Pepsi 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 ANNUAL REPORT 7

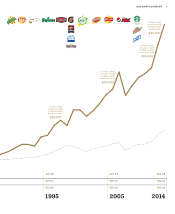

77companies, PepsiCo ranks in the top quartile

in Total Shareholder Returns — a performance

history we reflect on with pride as we celebrate

our50th year.

2014 — A Strong Performance Year

PepsiCo delivered strong performance in 2014,

meeting or exceeding all of our full-year finan-

cial targets.

• Organic revenue grew 4%, with PepsiCo

outpacing other Consumer Packaged Goods

companies in organic revenue growth.

• Core gross margins improved by 55 basis

points, and core operating margins improved

by30basis points.

• Core net return on invested capital (ROIC)

improved 110 basis points, to 17.5%.

• Core constant currency earnings per share

(EPS)grew 9%.

• Free cash flow excluding certain items was

strong at $8.3billion.

• PepsiCo increased its annual dividend for

the 42nd consecutive year in 2014 and returned

$8.7billion to our shareholders through share repur-

chases and dividends, a 36% increase over 2013.

While delivering this strong financial perfor-

mance, we continue to deliver progress on the

fundamental global capabilities that underpin our

long-term competitiveness and resilience in the

transformation journey we have been on.

First, our investment in innovation resulted in

strong retail sales in North America. Thanks to our

world-class research and development capabili-

ties and the strength of our new product pipeline,

innovation accounted for more than 9% of our net

revenue in 2014, versus more than 7% in 2012. These

efforts, combined with new best-in-class selling

tools and technologies, made PepsiCo the largest

contributor to U.S. retail sales growth among all food

and beverage manufacturers, with nearly $1billion of

retail sales growth in all measured channels — more

than the next 27 largest manufacturers combined.

Innovation is a critical

building block in our growth

model. Pictured: PepsiCo

innovation in North America.

>9%

Innovation accounted

for more than 9% of our

net revenue in 2014.

3. This comparison is based on publicly available data for the period

January2, 1974 through December31, 2014 and reects dividend

reinvestment and adjustments for stock splits.

4. Organic, core and constant currency results, as well as free cash ow

excluding certain items, are non-GAAP nancial measures. Please refer

to “Reconciliation of GAAP and Non-GAAP Information” beginning on

page141of this Annual Report for more information about these results,

including a reconciliation to the most directly comparable nancial

measuresin accordance with GAAP.

5. Our organic revenue calculation may dier from similar measures as

reported by other companies.

6. Based in part on data reported by Information Resources, Inc. through

itsSyndicated Advantage Service for the Total US Multi-Outlet Plus

Convenience for all Food & Beverage categories for the 52-week period

ending December28, 2014, including PepsiCo’s custom research denitions.