O'Reilly Auto Parts 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our Road to Success

begins and ends with excellent customer service

O’REILLY AUTOMOTIVE 2006 ANNUAL REPORT

Table of contents

-

Page 1

Our Road to Success b e g i n s a n d e n d s w i t h e xc e l l e n t c u s to m e r s e rv i c e O'REILLY AUTOMOTIVE 2006 ANNUAL REPORT -

Page 2

... sacrificing customer service levels. 2006 was another year of profitable growth for Team O'Reilly as we reached new levels of Net Income for the 14th consecutive year since becoming a public company. We posted an Operating Margin of 12.4% in 2006 as a result of our excellent customer service and... -

Page 3

... 5 million; whether in Bismarck, North Dakota, with an average winter low temperature of -1 degree, or in Brownsville, Texas, with an average winter high temperature of 70 degrees, our road to success begins and ends with excellent customer service. In every one of our 1,640 stores, our ability to... -

Page 4

... au to m ot i v e 2 0 0 6 a n n u a l r e p o rt management to stores. To better support our Professional Parts People, the new store openings were concentrated around our newest distribution centers in Atlanta, Georgia, and Indianapolis, Indiana. This increased market penetration provides improved... -

Page 5

...It is what we strive to achieve each day and is what we believe sets us apart from all the rest. We carry the same parts as our competition, and we are in the same market areas. The one thing that makes us better than our competition is our team members and the customer service they provide. page 3 -

Page 6

... competitive advantage." As our Company grows, so does our dedication to the team concept. From our stores to our distribution centers to our corporate and regional offices, Team O'Reilly works together to make O'Reilly Auto Parts the dominant supplier of auto parts in all our market areas. page 4 -

Page 7

... that special win-win relationship with our customers is what makes O'Reilly Auto Parts their "first choice" when it comes to fulfilling their auto parts needs. As we enter our 50th year, our team is more focused than ever on growing the business and increasing our market share by building business... -

Page 8

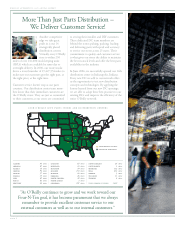

... success of their business. At a standard labor rate of $60 an hour, waiting on parts costs our installer customers $1 a minute, so the faster we can deliver, the stronger our relationships become. We offer extensive support programs, professional training classes and a dedicated sales team of 264... -

Page 9

...value the opportunity to do business with them. Our team members have been empowered to do "whatever it takes" to go the extra mile to meet the needs of our customers. They know that the business relationships they help build today, will result in the growth of our Company for years to come. page 7 -

Page 10

...distribution centers operating footprint alabama arkansas florida georgia illinois indiana iowa kansas kentucky 95 87 14 94 57 35 65 61 42 stores stores stores stores stores stores stores stores stores louisiana minnesota mississippi missouri montana nebraska north carolina north dakota oklahoma... -

Page 11

...640 stores are restocked nightly. Our 14 distribution centers contain over 4.4 million square feet of distribution space and house over 116,000 unique SKUs. Our customers have become accustomed to overnight or same-day delivery, and with our broad inventory coverage and advanced supply chain systems... -

Page 12

... p o rt What makes O'Reilly Auto Parts such a great company, and why has O'Reilly Auto Parts continued to outperform all other auto parts suppliers in just about every category imaginable? The answer is really quite simple ...It's called the O'Reilly Culture. Our culture is the driving force behind... -

Page 13

...our corporate and regional offices, each member of Team O'Reilly knows that they play a major role in perpetuating our culture and instilling it in our new team members. Market by market, customer by customer, our team members are committed to the goal of becoming the dominant supplier of auto parts... -

Page 14

... you know until they know that you care." c h a r l i e o 'r e i l l y Our business is pleasing customers, and we are committed to doing so in the following ways: we will train our team members to be the most knowledgeable Professional Parts People in the industry; we will stand behind anything that... -

