Lululemon 2015 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2015 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our board of directors has selected PricewaterhouseCoopers LLP , or PwC , as our independent registered public accounting firm to

audit the consolidated financial statements of lululemon for the fiscal year ending January 29, 2017 . PwC has acted in such capacity since its appointment in fiscal

2006. A representative of PwC is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and

is expected to be available to respond to appropriate questions.

Stockholder ratification of the selection of PwC as our independent registered public accounting firm is not required by our bylaws or otherwise. However,

the board of directors is submitting the selection of PwC to the stockholders for ratification as a matter of good corporate governance practice. If the stockholders

fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee at its

discretion may direct the selection of a different independent registered public accounting firm at any time during the year if it determines that such a change

would be in the best interests of lululemon and our stockholders.

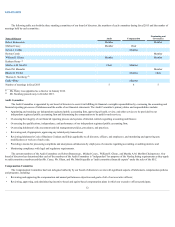

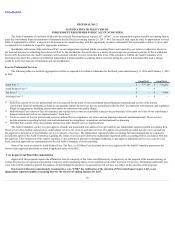

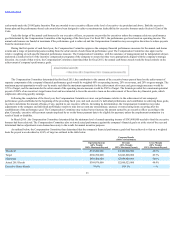

Fees for Professional Services

The following table sets forth the aggregate fees billed or expected to be billed to lululemon for the fiscal years ended January 31, 2016 and February 1, 2015

by PwC :

Fiscal 2015 Fiscal 2014

Audit Fees (1) $ 773,161 $ 750,262

Audit-Related Fees (2) $ — $ —

Tax Fees (3) $ — $ 9,900

All Other Fees (4) $ — $ —

__________

(1) Audit Fees consist of fees for professional services rendered for the audit of our consolidated annual financial statements and review of the interim

consolidated financial statements included in our quarterly reports and services that are normally provided by PwC in connection with statutory and regulatory

filings or engagements, including consent procedures in connection with public filings.

(2) Audit-Related Fees consist of fees for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated

financial statements and are not reported under "Audit Fees".

(3) Tax Fees consist of fees for professional services rendered for tax compliance, tax advice and tax planning (domestic and international). These services

include assistance regarding federal, state and international tax compliance, acquisitions and international tax planning.

(4) All Other Fees consist of fees for products and services other than the services reported above.

The Audit Committee's policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm.

These services may include audit services, audit-related services, tax services, and other services. Pre-approval is generally provided for up to one year and any

pre-approval is detailed as to the particular service or category of services. The independent registered public accounting firm and management are required to

periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this

pre-approval. The Chairperson of the Audit Committee is also authorized, pursuant to delegated authority, to pre-approve additional services on a case-by-case

basis, and such approvals are communicated to the full Audit Committee at its next meeting.

None of the services related to Audit-Related Fees, Tax Fees, or All Other Fees described above were approved by the Audit Committee pursuant to the

waiver of pre-approval provisions set forth in applicable rules of the SEC.

Vote Required and Board Recommendation

Approval of this proposal requires the affirmative vote of a majority of the votes cast affirmatively or negatively on the proposal at the annual meeting, as

well as the presence of a quorum representing a majority of all outstanding shares of our common stock, either in person or by proxy. Abstentions and broker non-

votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal.

Our board of directors unanimously recommends a vote "FOR" the ratification of the selection of PricewaterhouseCoopers LLP as our

independent registered public accounting firm for the fiscal year ending January 29, 2017 .

18