Lululemon 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

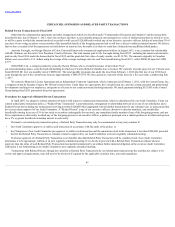

Agreements with Named Executive Officers

Laurent Potdevin

On December 1, 2013, we entered into an Executive Employment Agreement with our current Chief Executive Officer, Laurent Potdevin. Under the terms of

his employment agreement, Mr. Potdevin received an initial annual base salary of $900,000 which was subsequently adjusted to $1,025,000 for fiscal 2016 . Under

the terms of his employment agreement, Mr. Potdevin is eligible to receive an annual target performance bonus of 150% of his base salary for the applicable fiscal

year, if specified financial performance and individual performance goals are met for that year. Pursuant to the terms of his employment agreement, we granted Mr.

Potdevin 42,115 restricted shares, which vest in 1/3 installments on the three anniversary dates following the grant date of January 20, 2014. Mr. Potdevin also

received a signing bonus of $200,000 and a retention bonus of $1,650,000 as part of his employment agreement.

Mr. Potdevin agreed to serve as a director of lululemon and its affiliates, and will not be entitled to additional compensation for these positions. Upon the

termination of his employment agreement for any reason, Mr. Potdevin has agreed to resign from all these director positions. Mr. Potdevin has further agreed that,

while he is still employed by us, he will not serve as a director of more than two entities that are unrelated to lululemon, and has agreed to obtain the advance

consent of our board of directors prior to commencing any such service for an unrelated entity.

We will reimburse Mr. Potdevin for all reasonable out-of-pocket business-related expenses and he is entitled to participate in the employee benefit and fringe

benefit arrangements generally available to our senior executive employees. We also agreed to reimburse Mr. Potdevin for his reasonable moving and relocation

expenses incurred and to remit up to 45.8% of the tax due to the Canada Revenue Agency (or comparable U.S. Agency) on the relocation benefits on behalf of Mr.

Potdevin, which amount shall itself be grossed-up to account for any taxes associated with the grossed up amount. We also agreed to assist Mr. Potdevin with his

tax filings in Canada and the United States for the 2014 and 2015 tax filing years. With respect to the tax years ending December 31, 2014 and 2015, respectively,

we agreed to tax equalize the payments for Mr. Potdevin's base salary and bonus, according to the terms set out in his employment agreement.

Mr. Potdevin's employment may be terminated by Mr. Potdevin or by us at any time, with or without cause. In the event Mr. Potdevin voluntarily resigns or

we terminate his employment for cause, he will receive only his accrued base salary then in effect and benefits earned and payable as of the date of termination. In

the event we terminate Mr. Potdevin without cause or for good reason, and subject to his compliance with the surviving terms of his employment agreement and

his release of all employment-related claims he may have against us, he will be entitled to (i) 18 months of base salary, (ii) acceleration of vesting of all

performance-based restricted stock units held by Mr. Potdevin on a pro rata basis, and (iii) acceleration of vesting of all stock options held by Mr. Potdevin to the

extent such stock options were scheduled to vest on the next annual vesting date.

For purposes of Mr. Potdevin's employment agreement with us, termination "for cause" includes any of the following conduct by, or authorized or permitted

by, Mr. Potdevin:

• violation of any contractual or common law duty to the company;

• conviction or entry of a plea of nolo contendere for fraud, misappropriation or embezzlement, or any felony or crime of moral turpitude;

• acts or omissions constituting gross negligence, recklessness or willful misconduct with respect to Mr. Potdevin's obligations under his employment

agreement or otherwise relating to the business of company;

•material breach of his employment agreement; or

• failure to relocate his primary residence to the Vancouver, British Columbia, area within 120 days after a Canadian work permit and all other necessary

authorizations and approvals to work in Canada are granted.

In the event of any of the foregoing, Mr. Potdevin will have 15 days from receipt of written notice from us to cure the issue, if curable, which notice shall

specifically identify the applicable cause and how it shall be cured, and failure to timely effect such cure shall entitle us to terminate Mr. Potdevin's employment

for cause.

Stuart Haselden

On January 2, 2015, we entered into an Executive Employment Agreement with our current Chief Financial Officer and Executive Vice President,

Operations, Stuart Haselden. Mr. Haselden commenced serving as our Chief Financial Officer on February 2, 2015. Under the terms of his employment agreement,

Mr. Haselden received an initial annual base salary of CDN$575,000 and he is eligible to receive an annual target performance bonus of 75% of his base salary for

the applicable fiscal year, if specified financial performance and individual performance goals are met for that year. Mr. Haselden's annual base salary was

subsequently adjusted to USD$575,000 for fiscal 2015, and then adjusted to USD$625,000 in October 2015 in connection with the expansion of his role to include

certain operational aspects. Mr. Haselden's annual base salary was subsequently adjusted to USD $645,000 for fiscal 2016 . Mr. Haselden received a retention

bonus of $500,000 as part of his employment agreement. In addition, Mr. Haselden received a one-time

36