National Grid 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

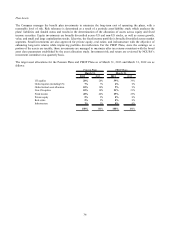

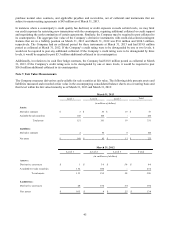

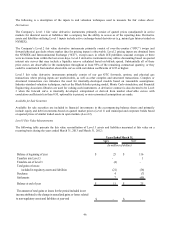

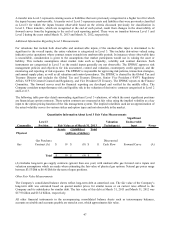

Level 1 investments. For investments in commingled funds that are not publicly traded and have ongoing subscription

and redemption activity, the fair value of the investment is the net asset value (“NAV”) per fund share, derived from the

underlying securities’ quoted prices in active markets, and they are classified as Level 2 investments. Investments in

commingled funds with redemption restrictions and that use NAV are classified as Level 3 investments.

Global Tactical Asset Allocation

Assets held in global tactical asset allocation funds are managed by investment managers who use both top-down and

bottom-up valuation methodologies to value asset classes, countries, industrial sectors, and individual securities in order

to allocate and invest assets opportunistically. If the inputs used to measure a financial instrument fall within different

levels of the fair value hierarchy within the commingled fund, the categorization is based on the lowest level input that is

significant to the measurement of that financial instrument. The assets invested through commingled funds are classified

as Level 2. Those which are open ended mutual funds are classified as Level 1 and have observable pricing. However,

the underlying Level 3 assets that makeup these funds are classified in the same category as the investments to which

they relate.

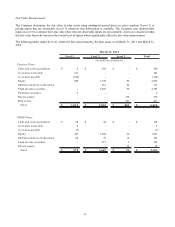

Fixed Income Securities

Fixed income securities (which include corporate debt securities, municipal fixed income securities, US Government and

Government agency securities including government mortgage backed securities, index linked government bonds, and

state and local bonds) convertible securities, and investments in securities lending collateral (which include repurchase

agreements, asset backed securities, floating rate notes and time deposits) are valued with an institutional bid valuation.

A bid valuation is an estimated price at which a dealer would pay for a security (typically in an institutional round lot).

Oftentimes, these evaluations are based on proprietary models which pricing vendors establish for these purposes. In

some cases there may be manual sources when primary vendors do not supply prices. Fixed income investments are

primarily comprised of fixed income securities and fixed income commingled funds. The prices for direct investments in

fixed income securities are generated on a daily basis. Prices generated from less active trading with wider bid ask prices

are classified as Level 2 investments. If prices are based on uncorroborated and unobservable inputs, then the

investments are classified as Level 3 investments. Commingled funds with publicly quoted prices and active trading are

classified as Level 1 investments. For commingled funds that are not publicly traded and have ongoing subscription and

redemption activity, the fair value of the investment is the NAV per fund share, derived from the underlying securities’

quoted prices in active markets, and are classified as Level 2 investments. Investments in commingled funds with

redemption restrictions and that use NAV are classified as Level 3 investments.

Private Equity and Real Estate

Commingled equity funds, commingled special equity funds, limited partnerships, real estate, venture capital and other

investments are valued using evaluations (NAV per fund share), based on proprietary models, or based on the net asset

value.

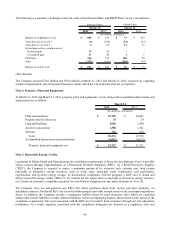

Investments in private equity and real estate funds are primarily invested in privately held real estate investment

properties, trusts, and partnerships as well as equity and debt issued by public or private companies. The Company’ s

interest in the fund or partnership is estimated based on the NAV. The Company’ s interest in these funds cannot be

readily redeemed due to the inherent lack of liquidity and the primarily long-term nature of the underlying assets.

Distribution is made through the liquidation of the underlying assets. The Company views these investments as part of a

long-term investment strategy. These investments are valued by each investment manager based on the underlying

assets. The funds utilize valuation techniques consistent with the market, income, and cost approaches to measure the fair

value of certain real estate investments. The majority of the underlying assets are valued using significant unobservable

inputs and often require significant management judgment or estimation based on the best available information. Market

data includes observations of the trading multiples of public companies considered comparable to the private companies

being valued. As a result, the Company classifies these investments as Level 3 investments.

While management believes its valuation methodologies are appropriate and consistent with other market participants,

the use of different methodologies or assumptions to determine the fair value of Level 3 financial instruments could

result in a different fair value measurement at the reporting date.