National Grid 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

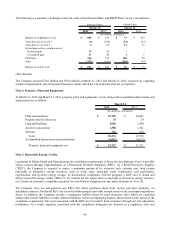

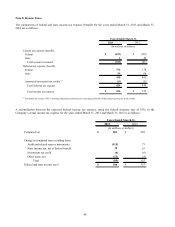

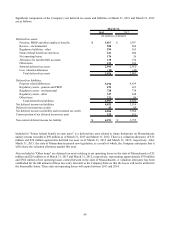

Note 8. Income Taxes

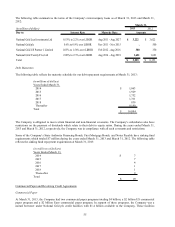

The components of federal and state income tax expense (benefit) for the years ended March 31, 2013 and March 31,

2012 are as follows:

2013 2012

Current tax expense (benefit):

Federal $ (323) $ (129)

State 548

Total current tax benefit (318) (81)

Deferred tax expense (benefit):

Federal 376 378

State 54 64

430 442

Amortized investment tax credits

(1)

(6) (6)

Total deferred tax expense 424 436

Total income tax expense $ 106 $ 355

Years Ended March 31,

(in millions of dollars)

(1) Investment tax credits ("ITC") are being deferred and amortized over the depreciable life of the property giving rise to the credits.

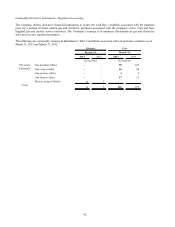

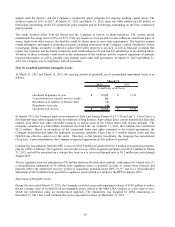

A reconciliation between the expected federal income tax expense, using the federal statutory rate of 35%, to the

Company’ s actual income tax expense for the years ended March 31, 2013 and March 31, 2012 is as follows:

2013 2012

Computed tax 201$ 230$

Change in computed taxes resulting from:

Audit and related reserve movements (115) 73

39 63

Investment tax credit (6) (6)

Other items, net (13) (5)

Total (95) 125

Federal and state income taxes 106$ 355$

State income tax, net of federal benefit

Years Ended March 31,

(in millions of dollars)