Page 15

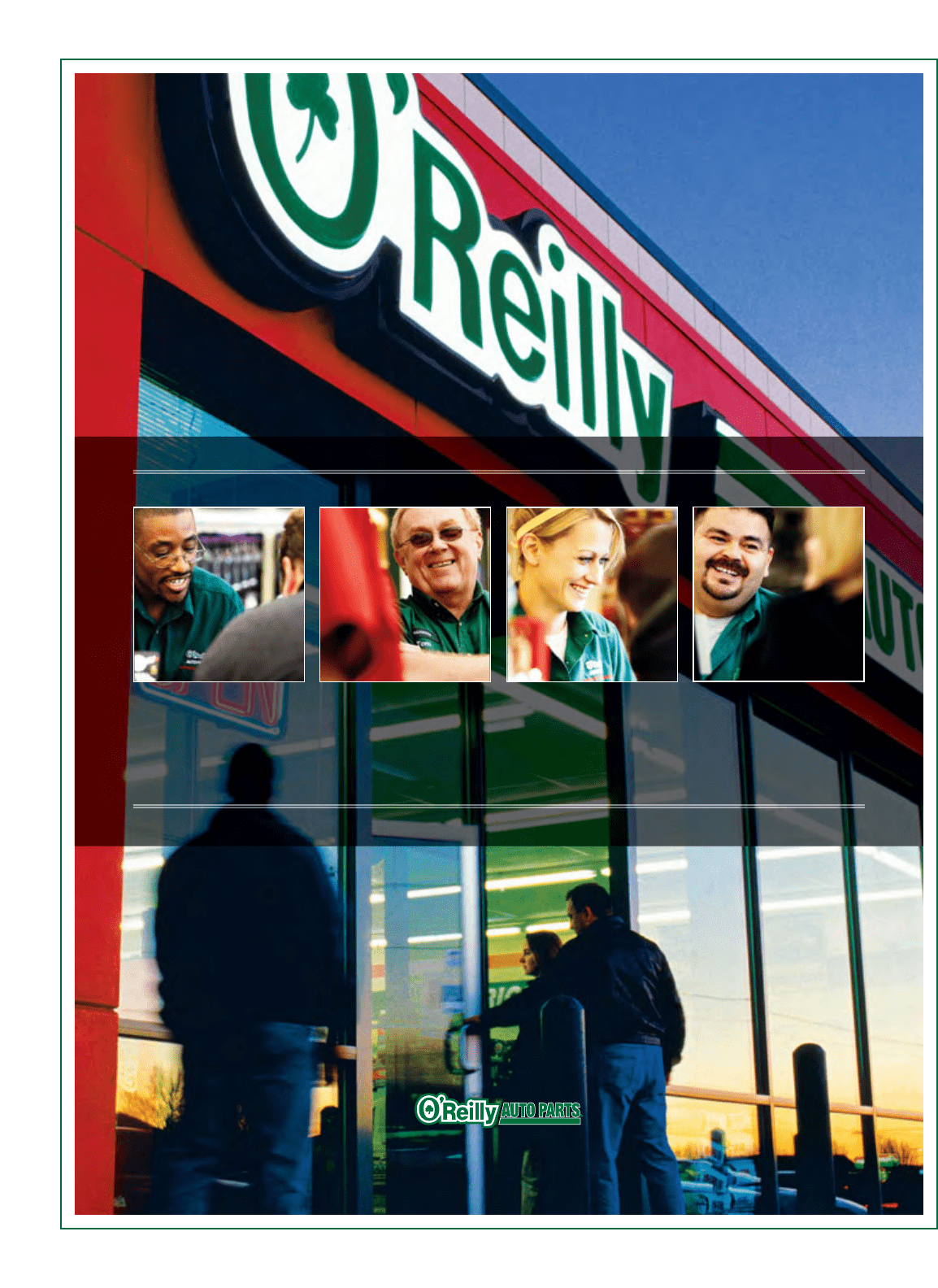

2006 Financial Results -

Page 16

... data) years ended december 31, 2006 2005 2004 i n co m e s tat e m e n t d ata : Sales Cost of goods sold, including warehouse and distribution expenses Gross profit Operating, selling, general and administrative expenses Operating income Other income (expense), net Income before income taxes... -

