Lululemon 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

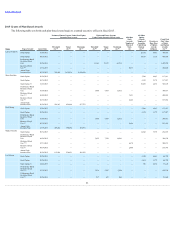

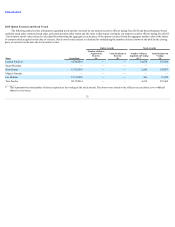

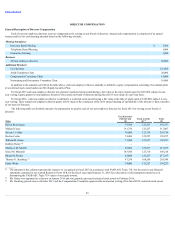

Termination Scenario

Stock Options

Performance-Based Restricted Stock Units (PSUs)

Restricted Shares

Restricted Stock Units

(RSUs)

Other Termination

All options may be exercised

within 90 days to the extent

they were exercisable at the

time of termination.

In the event of the participant's voluntary

termination, all PSUs are immediately forfeited.

In the event of termination without cause for

PSUs granted before September 2012, on the PSU

vesting date, the number of PSUs that become

fully vested is equal to the number of PSUs that

would have become vested if no termination had

occurred, multiplied by a percentage equal to the

number of full months of such participant's

service during the performance period to the total

number of full months contained in the

performance period.

In the event of termination without cause more

than 12 months before the end of the performance

period, all PSUs granted from September 2012

onward are immediately forfeited.

In the event of termination without cause within

12 months of the end of the performance period

for PSUs granted from September 2012 onward,

on the PSU vesting date the number of PSUs that

become fully vested is equal to the number of

PSUs that would have become vested if no

termination had occurred, multiplied by a

percentage equal to the number of full months of

such participant's service during the performance

period to the total number of full months

contained in the performance period.

All unvested shares of

restricted stock are

immediately forfeited.

All unvested RSUs are

immediately forfeited.

Change in Control

Board has discretion to

determine effect of change in

control.

If not assumed or substituted for, 100% of the

target number of PSUs become fully vested as of

the date of the change in control.

If the participant's service is terminated without

cause or for good reason within two years

following change in control, 100% of the target

number of PSUs become fully vested as of the

date of such termination.

Board has discretion to

determine effect of change in

control on unvested shares of

restricted stock.

If not assumed or substituted

for, 100% of the RSUs

become fully vested as of the

date of the change in control.

If the participant's service is

terminated without cause or

for good reason within two

years following change in

control, 100% of the RSUs

become fully vested as of the

date of such termination.

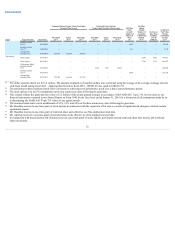

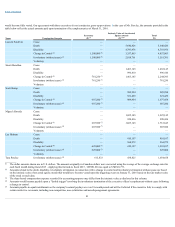

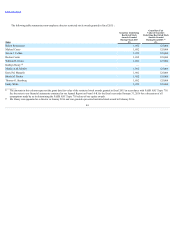

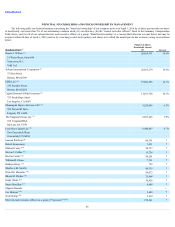

Potential Payments upon Termination of Employment and Change in Control

The following table sets forth the payments and the intrinsic value of accelerated equity awards that would be due to each of our named executive officers

upon the termination of his or her employment and upon a change in control. Except in the case of Ms. Poseley, our former Chief Product Officer, who was

terminated without cause and who ceased being an employee as of March 31, 2016, the amounts provided in the table below assume that each termination was

effective as of January 31, 2016 (the last day of our fiscal year) and are merely illustrative of the impact of hypothetical events, based on the terms of arrangements

then in effect. The amounts to be payable upon an actual termination of employment can only be determined at the time of such event, based on the facts and

circumstances then prevailing. Our named executive officers are not entitled to any payments following a change in control under the terms of their employment

agreements. Under the terms of our 2014 Equity Incentive Plan, the board of directors may take a number of actions with respect to outstanding equity awards in

connection with a change in control, including the acceleration of the unvested portion of equity awards or the cancellation of such outstanding awards in exchange

for substitute awards. For the purpose of the table below, except in the case of Ms. Poseley, we have assumed that in the case of termination of service in

connection with a change in control the executive would be involuntarily terminated without cause, the board of directors would elect to accelerate the unvested

portion of the outstanding stock options, restricted shares, restricted stock units, and 100% of the target number of PSUs

40