Pfizer 2010 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

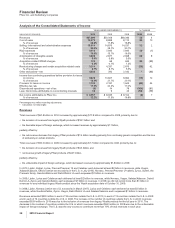

Financial Review

Pfizer Inc. and Subsidiary Companies

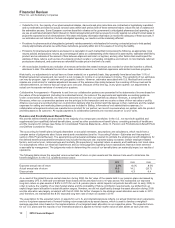

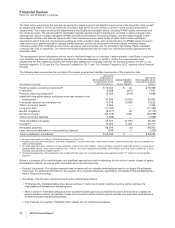

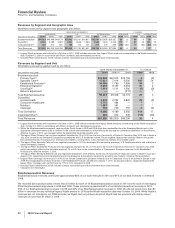

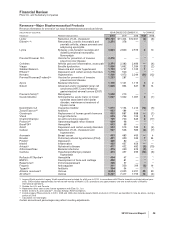

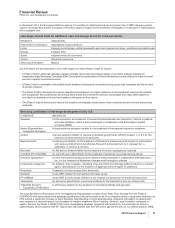

Revenues by Segment and Geographic Area

Worldwide revenues by segment and geographic area follow:

YEAR ENDED DECEMBER 31, % CHANGE

WORLDWIDE U.S. INTERNATIONAL WORLDWIDE U.S. INTERNATIONAL

(MILLIONS OF DOLLARS) 2010(a) 2009(a) 2008 2010(a) 2009(a) 2008 2010(a) 2009(a) 2008 10/09 09/08 10/09 09/08 10/09 09/08

Biopharmaceutical $58,523 $45,448 $44,174 $25,962 $20,010 $18,817 $32,561 $25,438 $25,357 29 330 628 —

Diversified 8,966 4,189 3,592 2,981 1,646 1,383 5,985 2,543 2,209 114 17 81 19 135 15

Corporate/Other(b) 320 372 530 103 93 201 217 279 329 (14) (30) 11 (54) (22) (15)

Total Revenues $67,809 $50,009 $48,296 $29,046 $21,749 $20,401 $38,763 $28,260 $27,895 36 434 737 1

(a) Legacy Wyeth revenues are included for a full year in 2010. 2009 includes revenues from legacy Wyeth products commencing on the Wyeth acquisition

date, October 15, 2009, in accordance with Pfizer’s domestic and international year-ends.

(b) Includes Pfizer CentreSource, which includes contract manufacturing and bulk pharmaceutical chemical sales.

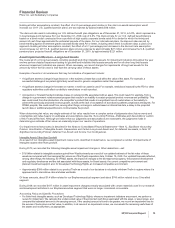

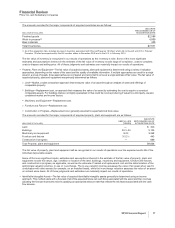

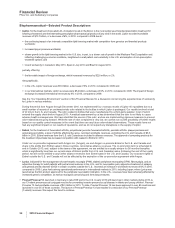

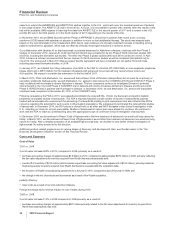

Revenues by Segment and Unit

Worldwide revenues by segment and by unit follow:

YEAR ENDED DECEMBER 31, % CHANGE

(MILLIONS OF DOLLARS) 2010(a) 2009(a),(b) 2008(b) 10/09 09/08

Biopharmaceutical:

Primary Care(c) $23,328 $22,576 $23,160 3(3)

Specialty Care(d) 15,021 7,414 6,000 103 24

Established Products(e) 10,098 7,790 7,588 30 3

Emerging Markets(f) 8,662 6,157 6,053 41 2

Oncology(g) 1,414 1,511 1,590 (6) (5)

Returns adjustment —— (217) —*

Total Biopharmaceutical 58,523 45,448 44,174 29 3

Diversified:

Animal Health 3,575 2,764 2,825 29 (2)

Consumer Healthcare 2,772 494 — **

Nutrition 1,867 191 — **

Capsugel 752 740 767 2(4)

Total Diversified 8,966 4,189 3,592 114 17

Corporate/Other(h) 320 372 530 (14) (30)

Total Revenues $67,809 $50,009 $48,296 36 4

(a) Legacy Wyeth revenues are included for a full year in 2010. 2009 reflects revenues from legacy Wyeth products commencing on the Wyeth acquisition

date, October 15, 2009, in accordance with Pfizer’s domestic and international year-ends.

