Pfizer 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

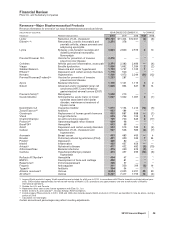

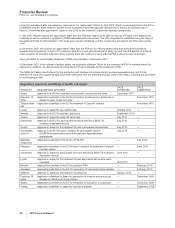

•Zosyn/Tazocin, our broad-spectrum intravenous antibiotic, faces generic competition in the U.S. and certain other markets. It had

worldwide revenues of $952 million in 2010.

•Genotropin, the world’s leading human growth hormone, is used in children for the treatment of short stature with growth hormone

deficiency, Prader-Willi Syndrome, Turner Syndrome, Small for Gestational Age Syndrome, Idiopathic Short Stature (in the U.S. only)

and Chronic Renal Insufficiency (outside the U.S. only), as well as in adults with growth hormone deficiency. Genotropin is supported

by a broad platform of innovative injection-delivery devices. Genotropin worldwide revenues were relatively flat compared to 2009.

•Vfend, as the only branded agent available in intravenous and oral forms, continued to build on its position as the best-selling systemic,

antifungal agent worldwide in 2010. The global revenues of Vfend continued to be driven in 2010 by its acceptance as an excellent

broad-spectrum agent for treating yeast and molds. Vfend worldwide revenues increased 3% in 2010, compared to 2009.

In October 2009, we settled a challenge by Mylan, Inc. (Mylan) and its subsidiary, Matrix Laboratories Limited (Matrix), to four of

our patents relating to Vfend by entering into an agreement granting Matrix and another subsidiary of Mylan the right to market

their voriconazole (generic Vfend) tablet in the U.S. Pursuant to that settlement agreement, Matrix and the other Mylan subsidiary

launched their generic voriconazole tablet in the U.S. in February 2011. In addition, the basic patent for Vfend tablets in Brazil

expired on January 1, 2011.

•Chantix/Champix, the first new prescription treatment to aid smoking cessation in nearly a decade, has been launched in all major

markets. Chantix/Champix worldwide revenues increased 8% in 2010, compared to 2009. Revenues in 2010 were impacted by strong

operational performance in international developed markets and the favorable impact of foreign exchange, partially offset by the impact

of changes to the product’s label and other factors, especially in the U.S. We are continuing our educational and promotional efforts,

which are focused on the Chantix benefit-risk proposition, the significant health consequences of smoking and the importance of the

physician-patient dialogue in helping patients quit smoking.

•Protonix, our proton pump inhibitor for gastroesophageal reflux disease, had revenues of $690 million in 2010. We have an exclusive

license from Nycomed GmbH to sell Protonix in the U.S., where it faces generic competition as the result of at-risk launches by certain

generic manufacturers that began in December 2007 and the expiration of the basic U.S. patent (including the six-month pediatric

exclusivity period) in January 2011.

•BeneFIX and ReFacto AF/Xyntha are hemophilia products that use state-of-the-art manufacturing to assist patients with this lifelong

bleeding disorder. BeneFIX is the only available recombinant factor IX product for the treatment of hemophilia B, while ReFacto AF/

Xyntha are recombinant factor VIII products for the treatment of hemophilia A. Both products are indicated for the control and

prevention of bleeding in patients with these disorders and in some countries also are indicated for prophylaxis in certain situations,

such as surgery. BeneFIX recorded worldwide revenues of $643 million in 2010. ReFacto AF/Xyntha recorded worldwide revenues of

$404 million in 2010.

•Caduet is a single-pill therapy combining Norvasc and Lipitor. Caduet worldwide revenues declined 4% in 2010, compared to 2009,

primarily due to increased generic competition, as well as an overall decline in U.S. hypertension market volume, partially offset by

strong operational performance in international markets and the favorable impact of foreign exchange. We expect that Caduet will lose

exclusivity in the U.S. in November 2011.

•Revatio, for the treatment of PAH, had an increase in worldwide revenues of 7% in 2010, compared to 2009, due in part to increased

PAH awareness driving earlier diagnosis and increased therapy days in the U.S. and EU.

•Pristiq was approved for the treatment of Major Depressive Disorder (MDD) in the U.S. in February 2008 and subsequently was

approved for that indication in 28 other countries. Pristiq has also been approved for treatment of moderate-to-severe vasomotor

symptoms (VMS) associated with menopause in Thailand, Mexico and the Philippines. Pristiq recorded worldwide revenues of $466

million in 2010.

•Alliance revenues worldwide increased 40% in 2010, compared to 2009, mainly due to the strong performance of Spiriva, Aricept and

Rebif, as well as the inclusion of sales of Enbrel, a legacy Wyeth product, in the U.S. and Canada. We lost exclusivity for Aricept 5mg

and 10mg tablets in the U.S. in November 2010. We expect that the Aricept 23mg tablet will have exclusivity in the U.S. until July 2013.

See Notes to Consolidated Financial Statements—Note 19. Legal Proceedings and Contingencies for a discussion of recent

developments concerning patent and product litigation relating to certain of the products discussed above.

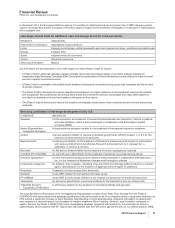

Product Developments—Biopharmaceutical

We continue to invest in R&D to provide potential future sources of revenues through the development of new products, as well as

through additional uses for existing in-line and alliance products. We remain on track to achieve our previously announced goal of

15 to 20 regulatory submissions in the 2010 to 2012 period. Notwithstanding our efforts, there are no assurances as to when, or if,

we will receive regulatory approval for additional indications for existing products or any of our other products in development.

On February 1, 2011, we announced that we are continuing to closely evaluate our global research and development function and

will accelerate our current strategies to improve innovation and overall productivity by prioritizing areas with the greatest scientific

and commercial promise, utilizing appropriate risk/return profiles and focusing on areas with the highest potential to deliver value in

the near term and over time (see the “Our Strategy” section of this Financial Review). Our high-priority therapeutic areas are

immunology and inflammation, oncology, cardiovascular and metabolic diseases, neuroscience and pain, and vaccines.

28 2010 Financial Report