primarily for the following pre-tax adjustments:

• Elimination of Hospira’s historical intangible asset amortization expense (approximately $33 million in 2015 and $77 million in 2014).

• Additional amortization expense (approximately $343 million in 2015 and $496 million in 2014) related to the preliminary estimate of the fair

value of identifiable intangible assets acquired.

• Additional depreciation expense (approximately $54 million in 2015 and $104 million in 2014) related to the preliminary estimate of the fair

value adjustment to property, plant and equipment (PP&E) acquired.

• Adjustment related to the preliminary estimate of the non-recurring fair value adjustment to acquisition-date inventory estimated to have

been sold (the elimination of $340 million of charges in 2015 and the addition of $576 million of charges in 2014).

• Adjustment to decrease interest expense (approximately $18 million in 2015 and $42 million in 2014) related to the fair value adjustment of

Hospira debt.

• Adjustment for non-recurring acquisition-related costs directly attributable to the acquisition (the elimination of $877 million of charges in

2015, and the addition of $877 million of charges in 2014, reflecting non-recurring charges incurred by both Hospira and Pfizer).