Page 17

o'r e i l ly au to m ot i v e 2 0 0 6 a n n u a l r e p o rt s e l e c t e d c o n s o l i d a t e d f i n a n c i a l d a t a (continued) 2003 2002 2001 2000 1999 1998 1997 $1,511,816 873,481 638,335 473,060 165,275 (5,233) 160,042 59,955 100,087 $ 100,087 $1,312,490 759,090 553,400 415,... -

Page 18

..., except selected operating data) years ended december 31, 2006 2005 2004 s e l e c t e d o pe r at i n g d ata : Number of stores at year-end (a) Total store square footage at year-end (in 000's) (a) (b) Weighted-average sales per store (in 000's) (a) (b) Weighted-average sales per square foot... -

Page 19

o'r e i l ly au to m ot i v e 2 0 0 6 a n n u a l r e p o rt s e l e c t e d c o n s o l i d a t e d f i n a n c i a l d a t a (continued) 2003 2002 2001 2000 1999 1998 1997 1,109 7,348 $ $ 1,413 215 7.8% $ $ 981 6,408 1,372 211 3.7% $ $ 875 5,882 1,426 219 8.8% $ $ 672 4,491 1,412 218 ... -

Page 20

... our product mix, price changes in response to competitive factors and fluctuations in merchandise costs and vendor programs. Operating, selling, general and administrative expenses consist primarily of salaries and benefits for store and corporate team members, occupancy costs, advertising expenses... -

Page 21

... negatively impacted our sales were constraints on our customer's discretionary income as a result of increased interest rates and higher energy costs combined with a reduction in the miles driven due to higher gas prices during the key summer selling season. Gross profit increased $114.2 million... -

Page 22

... Auto Parts Distributors, Inc. ("Midwest"), which included 72 stores and distribution centers in St. Paul, Minnesota and Billings, Montana. Capital expenditures were $228.9 million in 2006, $205.2 million in 2005 and $173.5 million in 2004. These expenditures were primarily related to the opening... -

Page 23

...was subsequently equipped and opened in 2006. In 2004, we acquired and opened one new distribution center near Atlanta, Georgia. Our continuing store expansion program requires significant capital expenditures and working capital principally for inventory requirements. Our 2007 growth plans call for... -

Page 24

... on customer buying patterns. Store sales and profits have historically been higher in the second and third quarters (April through September) of each year than in the first and fourth quarters. q u a rt e r ly r e s u lt s The following table sets forth certain quarterly unaudited operating data... -

Page 25

... the financial statements the cost of employee services received in exchange for awards of equity instruments, based on the grant date fair value of those awards. SFAS No. 123R also requires that the benefits associated with the tax deductions in excess of recognized compensation cost be reported as... -

Page 26

.... Ernst & Young LLP, Independent Registered Public Accounting Firm, has audited the Company's consolidated financial statements has issued an attestation report on management's assessment of the Company's internal control over financial reporting, as stated in their report which is included herein... -

Page 27

... and 2005, and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2006 and our report dated February 26, 2007 expressed an unqualified opinion thereon. Kansas City, Missouri February 26, 2007 p a g e 25 -

Page 28

... material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial... -

Page 29

...equipment, at cost: Land Buildings Leasehold improvements Furniture, fixtures and equipment Vehicles Accumulated depreciation and amortization Net property and equipment Notes receivable...: Accounts payable Self insurance reserves Accrued payroll Accrued benefits and withholdings Deferred income taxes... -

Page 30

..., including warehouse and distribution expenses Gross profit Operating, selling, general and administrative expenses Operating income Other income (expense): Interest expense Interest income Other, net Total other income (expense) Income before income taxes and cumulative effect of accounting change... -

Page 31

...2-for-1 stock split Issuance of common stock under employee benefit plans Issuance of common stock under stock option plans Tax benefit of stock options exercised Share based compensation Net income b a l a n c e at d e c e m b e r 3 1 , 2 0 0 5 Issuance of common stock under employee benefit plans... -

Page 32

... change Depreciation and amortization Deferred income taxes Share based compensation programs Tax benefit of stock options exercised Other Changes in operating assets and liabilities: Accounts receivable Inventory Accounts payable Other Net cash provided by operating activities $178,085 $164,266... -

