National Grid 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

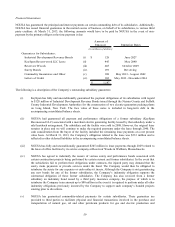

executive share-based incentives and will not exceed 10% in any 10-year period for all employee incentives. This is

reviewed by the Remuneration Committee and currently, the Company has excess headroom of 4.07% and 7.75%

respectively.

The number of units within each award is subject to change depending upon the Company’ s ability to meet the stated

performance targets. Under the LTPP, performance conditions are split into three parts as follows: (i) 50% of the units

awarded are subject to annualized growth in the Company’ s earnings per share (“EPS”) over a general index of retail

prices over a period of three years; (2) 25% of the units awarded will vest based upon the Company’ s Total Shareholder

Return (“TSR”) compared to that of the Financial Times Stock Exchange (“FTSE”) 100 over a period of three years; and

(3) 25% of the units awarded are subject to the average achieved regulatory ROE. Under the PSP, performance

conditions are split into two parts as follows: (1) 50% of the units awarded are subject to annualized growth in the

Company’ s EPS over a general index of retail prices over a period of three years; and (2) 50% of the units awarded will

vest based upon the Company’ s TSR compared to that of the FTSE 100 over a period of three years. Units under both

plans generally vest at the end of the performance period.

Fair value of the performance restricted stock of the PSP units is calculated at the end of each fiscal year. Fair value for

the LTPP awards is calculated as of the grant date and at the end of each period. A Monte Carlo simulation model has

been used to estimate the fair value for the TSR portion of the awards. For the EPS and ROE portions of the awards, the

fair value of the award is determined using the stock price as quoted per the London Stock Exchange or the price for the

American Depository Shares as quoted on the New York Stock Exchange as of the earlier of the reporting date or vesting

date.

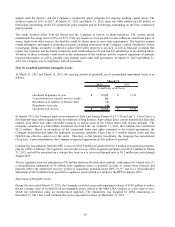

The following table represents the assumptions used to calculate the fair value of the TSR portion of the awards:

Expected volatility

12.72% - 14.48%

Expected term 3 years

Risk free rates 0.07% - 0.26%

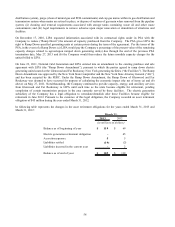

The EPS portions of the PSP and LTTP awards and the ROE portion of the LTTP awards are classified as liability

awards as they are each indexed to a factor that is not a market, performance, or service condition. Therefore, the

changes in the fair value of the EPS portions of the PSP and EPS and ROE portions of the LTTP awards are reflected

within net income. The TSR portions of the PSP and LTTP awards are classified as equity awards as they are indexed to

market conditions, and are expensed over the performance period.

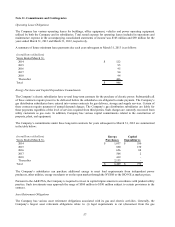

The following table summarizes the stock based compensation expense recognized by the Company for the years ended

March 31, 2013 and March 31, 2012:

Units

Nonvested as of March 31, 2011 1,081,801 45.42$

Vested 179,612 53.92

Granted 310,468 42.19

Forfeited/Cancelled 197,117 51.26

Nonvested as of March 31, 2012 1,015,540 42.19

Vested 119,468 45.53

Granted 272,274 48.29

Forfeited/Cancelled 222,401 42.97

Nonvested as of March 31, 2013 945,945 40.36$

Weighted

Average Grant

Date Fair Value

The total expense recognized for unvested awards was $24.7 million and $12.3 million for the years ended March 31,

2013 and March 31, 2012 respectively, and will vest over three years. The total tax benefit recorded was approximately

$9.9 million and $4.9 million as of March 31, 2013 and March 31, 2012 respectively. Total expense expected to be

recognized by the Company in future periods for unvested awards outstanding as of March 31, 2013 is $9.0 million, $5.2

million, and $1.0 million for the years ended March 31, 2014, 2015, and 2016 respectively.