Pfizer 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

partner are active participants in the activity and are exposed to the significant risks and rewards of the activity. Our rights and

obligations under our collaborative arrangements vary. For example, we have agreements to co-promote pharmaceutical products

discovered by us or other companies, and we have agreements where we partner to co-develop and/or participate together in

commercializing, marketing, promoting, manufacturing and/or distributing a drug product.

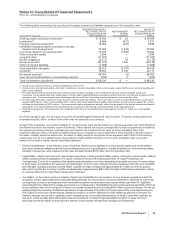

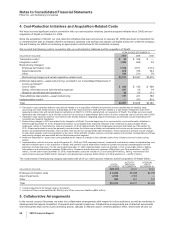

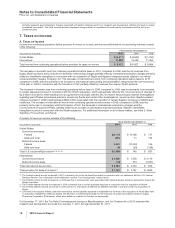

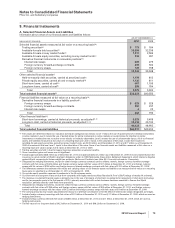

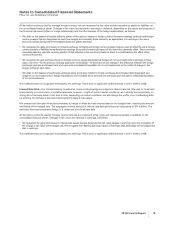

The amounts and classifications in our consolidated statements of income of payments (income/(expense)) between us and our

collaboration partners follow:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009 2008

Revenues—Revenues(a) $ 568 $ 593 $ 488

Revenues—Alliance revenues(b) 4,084 2,925 2,251

Total revenues from collaborative arrangements 4,652 3,518 2,739

Cost of sales(c) (109) (166) (147)

Selling, informational and administrative expenses(d) (131) 10 75

Research and development expenses(e) (316) (361) (476)

Other deductions—net 37 37 —

(a) Represents sales to our partners of products manufactured by us.

(b) Substantially all relate to amounts earned from our partners under co-promotion agreements.

(c) Primarily relates to royalties earned by our partners and cost of sales associated with inventory purchased from our partners.

(d) Represents net reimbursements from our partners/(to our partners) for selling, informational and administrative expenses incurred.

(e) Primarily related to net reimbursements, as well as upfront payments and milestone payments earned by our partners. The upfront and milestone

payments were as follows: $147 million in 2010, $150 million in 2009 and $300 million in 2008.

The amounts disclosed in the above table do not include transactions with third parties other than our collaboration partners, or

other costs associated with the products under the collaborative arrangements.

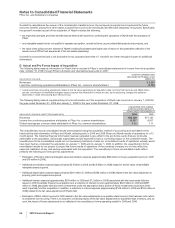

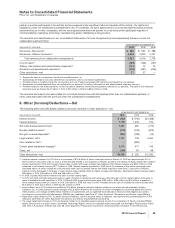

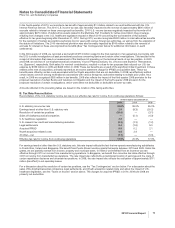

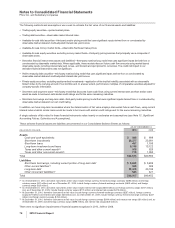

6. Other (Income)/Deductions—Net

The following table sets forth details related to amounts recorded in Other deductions—net:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009 2008

Interest income $ (402) $ (746) $(1,288)

Interest expense 1,799 1,233 516

Net interest expense/(income)(a) 1,397 487 (772)

Royalty-related income(b) (579) (243) (673)

Net gain on asset disposals(c) (262) (188) (14)

Legal matters, net(d) 1,737 234 3,300

Gain related to ViiV(e) —(482) —

Certain asset impairment charges(f) 2,175 417 143

Other, net (130) 67 48

Other deductions—net $4,338 $ 292 $ 2,032

(a) Interest expense increased in 2010 due to our issuance of $13.5 billion of senior unsecured notes on March 24, 2009 and approximately $10.5

billion of senior unsecured notes on June 3, 2009, primarily related to the acquisition of Wyeth, as well as the addition of legacy Wyeth debt. Interest

income decreased in 2010 due to lower interest rates, coupled with lower average cash balances. Net interest expense was $487 million in 2009

compared to net interest income of $772 million in 2008. Interest expense increased in 2009 due to the issuance of the senior unsecured notes

discussed above, of which virtually all of the proceeds were used to partially finance the Wyeth acquisition (see Note 2. Acquisition of Wyeth).

Interest income decreased in 2009 due to lower interest rates, partially offset by higher average cash balances. Capitalized interest expense totaled

$36 million in 2010, $34 million in 2009 and $46 million in 2008.

(b) In 2008, includes $425 million related to the sale of certain royalty rights.

(c) In 2010 and 2009, primarily represents gains on sales of certain investments and businesses. Net gains also include realized gains and losses on

sales of available-for-sale securities: in 2010, 2009 and 2008, gross realized gains were $153 million, $186 million and $20 million, respectively.

Gross realized losses were $12 million in 2010, $43 million in 2009 and none in 2008. Proceeds from the sale of available-for-sale securities were

$5.3 billion in 2010, $27.0 billion in 2009 and $2.2 billion in 2008.

(d) Legal matters, net in 2010 includes an additional $1.3 billion charge for asbestos litigation related to our wholly owned subsidiary, Quigley

Company, Inc. In 2008, primarily includes charges of $2.3 billion related to the resolution of certain investigations concerning Bextra and various

other products, and charges of $900 million related to our agreements and our agreements-in-principle to resolve certain litigation and claims

involving our non-steroidal anti-inflammatory (NSAID) pain medicines (see Note 3C. Other Significant Transactions and Events: Legal Matters).

(e) Represents a gain related to ViiV, an equity method investment, which is focused solely on research, development and commercialization of HIV

medicines (see Note 3E. Other Significant Transactions and Events: Equity Method Investments).

(f) The asset impairment charges in 2010 are primarily related to (i) intangible assets acquired as part of our acquisition of Wyeth, including IPR&D

assets, Brands and, to a lesser extent, Developed Technology Rights.;and (ii) an intangible asset associated with the legacy Pfizer product Thelin

(see Note 2. Acquisition of Wyeth and Note 3B. Other Significant Transactions and Events: Asset Impairment Charges).The 2009 amounts

2010 Financial Report 69