Pepsi 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$100

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

$40,000

$45,000

PEP Net

Revenue*

End-of-Year

Split Share

Price**

End-of-Year

Actual

Closing

Price

$510 M $2.3 B $8.1 B

$0.75 $1.30 $4.04

$81.50 $70.50

1975 19851965

$72.75

BRAND

2 PEPSICO

The Growth of

PepsiCo’s Portfolio of

Billion Dollar Brands

PepsiCo’s product portfolio

includes 22 brands that

generate more than $1 billion

each in estimated annual

retail sales.

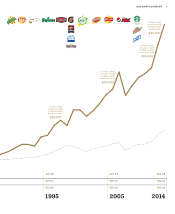

Cumulative Total

Shareholder Return

Since 1965

Return on PepsiCo stock investment

and the S&P 500, assuming the

reinvestment of all dividends paid and

adjusted for stock splits, calculated

through December 31, 2014.

A $100 investment in PepsiCo stock

at the end of 1965 was worth nearly

$43,000 at the end of 2014, a 13.2%

annualized return, compared to a

$100investment in the S&P 500 over

the same time period, which was worth

nearly $10,000 at the end of 2014, a

9.8%annualized return.

On October 6, 1997, PepsiCo spun off its

restaurant business to its shareholders,

who received one share of common stock

of Yum! Brands, Inc. (formerly known as

TRICON Global Restaurants, Inc.) (Yum!) for

every 10 shares of PepsiCo capital stock

owned by them (Spin-Off). This return on

PepsiCo stock assumes that shareholders

immediately sold the Yum! shares received

from the Spin-Off and concurrently

reinvested the proceeds in additional

shares of PepsiCo commonstock.

PepsiCo, Inc. Total Shareholder Return from

December 31, 1965 to December 31, 2014

S&P 500 Total Shareholder Return from

December 31, 1965 to December 31, 2014

In 1986, a $100

investment made

in 1965 would be

worth more than:

$1,000

*Represents net revenue as initially reported for each of the years presented and does not reect subsequent reclassications or changes in presentation.

**Closing prices have been restated to reect PepsiCo stock splits.