Pfizer 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

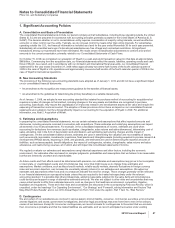

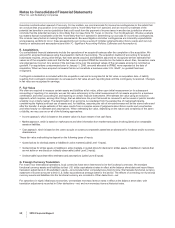

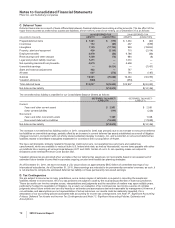

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

•Elimination of $834 million of costs incurred in 2009, which are directly attributable to the acquisition, and which do not have a

continuing impact on the combined company’s operating results. Included in these costs are advisory, legal and regulatory costs

incurred by both legacy Pfizer and legacy Wyeth and costs related to a bridge term loan credit agreement with certain financial

institutions that has been terminated.

In addition, all of the above adjustments were adjusted for the applicable tax impact. The taxes associated with the fair value

adjustments for acquired intangible assets, property, plant and equipment and legacy Wyeth debt, as well as the elimination of the

impact of the fair value step-up of acquired inventory reflect the statutory tax rates in the various jurisdictions where the fair value

adjustments occurred. The taxes associated with incremental debt to partially finance the acquisition reflect a 38.3% tax rate since

the debt is an obligation of a U.S. entity and is taxed at the combined effective U.S. federal statutory and state rate. The taxes

associated with the elimination of the costs directly attributable to the acquisition reflect a 28.4% effective tax rate since the costs

were incurred in the U.S. and were either taxed at the combined effective U.S. federal statutory and state rate or not deductible for

tax purposes depending on the type of expenditure.

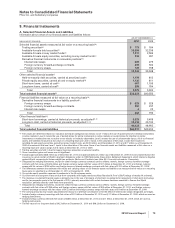

3. Other Significant Transactions and Events

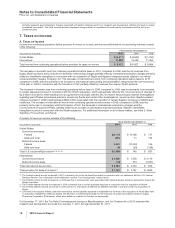

A. Tax Audit Settlements

During the fourth quarter of 2010, we reached a settlement with the U.S. Internal Revenue Service (IRS) related to issues we had

appealed with respect to the audits of the Pfizer Inc. tax returns for the years 2002 through 2005, as well as the Pharmacia audit for

the year 2003 through the date of merger with Pfizer (April 16, 2003). The IRS concluded its examination of the aforementioned tax

years and issued a final Revenue Agent’s Report (RAR). We agreed with all of the adjustments and computations contained in the

RAR. As a result of settling these audit years, in the fourth quarter of 2010, we reduced our unrecognized tax benefits by

approximately $1.4 billion and reversed the related interest accruals by approximately $600 million. During 2010, we also recognized

$320 million in tax benefits and reversed the related interest accruals of $140 million resulting from the resolution of certain tax

positions pertaining to prior years with various foreign tax authorities as well as from the expiration of the statute of limitations. The

aforementioned amounts had been classified in Other taxes payable, and the corresponding tax benefit was recorded in Provision

for taxes on Income (see Note 7.Taxes on Income). In the second quarter of 2008, we effectively settled certain issues common

among multinational corporations with various foreign tax authorities primarily relating to tax years 2000 to 2005. As a result, we

recognized $305 million in tax benefits in Provision for taxes on income.

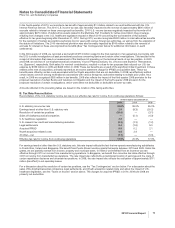

B. Asset Impairment Charges

During 2010 we recorded the following intangible asset impairment charges in Other deductions—net (see Note 6. Other (Income)/

Deductions—net):

•We recorded $1.8 billion in 2010 related to intangible assets, including certain IPR&D and Brand intangible assets that were acquired

as part of our acquisition of Wyeth. These impairment charges primarily resulted from our updated estimate of the fair value of these

assets, which was based upon updated forecasts, compared with their assigned fair values as of the Wyeth acquisition date,

October 15, 2009. Our updated forecasts of net cash flows for the impaired assets, reflect, among other things, the following: for IPR&D

assets, the impact of changes to the development programs, the projected development and regulatory timeframes and the risk

associated with these assets; for Brand assets, the current competitive environment and planned investment support; and, for

Developed Technology Rights, an increased competitive environment.

•We recorded a charge of approximately $300 million in the fourth quarter of 2010 associated with our product Thelin, as a result of our

decisions to voluntarily withdraw Thelin in regions where it is approved and to discontinue clinical studies worldwide.

Of these amounts, about $1.4 billion related to our Biopharmaceutical segment and about $700 million related to our Diversified

segment.

Also, in the third quarter of 2010, we recorded a $212 million write-off of Wyeth-related inventory in Cost of sales related to

unfinished inventory acquired from Wyeth that became unusable after the acquisition date (which included a purchase accounting

fair value adjustment of $104 million).

In the fourth quarter of 2009, we recorded $417 million in asset impairment charges primarily associated with certain materials used

in our research and development activities that were no longer considered recoverable. In the fourth quarter of 2008, we recorded

$143 million in asset impairment charges related to certain equity investments and the exit of our Exubera product.

For additional information on our accounting policy for reviewing long-lived assets for impairment, see Note 1L. Significant

Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

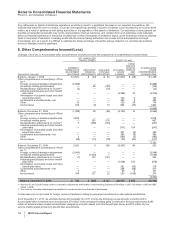

C. Legal Matters

Asbestos Litigation Charge

We recorded additional charges of $701 million in the third quarter of 2010 and $620 million in the fourth quarter of 2010, for

asbestos litigation related to our wholly owned subsidiary, Quigley Company, Inc. (see Note 19. Legal Proceedings and

Contingencies for additional information).

2010 Financial Report 65