Lululemon 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

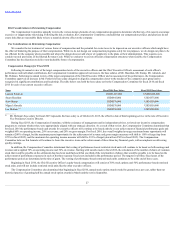

Risk Considerations in Determining Compensation

The Compensation Committee annually reviews the various design elements of our compensation program to determine whether any of its aspects encourage

excessive or inappropriate risk-taking. Following the risk evaluation, the Compensation Committee concluded that our compensation policies and practices do not

create risks that are reasonably likely to have a material adverse effect on the company.

Tax Considerations in Determining Compensation

We consider the tax treatment of various forms of compensation and the potential for excise taxes to be imposed on our executive officers which might have

the effect of hindering the purpose of their compensation. While we do not design our compensation programs solely for tax purposes, we do design our plans to be

tax efficient for the company where possible and where the design does not add a layer of complexity to the plans or their administration. This requires us to

consider several provisions of the Internal Revenue Code. While we endeavor to use tax-efficient compensation structures when feasible, the Compensation

Committee has the discretion to deliver non-deductible forms of compensation.

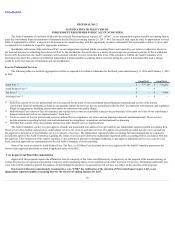

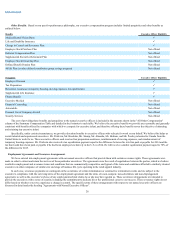

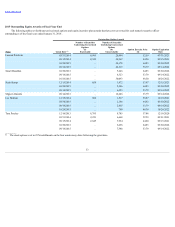

Compensation Changes for Fiscal 2016

Following its annual review of the target compensation levels of the executive officers and the Chief Executive Officer's assessment of each officer's

performance and individual contributions, the Compensation Committee approved increases to the base salaries of Mr. Haselden, Mr. Stump, Mr. Almeida, and

Mr. Holman. Following its annual review of the target compensation of the Chief Executive Officer and an assessment of his performance, the Compensation

Committee approved an increase in Mr. Potdevin's base salary designed to align his compensation closer to the median of the company's peer group and to

recognize his significant contributions and leadership. The table below sets forth the base salary set by the Compensation Committee for fiscal 2016 and fiscal

2015 for each of our current executive officers:

Name

Fiscal 2016 Base Salary

Fiscal 2015 Base Salary

Laurent Potdevin

USD$1,025,000

USD$1,000,000

Stuart Haselden

USD$645,000

USD$575,000

Scott Stump

USD$570,000

USD$550,000

Miguel Almeida

USD$570,000

USD$550,000

Lee Holman (1)

USD$550,000

USD$500,000

_________

(1) Mr. Holman's base salary for fiscal 2015 represents his base salary as of October 26, 2015, the effective date of him beginning service in the role of Executive

Vice President, Creative Director.

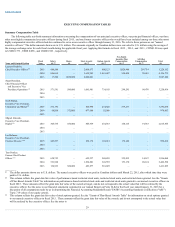

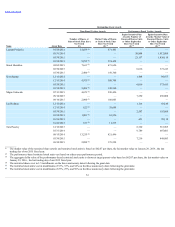

During fiscal 2015, the Compensation Committee, with the assistance of management and its independent advisor, reviewed our incentive compensation

programs to evaluate whether they were appropriately aligned with our strategic direction. As a result of that review, the Compensation Committee determined that

for fiscal 2016 the performance-based cash awards for executive officers will continue to be based entirely on our achievement of financial performance goals and

weighted 60% on operating income, 20% on revenue, and 20% on gross margin. For fiscal 2016, the overall weighted average maximum bonus opportunity will

remain at 200% of target, but the maximum payout opportunity for the achievement of revenue and gross margin measures will shift to 150% of target (up from

125% in fiscal 2015), and the maximum for operating income measure will shift to 233% of target (down from 250% in fiscal 2015). The Compensation

Committee believes this formula will continue to focus the executive team on the achievement of these three key financial goals, with an emphasis on delivering

quality earnings.

In addition, the Compensation Committee determined that vesting of performance-based restricted stock units will continue to be based on both earnings and

revenue and weighted 70% on operating income and 30% on revenue. Starting with awards made in fiscal 2016, the calculation of the number of shares of common

stock that would be payable on the settlement date has been modified such that one third of the total number of shares that would be payable is to be based on the

achievement of performance measures in each of the three separate fiscal years included in the performance period. The targets for all three fiscal years of the

performance period are determined at the time of grant. The vesting of performance-based restricted stock units continues to be at the end of three years.

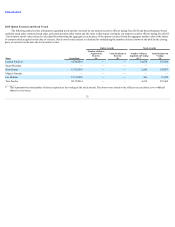

Beginning in fiscal 2016, the Chief Executive Officer's equity-based compensation will consist of 50% stock options and 50% performance-based restricted

stock units, and will not include restricted stock units like the other executive officers.

The Compensation Committee also determined that beginning in fiscal 2016, annual stock option awards would be granted once per year, rather than our

historical practice of granting half the annual stock option awards in March and the rest in September.

27