(b) Within the Biopharmaceutical segment, revenues from South Korea in 2009 and 2008 have been reclassified from the Emerging Markets unit to the

appropriate developed market units to conform to the current-year presentation, which reflects the fact that the commercial operations of South Korea,

effective January 1, 2010, are managed within the appropriate developed market units.

(c) The legacy Pfizer Primary Care unit was negatively impacted by 2% in 2010 due the loss of exclusivity of Lipitor in Canada in May 2010 and in Spain in

July 2010, as well as by developed Europe pricing pressures and U.S. healthcare reform. These negative impacts were partially offset by the growth

from selected brands, including Lyrica, Champix and Celebrex, among others, in key international markets, most notably Japan.

(d) The legacy Pfizer Specialty Care unit was negatively impacted in 2010 by developed Europe pricing pressures, U.S. healthcare reform and a decline in

certain therapeutic markets.

(e) The legacy Pfizer Established Products unit was negatively impacted by 4% in 2010 due to the loss of exclusivity for Norvasc in Canada in July 2009,

which was partially offset by the favorable impact of 1% in 2010 due to the reclassification of Camptosar’s European revenues to the Established

Products unit, effective January 1, 2010.

(f) The legacy Pfizer Emerging Markets unit was negatively impacted in 2010 primarily by the loss of exclusivity of Viagra and Lipitor in Brazil in June and

August 2010, respectively and emerging Europe pricing pressures, but positively impacted by growth in key markets, including China and Brazil.

(g) Legacy Pfizer Oncology unit revenues in 2010 do not include Camptosar’s European revenues due to Camptosar’s loss of exclusivity in Europe in July

2009. The reclassification of those revenues to the Established Products unit effective January 1, 2010, as discussed above, negatively impacted the

legacy Pfizer Oncology unit’s performance by 17% in 2010 compared to 2009.

(h) Includes Pfizer CentreSource, which includes contract manufacturing and bulk pharmaceutical chemical sales.

* Calculation not meaningful.

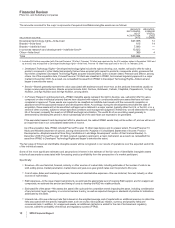

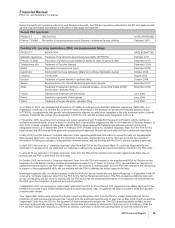

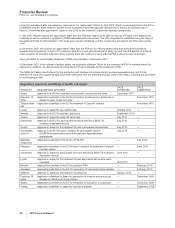

Biopharmaceutical Revenues

Biopharmaceutical revenues contributed approximately 86% of our total revenues in 2010 and 91% of our total revenues in 2009 and

2008.

We recorded direct product sales of more than $1 billion for each of 15 Biopharmaceutical products in 2010 and for each of nine legacy

Pfizer Biopharmaceutical products in 2009 and 2008. These products represented 60% of our Biopharmaceutical revenues in 2010,

56% of our Biopharmaceutical revenues in 2009 and 60% of our Biopharmaceutical revenues in 2008. We did not record more than $1

billion in revenues for any individual legacy Wyeth product in 2009 as the Wyeth acquisition date was October 15, 2009. While Wyeth’s

revenues are not included in our 2008 amounts, as Wyeth had not yet been acquired, Wyeth had five products with direct product

revenues of more than $1 billion in 2008.

22 2010 Financial Report