Lululemon 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

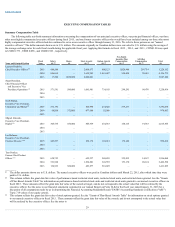

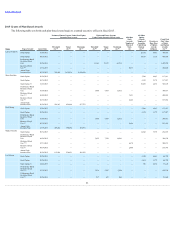

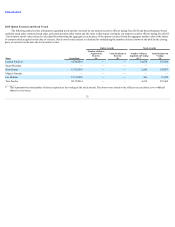

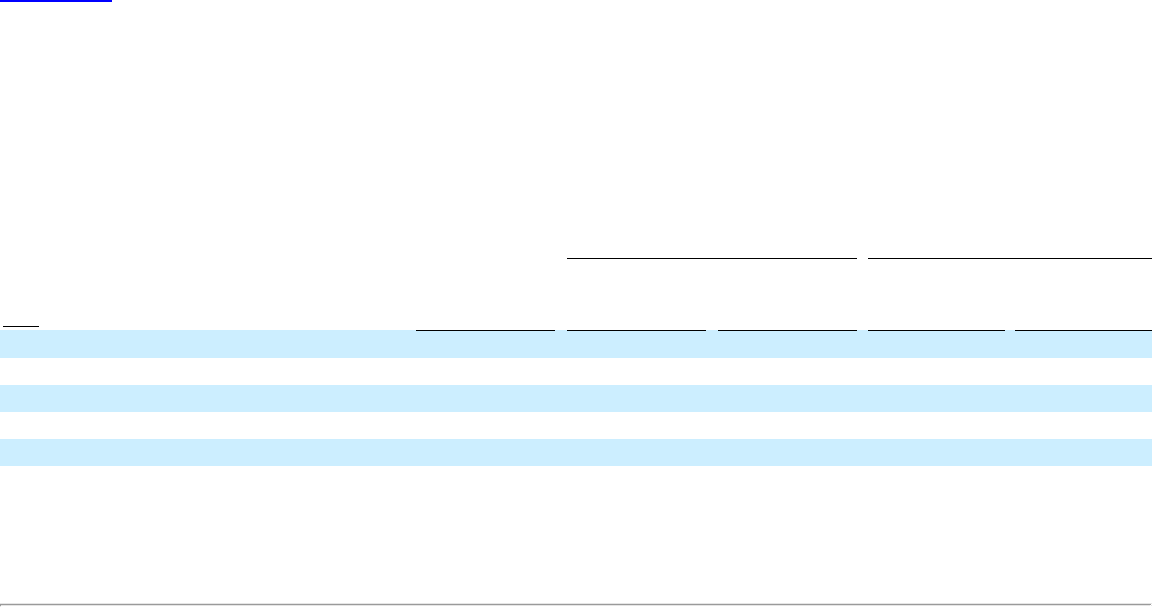

2015 Option Exercises and Stock Vested

The following table provides information regarding stock options exercised by our named executive officers during fiscal 2015 and the performance-based

restricted stock units, restricted stock units, and restricted shares that vested and the value realized upon vesting by our named executive officers during fiscal 2015

. Stock option award value realized is calculated by subtracting the aggregate exercise price of the options exercised from the aggregate market value of the shares

of common stock acquired on the date of exercise. Stock award value realized is calculated by multiplying the number of shares shown in the table by the closing

price of our stock on the date the stock awards vested.

Option Awards

Stock Awards

Name

Grant Date

Number of Shares

Acquired on

Exercise

(#)

Value Realized on

Exercise

($)

Number of Shares

Acquired on Vesting

(#) (1)

Value Realized on

Vesting

($)

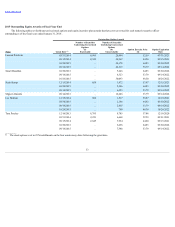

Laurent Potdevin

01/20/2014

—

—

14,038

785,426

Stuart Haselden

—

—

—

—

—

Scott Stump

12/15/2014

—

—

2,450

120,687

Miguel Almeida

—

—

—

—

—

Lee Holman

12/15/2014

—

—

306

15,074

Tara Poseley

09/15/2014

—

—

4,412

235,468

_________

(1) This represents the total number of shares acquired on the vesting of the stock awards. The shares were issued to the officers on a net basis as we withheld

shares to cover taxes.

35