International Paper 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 International Paper annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For International Paper, 2012 was marked by strong execution and

good results against a challenging global economic backdrop. We

delivered our second best earnings per share1 since 1995 and gener-

ated record cash from operations. Shareowners benefited from strong

free cash flow as International Paper raised the dividend 14 percent

in 2012 and maintained a strong balance sheet, retiring $1.9 billion in

debt. International Paper’s success was bolstered by industry leading

margins in our Industrial Packaging business, as well as record

revenue and earnings performance in both IP Russia and our

Foodservice business.

Strong performance in a challenging and unpredictable economic

environment is the result of International Paper’s strategic position-

ing and global balance. However, we should not be measured by

prior results. We should instead be defined by Our Path Forward.

In 2012, we shared with investors International Paper’s plan to

reach our potential through several strategic earnings drivers—that

with continued great execution—will result in our goal of 38 percent

improvement in EBITDA to more than $5 billion in a mid-cycle

environment.

The pages following this letter provide more clarity around the earnings

drivers within each business. It is a story that begins in North

America with the acquisition of Temple-Inland and our creation of a

premier Industrial Packaging business, as well as a powerful cash

flow engine. In less than a year, we achieved higher and faster syn-

ergy and run rate targets, as the acquisition delivered more than

$300 million in 2012—and we expect a synergy run rate of at least

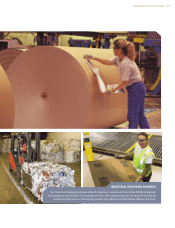

$400 million by first quarter 2013. In North America, we also high-

light our Franklin Mill in southeast Virginia, which was repurposed

and restarted to make fluff pulp, a key material used in manufacturing

TO THE SHAREOWNERS AND

EMPLOYEES OF INTERNATIONAL PAPER,

International Paper / 2012 Annual Report 1

“2012 WAS AN IMPORTANT TRANSITION YEAR

FOR INTERNATIONAL PAPER. I BELIEVE NO

OTHER COMPANY IN OUR INDUSTRY IS AS

WELL-POSITIONED TO CREATE VALUE FOR

OUR SHAREOWNERS ON A GLOBAL SCALE—

OR COMPETE AS SUCCESSFULLY IN OUR

DOMESTIC MARKET IN BOTH PACKAGING

AND PAPER.”

John V. Faraci

Chairman and Chief Executive Officer

International Paper

1Before special items and non-operating pension expenses.