National Grid 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

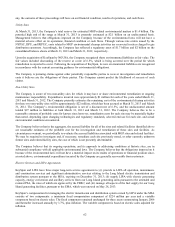

Note 15. Discontinued Operations

On December 8, 2010, NGUSA and Liberty Energy entered into a stock purchase agreement which was subsequently

amended and restated on January 21, 2011, pursuant to which NGUSA sold and Liberty Energy purchased all of the

common stock of Granite State and EnergyNorth. The sale of Granite State and EnergyNorth was consummated on July

3, 2012 for proceeds of $294 million.

On September 23, 2011, National Grid Development Holdings Corp., a wholly-owned subsidiary of KeySpan, entered

into a purchase agreement to sell all of its outstanding membership interest in Seneca to PDC Mountaineer, LLC. The

sale was completed on October 3, 2011 for proceeds of $163 million with a related gain on sale of investment of $99

million recorded in the quarter ended December 31, 2011. The Company recorded a $30 million reserve at March 31,

2012 for post-closing due diligence against which $30 million was subsequently applied.

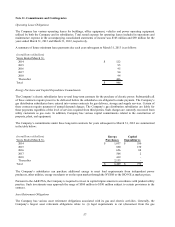

The information below highlights the major classes of revenues and expenses of Granite State, EnergyNorth, and Seneca

for the years ended March 31, 2013 and March 31, 2012:

2013 2012

(Revised)

Revenues 37$ 219$

Operat ing expenses:

Fuel and purchase power 16 117 (1)

Operat ions and maintenance 79

Operat ing taxes 210

Operating income 12 83

Other deductions -(1)

(Loss) gain on sale of discontinued operat ions (34) 99

Income tax (benefit) expense (15) 76

Net (loss) income from discontinued operations (7)$ 105$

March 31,

(in millions of dollars)

(1) Includes $36 million Ravenswood transfer tax contingency now resolved, as discussed in Note 11, “Commitments and Contingencies.”

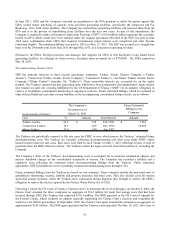

Note 16. Subsequent Event

During June 2013, the Company entered into a new bank loan for $762.6 million. This 18-month loan contains an option

to extend for a further year. The loan was originally borrowed in sterling, but swapped to USD at a fixed rate of

1.1325%.