National Grid 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

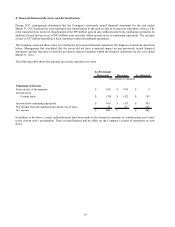

29

On February 22, 2013, a joint proposal was filed with the NYPSC that memorialized an agreement between Staff and

Brooklyn Union for a two year rate settlement covering Brooklyn Union’ s rate years ending December 31, 2013 and

December 31, 2014. On June 13, 2013, the NYPSC issued an order adopting the settlement. As a result, Brooklyn

Union’ s revenue requirements for calendar years 2013 and 2014 have changed as follows: (i) there is no change in base

delivery rates, other than those previously approved by the NYPSC in the rate plan, (ii) the allowed ROE has decreased

from 9.8% to 9.4%, and (iii) the common equity ratio in the capital structure has increased from 45% to 48%.

Additionally, the joint proposal provides that 80% of any earnings above the 9.4% allowed return will be applied as a

credit to Brooklyn Union’ s SIR balance for the benefit of customers.

Carrying Charges

During fiscal year 2013, the New York Gas Companies received an order from the NYPSC relating to SIR, requiring that

carrying charges on SIR related balances be calculated net of deferred taxes. As a result, management concluded that all

of its carrying charges should be calculated in the same manner and recognized impairment on existing carrying charges

deferred within regulatory assets of $62.7 million and derecognized existing carrying charges accrued within regulatory

liabilities of $32.2 million.

Other Regulatory Matters

In June 2009, the New York Gas Companies made a compliance filing with the NYPSC regarding the implementation of

the Temporary State Assessment. The NYPSC authorized recovery of the revenues required for payment of the

Temporary State Assessment subject to reconciliation over five years, July 1, 2009 through June 30, 2014. On June 14,

2013, the New York Gas Companies submitted a compliance filing proposing to maintain the currently effective

combined surcharge of $38.9 million for the July 1, 2013 through June 30, 2014 collection period. The New York Gas

Companies had a combined deferred payable balance related to the Temporary State Assessment in the amount of $12.7

million at March 31, 2013. The New York Gas Companies had a combined deferred receivable balance related to the

Temporary State Assessment in the amount of $4.6 million at March 31, 2012.

In February 2011, the NYPSC selected Overland Consulting Inc., a management consulting firm, to perform a

management audit of NGUSA’ s affiliate cost allocation, policies and procedures. The audit of these service company

charges sought to determine if any service company transactions have resulted in unreasonable costs to New York

customers for the provision of delivery service. A final report was provided to the New York Gas Companies by the

NYPSC in October 2012. In its January 16, 2013 Order Directing Submission of Implementation Plan and Establishing

Further Findings, the NYPSC disclosed the findings of the Overland Audit of the affiliate cost allocations, policies and

procedures of NGUSA’ s service companies as applicable to its New York utilities. The final audit report concluded that

the New York Gas Companies were overcharged $35.5 million in service company related costs. The New York Gas

Companies dispute the audit conclusions as they believe that sampling amounts found by Overland to be in error should

not have been extrapolated to the larger population. The NYPSC has ordered that further proceedings be conducted to

address the New York Gas Companies’ disagreement with the testing results and statistical extrapolation. Reserves of

$5.0 million and $15.0 million have been recorded in KeySpan Gas East Corporation’ s and Brooklyn Union Gas

Company’ s financial statements, respectively.

On December 2009, the NYPSC adopted the terms of a Joint Proposal between Staff and the New York Gas Companies

that provided for a RDM to take effect as of January 1, 2010. The RDM applies only to the New York Gas Companies’

firm residential heating sales and transportation customers, and permits the New York Gas Companies to reconcile actual

revenue per customer to target revenue per customer for the affected customer classes on an annual basis. The RDM is

designed to eliminate the disincentive for the New York Gas Companies to implement energy efficiency programs by

breaking the link between sales volumes and revenues. The New York Gas Companies had deferred receivable balances

related to the RDM in the amount of $3.7 million at March 31, 2013. Payable balances are fully refundable and

receivable balances fully recoverable from the affected customer class.

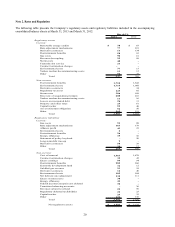

Boston Gas and Colonial Gas (the “Massachusetts Gas Companies”)

In November 2010, the DPU issued an order in the Massachusetts Gas Companies’ 2010 rate case approving a combined

revenue increase of $58 million based upon a 9.75% ROE and a 50% equity ratio. In November 2010, the Massachusetts

Gas Companies filed two motions in response to the DPU’ s November 2010 rate order, whereby in its motion for

recalculation, the Massachusetts Gas Companies had requested that the DPU recalculate certain adjustments that it made

in determining the $58 million increase approved in its order, which would have resulted in an additional $10.4 million