Page 33

... professional installer throughout Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, North Carolina, North Dakota, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Virginia, Wisconsin and Wyoming... -

Page 34

..., are charged to operations as incurred. Share-Based Compensation Plans The Company currently sponsors share-based employee benefit plans and stock option plans. Please see Note 9 for further information concerning these plans. In the first quarter of 2006, the Company adopted Statement of Financial... -

Page 35

... under the Company's employee stock option plan, director stock option plan, stock issued through the Company's employee stock purchase plan and stock awarded to employees through other benefit programs. Prior to January 1, 2006, the Company accounted for share based payments using the intrinsic... -

Page 36

... hard parts, maintenance items, accessories and tools. During the fourth quarter of 2004, the Company changed its method of applying its LIFO accounting policy for inventory costs. Under the new method, the Company has included in inventory certain procurement, warehousing and distribution center... -

Page 37

... stock split for all periods presented. n ot e 5 - re l at e d pa rt i e s The Company leases certain land and buildings related to forty-eight of its O'Reilly Auto Parts stores under six-year operating lease agreements with O'Reilly Investment Company and O'Reilly Real Estate Company, partnerships... -

Page 38

..., results of operations or cash flows of the Company. n ot e 9 - s h a re - b a s e d e m p l oy e e c o m pe n s at i o n p l a n s Stock Options The Company's employee stock based incentive plan provides for the granting of stock options to certain key employees of the Company for the purchase... -

Page 39

...employee stock option plan and director stock option plan, respectively. For the year ended December 31, 2006, the Company recognized stock option compensation expense related to these plans of $2,762,000 and a corresponding income tax benefit of $1,019,000. The fair value of each stock option grant... -

Page 40

... based on the market price of the Company's common stock on the date of grant and compensation cost is recorded over the vesting period. The Company recorded $416,000 of compensation cost for this plan for the year ended December 31, 2006 and recognized a corresponding income tax benefit of $154,000... -

Page 41

...of Directors adopted a shareholder rights plan whereby one right was distributed for each share of common stock, par value $.01 per share, of the Company held by stockholders of record (the "Rights") as of the close of business on May 31, 2002. The Rights initially entitle stockholders to buy a unit... -

Page 42

...86,803 2004 $ 65,708 4,355 $ 70,063 Federal income taxes at statutory rate State income taxes, net of federal tax benefit Other items, net The Company's provision for income taxes for 2005 included a non-cash tax adjustment of $6.1 million in the third quarter of 2005 resulting from the favorable... -

Page 43

...Services Joe Hankins Director of Store Design Billy Harris Director of Iowa and Nebraska Region Doy Hensley Director of Store Support Services Doug Hopkins Director of Distribution Systems Jack House Director of Customer Services Chad Keel Director of St. Louis Region Brad Knight Director of Pricing... -

Page 44

... Installer Marketing Manager Steve Lines Sales Training Manager Jim Litchford Jobber Regional Field Sales Manager James Lovelace Regional Field Sales Manager Deirdre Luscombe Eastern Division Human Resources Manager Jeff Main Jobber Systems Sales Manager Harry Marcley Distribution Center Manager Ed... -

Page 45

... Acquisition Manager Arnulfo Vega Regional Field Sales Manager Darin Venosdel Application Development Manager Rob Verch Product Manager II Patton Walden Midstate Division Training Manager Lane Wallace Pricing Manager Susan Weaver Human Resources Records/Benefits Manager Sherry Webb Accounts Payable... -

Page 46

... Ave in Springfield, Missouri. Shareholders of record as of February 28, 2007, will be entitled to vote at this meeting. market prices and d i v i d e n d i n f o r m at i o n The prices in the table below represent the high and low sales price for O'Reilly Automotive, Inc. common stock as reported... -

Page 47

... supplier of auto parts in our market areas by offering our retail customers, professional installers and jobbers the best combination of inventory, price, quality and service; providing our team members with competitive wages and benefits, and working conditions which promote high achievement... -

Page 48

233 south paterson springfield, missouri 65802 417.862.3333 www.oreillyauto.com