Lululemon 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Communications with Directors

Stockholders may communicate with members of our board of directors by transmitting correspondence by mail, facsimile or email, addressed as follows:

Corporate Secretary

c/o lululemon athletica inc.

1818 Cornwall Avenue

Vancouver, British Columbia

Canada V6J 1C7

Facsimile: (604) 874-6124

Email: [email protected]

The Corporate Secretary will, as appropriate, forward communication to our board of directors or to any individual director, directors, or committee of our

board of directors to whom the communication is directed.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of the officers, directors and employees of lululemon and our subsidiaries. The

most current version is available on our website at www.lululemon.com. If we make any substantive amendments to the code or grant any waiver from a provision

of the code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website, as well as via any other means

required by Nasdaq rules or applicable law.

2014 "Say-on-Pay" Advisory Vote on Executive Compensation

We provided stockholders a "say-on-pay" advisory vote on our executive compensation at our 2014 annual meeting under Section 14A of the Securities

Exchange Act of 1934, as amended. At our 2014 annual meeting, stockholders expressed substantial support for the compensation of our named executive officers

(which term includes our chief executive officer, chief financial officer and each of our next three most highly compensated executive officers during a particular

fiscal year), with approximately 99% of the votes cast on the proposal voting for approval of the "say-on-pay" advisory vote on executive compensation. Based

upon the 2011 "say-on-frequency" advisory vote in which a majority of our voting stockholders approved an advisory vote on "say-on-pay" every three years, our

next "say-on-pay" advisory vote on executive compensation will be held at our 2017 annual meeting of stockholders.

The Compensation Committee considered the results of the 2014 "say-on-pay" advisory votes following the 2014 annual meeting. The Compensation

Committee also considered many other factors in evaluating our executive compensation programs as discussed in the Compensation Discussion and Analysis,

including the Compensation Committee's assessment of the interaction of our compensation programs with our corporate business objectives, evaluations of our

programs by the Compensation Committee's independent consultant and a review of market practices for a comparative group of peers. While each of these factors

bore weight on the Compensation Committee's decisions regarding the compensation arrangements of our named executive officers, the Compensation Committee

did not make any changes to our executive compensation policies and practices as a direct result of the 2014 "say-on-pay" advisory vote.

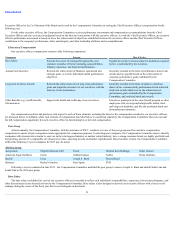

Risk Oversight

In its governance role, and particularly in exercising its duty of care and diligence, our board of directors is responsible for ensuring that appropriate risk

management policies and procedures are in place to protect the company's assets and business. While our board of directors has the ultimate oversight

responsibility for the risk management process, our board of directors has delegated to the Audit Committee the initial responsibility of overseeing the company's

risk assessment and risk management. In fulfilling its delegated responsibility, the Audit Committee has directed management to ensure that an approach to risk

management is implemented as a part of the day-to-day operations of lululemon, and to design internal control systems with a view to identifying and managing

material risks.

On a periodic basis (not less than quarterly), the Audit Committee reviews and discusses with our Chief Financial Officer, our Vice President, Corporate

Controller, and our internal auditors the company's significant financial risk exposures and the steps that management has taken to monitor, control, and report

such risks. In addition, the Audit Committee regularly evaluates the company's policies, procedures, and practices with respect to enterprise risk assessment and

risk management, including discussions with management about material risk exposures and the steps being taken to monitor, control, and report such risks. The

Audit Committee reports its activities to the full board of directors on a regular basis (not less than annually) and in that regard makes such recommendations to

our board of directors with respect to risk assessment and management as it may deem necessary or appropriate.

15