Mitsubishi 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

new plants and commencing production at joint venture com-

panies. We expect these efforts to deliver steady results, and we

will push forward with measures to bolster sales and pro ts in

emerging markets, centering on Asia.

We will accelerate structural reform efforts in mature mar-

kets with the aim of improving pro ts. In Japan, we aim to

develop the minicar business further through NMKV, our joint

venture with Nissan Motor Company that designs and develops

minicars. At the same time, we will work towards improving

sales ef ciency and pro tability by narrowing the number

of models and expanding sales volume per model. In North

America, we aim to improve production ef ciency at U.S. plants

by manufacturing vehicles for export. In Europe, where we

lowered xed costs and improved pro tability through the 2012

sale of production subsidiary Netherlands Car B.V. (NedCar), we

will work to recover sales volume and expand pro ts by maxi-

mizing the effect of the introduction of major models such as

the new Triton.

Restructure Operations

We will move aggressively forward with reforms to operating

structure. Speci cally, we aim to achieve an optimal balance

in our global production capacity. On the one hand, we will

expand production in emerging markets, where demand is

expected to grow. In mature markets, on the other hand, we

intend to maintain adequate capacity while moving forward

with streamlining our plants and introducing next-generation

production technology. We expect our overseas production ratio

to grow as a result of these moves. Meanwhile, in Japan we are

increasing the utilization rate at the Mizushima Plant, which is

the base of minicar manufacturing through projects carried out

by NMKV—our minicar planning and development joint venture

with Nissan Motor. We will also move ahead proactively with

effective use of resources through business partnerships.

In addition, we are cutting costs by reorganization and inte-

grating our car lines. By reducing the number of previous-gener-

ation and region-speci c models, we plan to reduce our number

of platforms from nine as of scal 2013 to seven by the end of

scal 2016, and decrease the number of models from 18 to 13

over that period. We expect to reduce xed costs, in particular,

by augmenting sales volume per model and per platform.

We will continue with activities aimed at curtailing total

costs under a committee controlled directly by the president

that has been achieving steady results. Through these efforts,

we aim to lower groupwide costs by scal 2016 by around

¥110 billion compared with scal 2013 levels.

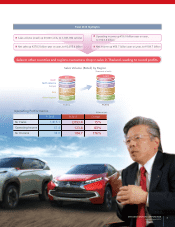

Sales Volume Target (Retail)

(Thousands of units)

FY2013 (Actual): 110

FY2016 (Target): 160

Europe z Improve protability

through reduction in

xed cost by selling

production facilities

z Maximize the effect of

new global model

launches including

new Triton

Sales Volume Target (Retail)

(Thousands of units)

FY2013 (Actual): 90

FY2016 (Target): 110

Russia & others z Expand sales, mainly in

strategic models such as SUVs

and pickup trucks

z Reduce costs by increasing

local production

Sales Volume Target

(Retail)

(Thousands of units)

FY2013 (Actual): 100

FY2016 (Target): 200

China & others z Shift to full production

at GAC Mitsubishi

Motors Co., Ltd.

(GMMC)

z Develop and enhance

sales network

Sales Volume Target (Retail)

(Thousands of units)

FY2013 (Actual): 240

FY2016 (Target): 390

ASEAN z Achieve goals set in ASEAN Challenge 12*1 and develop business

further in ve major ASEAN countries*2

z Reinforce business in the Philippines as a core market following

Thailand and Indonesia

*1: 360,000 units are to be sold in ve major ASEAN countries in scal 2015

*2: Thailand, Indonesia, the Philippines, Malaysia and Vietnam

Sales Volume Target (Retail)

(Thousands of units)

FY2013 (Actual): 140

FY2016 (Target): 150

Japan z Develop the minicar

business through NMKV

z Reduce the number of

models and increase

sales volume per model

Sales Volume Target (Retail)

(Thousands of units)

FY2013 (Actual): 100

FY2016 (Target): 150

North America z Revitalize sales network by

launching new models

z Improve production efciency

by exporting Outlander Sport

from U.S. factory

Regional Initiatives

MITSUBISHI MOTORS CORPORATION

Annual Report 2014 13