O'Reilly Auto Parts 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

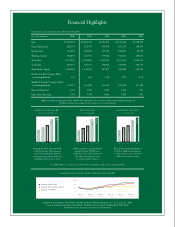

Financial Highlights

In thousands, except earnings per share data and operating data

years ended december 31 2006 2005 2004 2003 2002

Sales $2,283,222 $2,045,318 $1,721,241 $1,511,816 $1,312,490

Operating Income 282,315 252,524 190,458 165,275 138,301

Net Income(a) 178,085 164,266 117,674 100,087 81,992

Working Capital 566,892 424,974 479,662 441,617 483,623

Total Assets 1,977,496 1,718,896 1,432,357 1,157,033 1,009,419

Total Debt 110,479 100,774 100,914 121,902 191,152

Shareholders' Equity 1,364,096 1,145,769 947,817 784,285 650,524

Net Income Per Common Share

(assuming dilution)(a) 1.55 1.45 1.05 0.92 0.76

Weighted-Average Common Shares

(assuming dilution) 155,119 113,385 111,423 109,060 107,384

Stores At Year-End 1,640 1,470 1,249 1,109 981

Same-Store Sales Gain 3.3% 7.5% 6.8% 7.8% 3.7%

Earnings Per Share increased 6.9%

to $1.55 per share. We continued

our focus on profitable growth by

scrutinizing every expense while not

sacrificing customer service levels.

earnings per share(a)

(assuming dilution)

We posted an Operating Margin of

12.4% in 2006 as a result of our

excellent customer service and strict

adherence to expense control

operating income(a)

(in thousands)

2006 was another year of profitable

growth for Team O’Reilly as we

reached new levels of Net Income for

the 14th consecutive year since

becoming a public company.

net income(a)

(in thousands)

(a) 2004 figures are based on income before cumulative effect of accounting change.

2006 was another strong year for Team O’Reilly. We continued to drive increases in sales and profitability through our

relentless attention to providing the best customer service in the business.

comparison of five-year cumulative return

Comparison of Cumulative Total Return on $100 invested in O’Reilly Automotive, Inc. on December 31, 2001,

versus the Nasdaq United States Stock Market Total Return Index and The Nasdaq Retail Trade Stocks

Total Return Index, assuming reinvestment of all dividends.

o’reilly auto parts

nasdaq retail trade stocks

nasdaq us market 50

150

$ 200

dc. 31,

2001

dc. 31,

2002

dc. 31,

2003

dc. 31,

2004

dc. 31,

2005

dc. 31,

2006

100