Pfizer 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

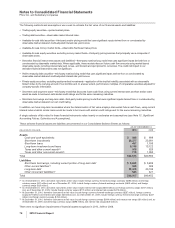

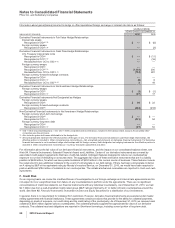

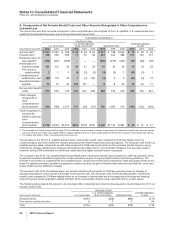

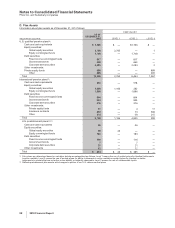

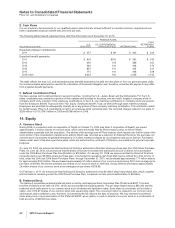

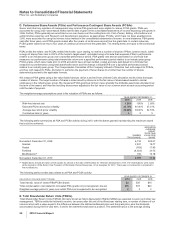

C. Obligations and Funded Status

The following table presents an analysis of the changes in 2010 and 2009 in the benefit obligations, plan assets and accounting

funded status of our U.S. qualified, U.S. supplemental (non-qualified) and international pension plans and our postretirement plans:

YEAR ENDED DECEMBER 31,

PENSION PLANS

U.S. QUALIFIED

U.S.

SUPPLEMENTAL

(NON-QUALIFIED) INTERNATIONAL

POSTRETIREMENT

PLANS

(MILLIONS OF DOLLARS) 2010 2009 2010 2009 2010 2009 2010 2009

Change in benefit obligation:

Benefit obligation at beginning of year(a) $12,578 $ 7,783 $ 1,368 $ 876 $ 9,062 $ 5,851 $ 3,733 $ 1,966

Service cost 347 252 28 24 231 188 79 39

Interest cost 740 526 77 53 427 342 211 145

Employee contributions ————18 12 22 49

Plan amendments (47) (1) (6) —(2) (2) (495) (151)

Increases arising primarily from

changes in actuarial assumptions 980 9180 33 362 1,136 281 108

Foreign exchange impact ————(504) 844 410

Acquisitions(a) 14,785 (1) 364 10 1,062 —1,798

Curtailments (233) (196) (29) (29) (33) (25) 1(26)

Settlements (904) (325) (235) (32) (54) (53) ——

Special termination benefits 73 61 180 137 6819 24

Benefits paid (500) (316) (161) (58) (376) (301) (273) (229)

Benefit obligation at end of year(b) 13,035 12,578 1,401 1,368 9,147 9,062 3,582 3,733

Change in plan assets:

Fair value of plan assets at beginning of

year(a) 9,977 5,897 ——6,524 4,394 370 303

Actual gain on plan assets 1,123 800 ——454 646 46 67

Company contributions 901 2396 90 457 448 249 180

Employee contributions ————18 12 22 49

Foreign exchange impact ————(314) 574 ——

Acquisitions(a) —3,919 ———804 ——

Settlements (905) (325) (235) (32) (54) (53) ——

Benefits paid (500) (316) (161) (58) (376) (301) (273) (229)

Fair value of plan assets at end of year 10,596 9,977 ——6,709 6,524 414 370

Funded status—Plan assets less than

the benefit obligation at end of year $ (2,439) $ (2,601) $(1,401) $(1,368) $(2,438) $(2,538) $(3,168) $(3,363)

(a) The increase in the benefit obligation and the fair value of plan assets at the beginning of the year in 2010 is primarily due to the acquisition of

Wyeth during 2009 (see Note 2. Acquisition of Wyeth, for additional information).

(b) For the U.S. and international pension plans, the benefit obligation is the projected benefit obligation. For the postretirement plans, the benefit

obligation is the accumulated postretirement benefit obligation.

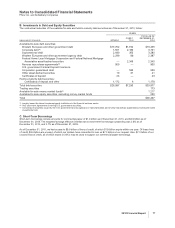

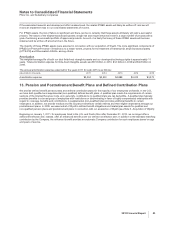

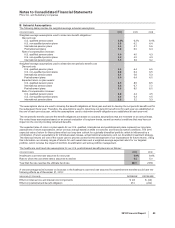

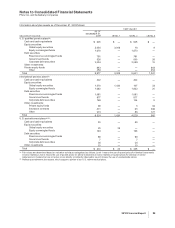

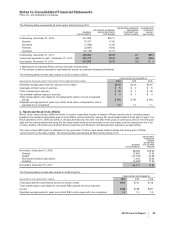

The favorable change in our U.S. qualified plans’ projected benefit obligations funded status from $2.6 billion underfunded in the

aggregate as of December 31, 2009, to $2.4 billion underfunded in the aggregate as of December 31, 2010, was largely driven by

the increase in plan assets due to the higher return on plan assets earned during 2010 and our $901 million contribution to plan

assets, which was partially offset by higher costs incurred from the acquired Wyeth defined benefit obligations and the 0.4

percentage-point reduction in the discount rate. Voluntary contributions to our U.S. qualified plans were $901 million in 2010 and $2

million in 2009. In the aggregate, the U.S. qualified pension plans are underfunded on a projected benefit measurement basis and

on an accumulated benefit obligation basis as of December 31, 2010 and 2009.

The U.S. supplemental (non-qualified) pension plans are not generally funded and these obligations, which are substantially greater

than the annual cash outlay for these liabilities, are paid from cash generated from operations.

The favorable change in our international plans’ projected benefit obligations funded status from $2.5 billion underfunded in the

aggregate as of December 31, 2009, to $2.4 billion underfunded in the aggregate as of December 31, 2010, was largely driven by a

0.1 percentage-point reduction in the average rate of compensation increases and strengthening of the U.S. dollar against the euro

and the U.K. pound, which was partially offset by a 0.3 percentage-point reduction in the discount rate and higher costs incurred

from the acquired Wyeth defined benefit obligations. Outside the U.S., in general, we fund our defined benefit plans to the extent

that tax or other incentives exist and we have accrued liabilities on our consolidated balance sheet to reflect those plans that are not

fully funded.

86 2010 Financial Report