National Grid 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

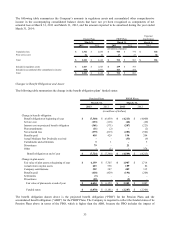

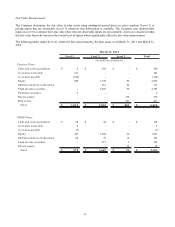

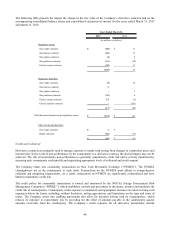

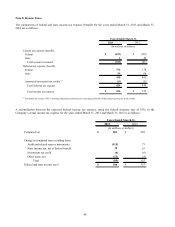

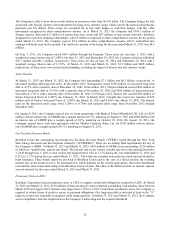

The following table presents the Company’ s derivative assets and liabilities at March 31, 2013 and March 31, 2012 that

are included in the accompanying consolidated balance sheets for the above contracts:

2013 2012 2013 2012

Current assets: Current liabilities:

Rate recoverable contracts: Rate recoverable contracts:

Gas swaps contracts 15$ 19$ Gas swaps contracts 6$ 59$

Gas futures contracts 11 Gas futures contracts 222

Gas options contracts 11 Gas options contracts -3

Gas purchase contracts 15 18 Gas purchase contracts 312

Electric swaps contracts 18 1 Electric swaps contracts -37

Gas swaps contracts -- Gas swaps contracts -1

Hedge contracts: Hedge contracts:

Fair value hedge contracts -1 Fair value hedge contracts -1

Cash flow hedge contracts 11 11 Cash flow hedge contracts --

61 52 11 135

Deferred assets: Deferred liabilities:

Rate recoverable contracts: Rate recoverable contracts:

Gas swaps contracts 1- Gas swaps contracts -7

Gas futures contracts 2- Gas futures contracts -6

Gas purchase contracts 440 Gas purchase contracts 719

Electric swaps contracts 6- Electric swaps contracts 13

Hedge contracts: Hedge contracts:

Fair value hedge contracts 12 Fair value hedge contracts --

Cash flow hedge contracts -- Cash flow hedge contracts 87 22

14 42 95 57

Total 75$ 94$ Total 106$ 192$

Asset Derivatives Liability Derivatives

(in millions of dollars) (in millions of dollars)

March 31, March 31,

Contracts not subject to rate recovery: Contracts not subject to rate recovery:

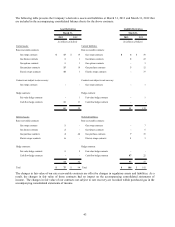

The changes in fair value of our rate recoverable contracts are offset by changes in regulatory assets and liabilities. As a

result, the changes in fair value of those contracts had no impact on the accompanying consolidated statements of

income. The changes in fair value of our contracts not subject to rate recovery are recorded within purchased gas in the

accompanying consolidated statements of income.