National Grid 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

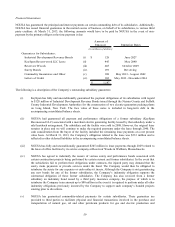

marketing activities. The guarantees cover actual purchases by these subsidiaries that are still outstanding

as of March 31, 2013.

(vi) NGUSA has arranged for stand-by letters of credit to be issued to third parties that have extended credit to

certain subsidiaries. Certain vendors require the Company to post letters of credit to guarantee subsidiary

performance under their contracts and to ensure payment to our subsidiary subcontractors and vendors

under those contracts. Certain of our vendors also require letters of credit to ensure reimbursement for

amounts they are disbursing on behalf of our subsidiaries, such as to beneficiaries under our self-funded

insurance programs. Such letters of credit are generally issued by a bank or similar financial institution.

The letters of credit commit the issuer to pay specified amounts to the holder of the letter of credit if the

holder demonstrates that we have failed to perform specified actions. If this were to occur, the Company

would be required to reimburse the issuer of the letter of credit.

As of the date of this report, the Company has not had a claim made against it for any of the above guarantees and we

have no reason to believe that the Company’ s subsidiaries or former subsidiaries will default on their current obligations.

However, we cannot predict when or if any defaults may take place or the impact any such defaults may have on our

consolidated results of operations, financial position, or cash flows.

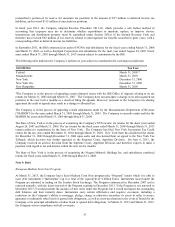

The Company has guaranteed $210 million of an $800 million Millennium Pipeline construction loan. The $210 million

represents the Company’ s proportionate share of the $800 million loan based on the Company’ s 26.25% ownership

interest in the Millennium Pipeline project.

Transfer Tax

As a condition of the acquisition by NGUSA of KeySpan in 2007, NGUSA was required to divest the acquired

Ravenswood merchant generating unit, and completed the disposal in August 2008. Ravenswood was accounted for as a

business held for sale, which required NGUSA to record Ravenswood at fair value, including valuing at approximately

$36 million certain contingencies relating to potential disposal costs where there was uncertainty as to whether they

would be payable. These contingencies have been resolved through the expiration of the relevant statute of limitations,

resulting in no payments being necessary. As a result, a gain of $36 million was recorded in fiscal 2012 within net

income from discontinued operations in the accompanying consolidated statements of income.

Legal Matters

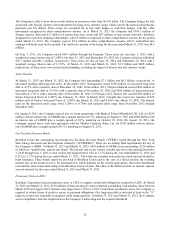

A collective and class action lawsuit has been filed by Local 1049 and its members alleging violations of the Fair Labor

Standards Act and the New York Labor Law as a result of the payroll irregularities that occurred after the Company’ s

implementation in November 2012 of its back office financial system. The lawsuit has been discontinued and settled in

the amount of approximately $1.9 million pursuant to agreement between Local 1049 and the Company.

In addition to the above matter, the Company is subject to various legal proceedings, primarily injury claims, arising out

of the ordinary course of its business. Except as described below, the Company does not consider any of such

proceedings to be material, individually or in the aggregate, to its business or likely to result in a material adverse effect

on its results of operations, financial position, or cash flows.

Environmental Matters

The normal ongoing operations and historic activities of the Company are subject to various federal, state and local

environmental laws and regulations. Under federal and state Superfund laws, potential liability for the historic

contamination of property may be imposed on responsible parties jointly and severally, without regard to fault, even if

the activities were lawful when they occurred.

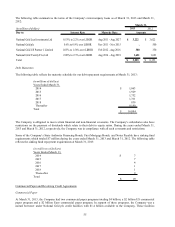

During the year ended March 31, 2012, Brooklyn Union received new information concerning the proposed remediation

plans for a site in downstate New York which resulted in Brooklyn Union increasing its environmental reserve by

approximately $107 million. During the year ended March 31, 2013, Brooklyn Union increased its environmental reserve

by approximately $17 million. After recording an offsetting increase in regulatory assets relating to environmental

remediation, there was no impact to the net assets of the Company.