Pepsi 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Pepsi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 PEPSICO

In 2014, we continued

to expand our portfolio

of nutritious beverages

and foods.

2. Based on Euromonitor International data.

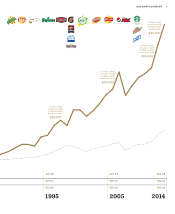

Trend 1: The Growth of the Middle Class

The past few decades saw the rise of the

middle class and the growth of women in the

workforce across the globe. Concurrently, as

consumers worldwide shifted more of their

spending to higher-quality products, they

favored companies that could deliver these

products through strong, trusted brands.

PepsiCo acted decisively to capitalize on

this trend. We globalized our footprint to

meet consumers’ quest for convenience

around the world, as most of our products can

go from package to consumption in seconds.

And we established our trusted brands in

each of our major markets. Our portfolio of

22 power brands that each generate more

than $1billion in estimated annual retail sales,

and more than 10 brands that each generate

between $500million and $1billion in esti-

mated annual retail sales, is synonymous with

quality, great taste and affordability.

Globalizing the company and connecting

our brands with consumers around the

world has, without question, helped drive

significant growth for PepsiCo during our

first half-century.

Trend 2: The Evolution of the Retail

Environment The global retail environment

changed dramatically over the past decades.

Around the world, we witnessed the emer-

gence of organized, efficient, modern trade

in many countries, followed by increasing

consolidation and sophistication of retailers

in each market.

Throughout this transformation, we

understood the paramount importance of

remaining a key partner to our large retail

customers, while continuing to provide the

best service to smaller stores. When Pepsi-

Cola and Frito-Lay joined forces, it brought

together two high-velocity categories

under one umbrella and allowed PepsiCo to

match retailers’ growing scale with our own.

Additionally, we have constantly retooled our

direct store delivery (DSD) selling system to

provide excellent service to large and small

retailers alike.

Thanks in large part to our company’s

focus on the transforming retail environment,

in 2014 PepsiCo was the number one food

and beverage business in the U.S., Canada,

Russia, India, Saudi Arabia and Egypt, and

among the top three in the U.K., Mexico

andTurkey, to name a few.

Trend 3: The Acceleration of Consumer

Focus on Health and Wellness The emer-

gence and acceleration of consumers’

focus on health and wellness (more

recently also a focal point of government

regulations) has increasingly challenged

companies with Fun-For-You portfolios to

adapt their products. At the same time, this

trend has also created significant growth

opportunities in the Better-For-You and

Good-For-You categories.

PepsiCo anticipated this shift early on, and

we took steps to future-proof our portfolio.

We invested in research and development

toimprove the nutritional value and increase

the appeal of our Fun-For-You products by

eliminating trans fats and reducing salt, fat

and added sugar content in key brands. We

preemptively acquired major brands across

the Good-For-You space, including Quaker

Oats, Gatorade for athletes, Tropicana,

Naked Juice and the Wimm-Bill-Dann line

ofdairy and juice products in Russia. We also

created a nutrition group to grow our Good-

For-You portfolio.

In 2014, our nutrition businesses accounted

for approximately 20% of PepsiCo’s net

revenue. We are one of the top companies

in the world in the growing everyday nutri-

tion space.