National Grid 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

Holding Company Charges

NGUSA receives charges from National Grid Commercial Holdings Limited, an affiliated company in the UK, for

certain corporate and administrative services provided by the corporate functions of National Grid plc to its US

subsidiaries. For the years ended March 31, 2013 and March 31, 2012, the effect on net income was $40 million before

tax and $26 million after tax.

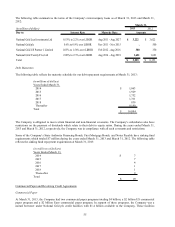

Note 13. Preferred Stock

Preferred stock of NGNA subsidiaries

The Company’ s subsidiaries have certain issues of non-participating preferred stock, some of which provide for

redemption at the option of the Company. A summary of the preferred stock of the Company’ s subsidiaries at March 31,

2013 and March 31, 2012 is as follows:

March 31,

March 31,

Call

Series Company 2013 2012 2013 2012 Price

(in millions of dollars, except per share and number of shares data)

$100 par value -

3.40% Series Niagara Mohawk

57,524

57,524

6

$

6$ 103.500$

3.60% Series Niagara Mohawk

137,152

137,152

14

14 104.850

3.90% Series Niagara Mohawk

95,171

95,171

9

9 106.000

4.44% Series Massachusetts Electric

22,585

22,585

2

2 104.068

6.00% Series NEP

11,117

11,117

1

1 Noncallable

$50 par value -

4.50% Series Narragansett

49,089

49,089

3

3 55.000

Golden Shares -

Niagara Mohawk and

KeySpan subsidiaries

33-- Noncallable

Total 372,641 372,641 35$ 35$

Shares

Outstanding Amount

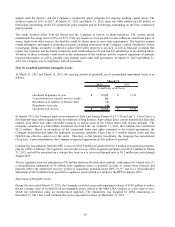

In connection with the acquisition of KeySpan by NGUSA, each of the Company’ s New York subsidiaries became subject to

a requirement to issue a class of preferred stock having one share (the “Golden Share”), subordinate to any existing preferred

stock. The holder of the Golden Share would have voting rights that limit the Company’ s right to commence any voluntary

bankruptcy, liquidation, receivership or similar proceeding without the consent of the holder of the Golden Share. The

NYPSC subsequently authorized the issuance of the Golden Share to a trustee, GSS Holdings, Inc. (“GSS”), who will hold

the Golden Share subject to a Services and Indemnity Agreement requiring GSS to vote the Golden Share in the best interests

of New York State. On July 8, 2011, the Company issued a total of 3 Golden Shares pertaining to Niagara Mohawk,

Brooklyn Union, and KeySpan Gas East each with a par value of $1.

Note 14. Stock-Based Compensation

The Remuneration Committee determines remuneration policy and practices with the aim of attracting, motivating and

retaining high caliber Executive Directors and other senior employees to deliver value for shareholders, high levels of

customer service, and safety and reliability in an efficient and responsible manner. As such, the Remuneration

Committee has established a Long-Term Performance Plan (“LTPP”) which is designed to drive medium to long-term

performance, aligning key strategic objectives to shareholder interests. The LTPP replaces the previous Performance

Share Plan (“PSP”). Both plans issue performance based restricted stock units (“RSU”s) which are granted in the

Parent’ s common stock traded on the London Stock Exchange for UK-based directors and employees or the Parent’ s

American Depository Receipts traded on the New York Stock Exchange for US-based directors and employees. Both

plans have a performance period of three years and have been approved by the Company’ s Remuneration Committee.

As of May 15, 2013, the number of ordinary shares issued was 3.8 billion and 127,142,880 were held as treasury shares.

The aggregate dilution resulting from executive share-based incentives will not exceed 5% in any 10-year period for