Pfizer 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

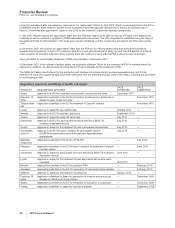

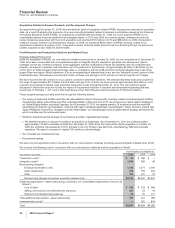

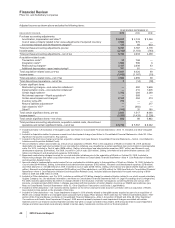

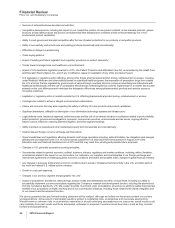

Adjusted income as shown above excludes the following items:

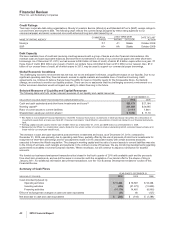

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009 2008

Purchase accounting adjustments:

Amortization, depreciation and other(a) $ 5,228 $ 2,743 $ 2,546

Cost of sales, primarily related to fair value adjustments of acquired inventory 2,904 976 —

In-process research and development charges(b) 125 68 633

Total purchase accounting adjustments, pre-tax 8,257 3,787 3,179

Income taxes (2,148) (1,154) (740)

Total purchase accounting adjustments—net of tax 6,109 2,633 2,439

Acquisition-related costs:

Transaction costs(c) 23 768 —

Integration costs(c) 1,004 569 6

Restructuring charges(c) 2,187 2,608 43

Additional depreciation—asset restructuring(d) 787 81 —

Total acquisition-related costs, pre-tax 4,001 4,026 49

Income taxes (1,092) (1,167) (10)

Total acquisition-related costs—net of tax 2,909 2,859 39

Total discontinued operations—net of tax 9(14) (78)

Certain significant items:

Restructuring charges—cost-reduction initiatives(e) —392 2,626

Implementation costs—cost-reduction initiatives(f) —410 1,605

Certain legal matters(g) 1,703 294 3,249

Net interest expense––Wyeth acquisition(h) —589 —

Certain asset impairment charges(i) 2,151 294 213

Inventory write-off(j) 212 ——

Returns liabilities adjustment(k) —— 217

Gain related to ViiV(l) —(482) —

Other(m) (102) 20 180

Total certain significant items, pre-tax 3,964 1,517 8,090

Income taxes(n) (3,265) (1,428) (2,228)

Total certain significant items—net of tax 699 89 5,862

Total purchase accounting adjustments, acquisition-related costs, discontinued

operations and certain significant items—net of tax $ 9,726 $ 5,567 $ 8,262

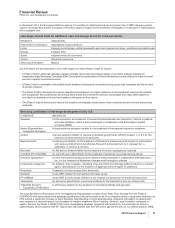

(a) Included primarily in Amortization of intangible assets (see Notes to Consolidated Financial Statements—Note 12. Goodwill and Other Intangible

Assets).

(b) Included in Acquisition-related in-process research and development charges (see Notes to Consolidated Financial Statements—Note 3D. Other

Significant Transactions and Events: Acquisitions).

(c) Included in Restructuring charges and certain acquisition-related costs (see Notes to Consolidated Financial Statements—Note 4. Cost-Reduction

Initiatives and Acquisition-Related Costs).

(d) Amount relates to certain actions taken as a result of our acquisition of Wyeth. Prior to the acquisition of Wyeth on October 15, 2009, additional

depreciation for asset restructuring related to our cost-reduction initiatives was classified as a certain significant item and included in implementation

costs. For 2010, included in Cost of sales ($526 million), Selling, informational and administrative expenses ($227 million) and Research and

development expenses ($34 million). For 2009, included in Cost of sales ($31 million), Selling, informational and administrative expenses ($37

million) and Research and development expenses ($13 million).

(e) Represents restructuring charges incurred for our cost-reduction initiatives prior to the acquisition of Wyeth on October 15, 2009. Included in

Restructuring charges and certain acquisition-related costs (see Notes to Consolidated Financial Statements—Note 4. Cost-Reduction Initiatives

and Acquisition-Related Costs).

(f) Amounts relate to implementation costs incurred for our cost-reduction initiatives prior to the acquisition of Wyeth on October 15, 2009. Included in

Cost of sales ($144 million), Selling, informational and administrative expenses ($182 million), Research and development expenses ($78 million)

and Other deductions—net ($6 million) for 2009. Included in Cost of sales ($745 million), Selling, informational and administrative expenses ($413

million), Research and development expenses ($433 million) and Other deductions—net ($14 million) for 2008 (see Notes to Consolidated Financial

Statements—Note 4. Cost-Reduction Initiatives and Acquisition-Related Costs). Includes additional depreciation for asset restructuring of $160

million in 2009 and $786 million in 2008.

(g) Included in Other deductions—net. For 2010, includes an additional $1.3 billion charge for asbestos litigation related to our wholly owned subsidiary

Quigley Company, Inc. (for additional information, see Notes to Consolidated Financial Statements Note 19. Legal Proceedings and Contingencies).

For 2008, includes approximately $2.3 billion in charges related to the resolution of certain investigations concerning Bextra and various other

products, and approximately $900 million in charges associated with the resolution of certain litigation involving our NSAID pain medicines (see

Notes to Consolidated Financial Statements—Note 3C. Other Significant Transactions and Events: Legal Matters).

(h) Included in Other deductions––net. Includes interest expense on the senior unsecured notes issued in connection with our acquisition of Wyeth,

less interest income earned on the proceeds of the notes.

(i) Included in Other deductions––net. Asset impairment charges in 2010 primarily related to intangible assets acquired as part of our acquisition of

Wyeth and a charge related to an intangible asset associated with a legacy Pfizer product, Thelin (see also the “Other (Income)/Deductions––Net”

section of this Financial Review and Notes to Consolidated Financial Statements—Note 2. Acquisition of Wyeth and Note 3B. Other Significant

Transactions and Events: Asset Impairment Charges). 2009 amounts primarily represent asset impairment charges associated with certain

materials used in our research and development activities that were no longer considered recoverable. 2008 amounts relate to asset impairment

charges and other associated costs primarily related to certain equity investments and the exit of our Exubera product.

40 2010 Financial Report