Pfizer 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

49

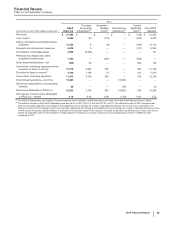

ANALYSIS OF THE CONSOLIDATED BALANCE SHEETS

For information about certain of our financial assets and liabilities, including Cash and cash equivalents, Short-term investments, Long-term

investments, Short-term borrowings, including current portion of long-term debt, and Long-term debt, see “Analysis of the Consolidated

Statements of Cash Flows” section of this Financial Review, the “Analysis of Financial Condition, Liquidity and Capital Resources: Selected

Measures of Liquidity and Capital Resources” section of this Financial Review and Notes to Consolidated Financial Statements—Note 7.

Financial Instruments.

For information about certain balances in Trade accounts receivable, less allowance for doubtful accounts, see also the “Analysis of Financial

Condition, Liquidity and Capital Resources: Selected Measures of Liquidity and Capital Resources: Accounts Receivable” section of this

Financial Review.

For information about events and circumstances impacting our tax-related accounts, see Notes to Consolidated Financial Statements—Note

5. Tax Matters.

For a description of changes in Total Equity, see the consolidated statements of equity.

The changes in our asset and liability accounts as of December 31, 2015, compared to December 31, 2014, generally reflect, among other

things, the impact of assets acquired and liabilities assumed as part of the acquisition of Hospira (see Notes to Consolidated Financial

Statements––Note 2A. Acquisitions, Licensing Agreements, Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-

Method Investment: Acquisitions), and decreases due to changes in foreign currency exchange rates, some of which impacts were significant.

The following explanations exclude the impact of the acquisition of Hospira and foreign exchange:

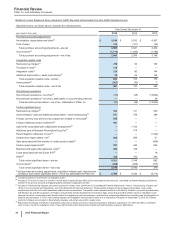

• For Trade accounts receivable, less allowance for doubtful accounts, the change also reflects the timing of sales and collections in the

normal course of business.

• For Inventories, the change also reflects an increase to inventory, resulting from a change in the profit deferred in inventory relating to

inventory that had not been sold to third parties, inventory acquired as part of the acquisition of Baxter’s portfolio of marketed vaccines,

recorded at acquisition-date fair value as well as inventory builds in the normal course of business, partially offset by planned inventory

reductions.

• For Other current assets, the change also reflects the decrease in the receivables associated with our derivative financial instruments as

well as the timing of receipts and payments in the normal course of business.

• For Property, plant and equipment, less accumulated depreciation, the change also reflects depreciation, mainly offset by capital additions.

• For Identifiable intangible assets, less accumulated amortization, the change also reflects amortization and to a lesser extent impairments,

partially offset by identifiable intangible assets acquired as part of the acquisition of Baxter’s portfolio of marketed vaccines. For additional

information about our intangible assets, see Notes to Consolidated Financial Statements—Note 10A. Identifiable Intangible Assets and

Goodwill: Identifiable Intangible Assets. For additional information about the asset impairment charges, see Notes to Consolidated

Financial Statements—Note 4. Other (Income)/Deductions—Net. For additional information about the assets acquired as part of the

acquisition of Baxter’s portfolio of marketed vaccines, see Notes to Consolidated Financial Statements—Note 2A. Acquisitions, Licensing

Agreements, Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-Method Investment: Acquisitions.

• For Trade accounts payable, the change also reflects the timing of purchases and payments in the normal course of business.

• For Accrued compensation and related items, the change also reflects a higher bonus accrual attributable to performance and a change in

the structure of our compensation whereby fixed compensation for certain previously non-bonus eligible colleagues was reduced and

replaced with an equal amount of variable compensation tied to the performance of the Company and is paid annually.

• For Other current liabilities, the change also reflects an increase in the payables associated with our derivative financial instruments, a net

increase in legal-related liabilities, mainly the accrual for the agreement in principle to resolve claims relating to Protonix, partially offset by

payments of certain legal claims, as well as the timing of other payments and accruals in the normal course of business. For additional

information, see Notes to Consolidated Financial Statements—Note 17A4. Commitments and Contingencies: Legal Proceedings—

Government Investigations.

• For Pension benefit obligations, net, and Postretirement benefit obligations, net, the change reflects, among other things, a $1.0 billion

voluntary pension contribution in January 2015, an increase in our discount rate assumptions used in the measurement of the plan

obligations, a $507 million reduction in our U.S. Postretirement Plan obligation due to a plan amendment approved in June 2015 that

introduced a cap on costs for certain groups within the plan, and a rise in the comparative strength of the U.S. dollar, as compared to other

currencies. For additional information, see Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement Benefit

Plans and Defined Contribution Plans.

• For Other noncurrent liabilities, the change reflects an increase in the payables associated with our derivative financial instruments and, to

a lesser extent, the deferral of an upfront payment received as part of our tanezumab collaborative arrangement, partially offset by other

payments and changes in accruals in the normal course of business.

• For Accumulated other comprehensive loss, the change primarily reflects foreign currency translation adjustments for 2015. For additional

information see the “Analysis of the Consolidated Statements of Comprehensive Income” section of this Financial Review.