Pfizer 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

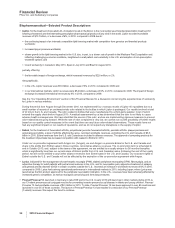

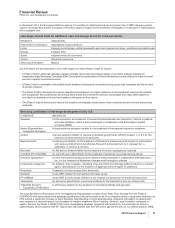

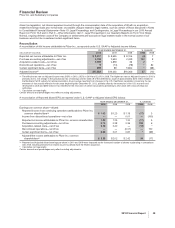

(a) Transaction costs represent external costs directly related to our acquisition of Wyeth and primarily include expenditures for banking, legal,

accounting and other similar services. Substantially all of the costs incurred in 2009 were fees related to a $22.5 billion bridge term loan credit

agreement entered into with certain financial institutions on March 12, 2009 to partially fund our acquisition of Wyeth. The bridge term loan credit

agreement was terminated in June 2009 as a result of our issuance of approximately $24.0 billion of senior unsecured notes in the first half of 2009.

(b) Integration costs represent external, incremental costs directly related to integrating acquired businesses and primarily include expenditures for

consulting and systems integration.

(c) Restructuring charges in 2010 are related to the integration of Wyeth. From the beginning of our cost-reduction and transformation initiatives in

2005 through December 31, 2010, Employee termination costs represent the expected reduction of the workforce by approximately 49,000

employees, mainly in manufacturing, sales and research, of which approximately 36,400 employees have been terminated as of December 31,

2010. Employee termination costs are generally recorded when the actions are probable and estimable and include accrued severance benefits,

pension and postretirement benefits, many of which may be paid out during periods after termination. Asset impairments primarily include charges

to write down property, plant and equipment to fair value. Other primarily includes costs to exit certain assets and activities. Substantially all of these

restructuring charges are associated with our Biopharmaceutical segment.

(d) Additional depreciation––asset restructuring represents the impact of changes in the estimated useful lives of assets involved in restructuring

actions.

(e) Implementation costs for the years ended December 31, 2009 and 2008 represent external, incremental costs directly related to implementing cost-

reduction initiatives prior to our acquisition of Wyeth, and primarily include expenditures related to system and process standardization and the

expansion of shared services. For the year ended December 31, 2009, implementation costs are included in Cost of sales ($42 million), Selling,

informational and administrative expenses ($166 million), Research and development expenses ($36 million) and Other deductions––net ($6

million). For the year ended December 31, 2008, implementation costs are included in Cost of sales ($149 million), Selling, informational and

administrative expenses ($394 million), Research and development expenses ($262 million) and Other deductions––net ($14 million).

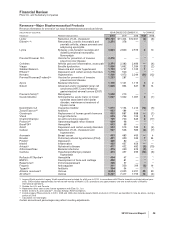

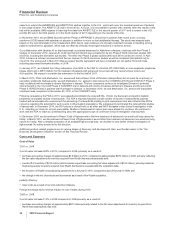

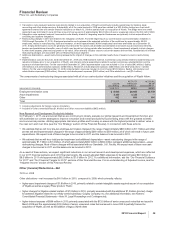

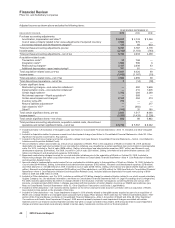

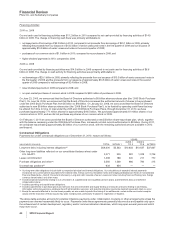

The components of restructuring charges associated with all of our cost-reduction initiatives and the acquisition of Wyeth follow:

COSTS

INCURRED

ACTIVITY

THROUGH

DECEMBER 31,

ACCRUAL

AS OF

DECEMBER 31,

(MILLIONS OF DOLLARS) 2005-2010 2010(a) 2010(b)

Employee termination costs $ 8,846 $6,688 $2,158

Asset impairments 2,322 2,322 —

Other 902 801 101

Total $12,070 $9,811 $2,259

(a) Includes adjustments for foreign currency translation.

(b) Included in Other current liabilities ($1.6 billion) and Other noncurrent liabilities ($652 million).

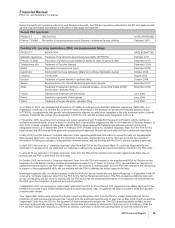

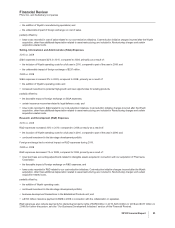

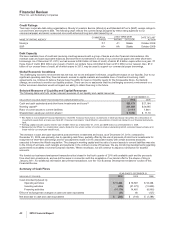

New Research and Development Productivity Initiative

On February 1, 2011, we announced that we are continuing to closely evaluate our global research and development function and

will accelerate our current strategies to improve innovation and overall productivity by prioritizing areas with the greatest scientific

and commercial promise, utilizing appropriate risk/return profiles and focusing on areas with the highest potential to deliver value in

the near term and over time (see the “Our Strategy” section of this Financial Review). In connection with these actions:

•We estimate that we will incur pre-tax employee-termination charges in the range of approximately $800 million to $1.1 billion and other

pre-tax exit and implementation charges in the range of approximately $300 million to $500 million, all of which will result in future cash

expenditures. We expect most of these charges to be incurred in 2011 and the balance to be incurred in 2012.

•We estimate that we will incur total pre-tax impairment and additional depreciation—asset restructuring charges in the range of

approximately $1.1 billion to $1.3 billion, of which approximately $800 million to $900 million represent additional depreciation—asset

restructuring charges. Most of these charges will be associated with our Sandwich, U.K. Facility. We expect most of these non-cash

charges to be incurred in 2011 and the balance to be incurred in 2012.

As a result of these actions, we expect significant reductions in our annual research and development expenses, which are reflected

in our 2011 financial guidance and 2012 financial targets. We expect adjusted R&D expenses to be approximately $8.0 billion to

$8.5 billion in 2011 and approximately $6.5 billion to $7.0 billion in 2012. For additional information, see the “Our Financial Guidance

for 2011” and “Our Financial Targets for 2012” sections of this Financial Review. For an understanding of Adjusted income, see the

“Adjusted Income” section of this Financial Review.

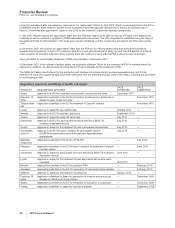

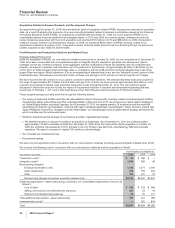

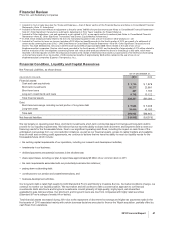

Other (Income)/Deductions—Net

2010 vs. 2009

Other deductions—net increased by $4.0 billion in 2010, compared to 2009, which primarily reflects:

•higher asset impairment charges of $1.8 billion in 2010, primarily related to certain intangible assets acquired as part of our acquisition

of Wyeth as well as a legacy Pfizer product, Thelin;

•higher charges for litigation-related matters of $1.5 billion in 2010, primarily associated with the additional $1.3 billion (pre-tax) charge

for asbestos litigation related to our wholly owned subsidiary, Quigley Company, Inc. (for additional information, see Notes to

Consolidated Financial Statements—Note 19. Legal Proceedings and Contingencies);

•higher interest expense of $566 million in 2010, primarily associated with the $13.5 billion of senior unsecured notes that we issued in

March 2009 and the approximately $10.5 billion of senior unsecured notes that we issued in June 2009 to partially finance the

acquisition of Wyeth, as well as the addition of legacy Wyeth debt;

2010 Financial Report 35